Nuclear energy’s resurgence and defense investments are trending across global headlines. That broader push has elevated Amentum Holdings (AMTM), a relatively under-the-radar nuclear energy stock. The company now oversees nearly 90% of America’s nuclear infrastructure for the Department of Energy.

That footprint is why Andrew Left of Citron Research recently called it “the Most Important Company in America” and flagged its unique national security role. Following this bullish note, its shares rose by 17%.

Left notes that AMTM's efforts align with President Donald Trump's emphasis on energy independence and military modernization. These priorities also include aggressive funding for nuclear innovation. Trump himself called nuclear a “hot industry,” adding, “It’s time for nuclear, and we’re going to do it very big.” They continue to shape America’s strategic approach today.

Will this little-known stock translate policy tailwinds and government demand into lasting value for shareholders? Let’s find out what Amentum is really about.

Strong Performance Propels AMTM Into the Spotlight

Amentum Holdings delivers advanced nuclear management and engineering services for the U.S. government, overseeing $5.3 billion in market cap. The stock is trading at $24.99 as of early afternoon on Nov. 21, with a year-to-date (YTD) gain of 18% and a 52-week performance of only 0.36%.

Its forward price-to-earnings is 10.97x against the sector median of 19.86x, and its price-to-sales sits at 0.47x compared to a sector median of 1.68x. That reflects a significant discount for a firm leading nearly 90% of America’s nuclear infrastructure stewardship.

Amentum’s latest quarterly earnings, published Aug. 5, highlight a business running at scale. This quarter, Amentum reported $3.6 billion in revenues, a 2% increase on a pro forma basis, which illustrates stability. This net income of $10 million signals positive margins in a sector known for enormous capital intensity. The adjusted EBITDA reached $274 million.

This underscores the firm’s strong operational leverage and ability to convert revenue into core earnings. The most recent result for diluted earnings per share stands at $0.04, with adjusted diluted earnings per share at $0.56. This difference points to notable add-backs common in the industry’s reporting.

This operating cash flow totaled $106 million for the quarter. That gives the company the liquidity necessary to invest and compete for high-value government programs. The free cash flow of $100 million confirms disciplined capital management and prudent expenditure. This extensive backlog sits at $44.6 billion, which anchors revenue visibility far into the future.

It highlights persistent demand for the company’s mission-critical services. The year-to-date book-to-bill ratio matches 1.0x, balancing new contract wins with revenue recognition, which indicates sustainable execution. This period also saw net debt trimmed to $3.8 billion. That brought net leverage to 3.5x, a clear sign of Amentum’s improving balance sheet.

Major Federal Wins Cement AMTM’s Role

Amentum stands out for turning headline contracts into strategic momentum. This year, the company secured the Space Force Range Contract, a United States Space Force agreement worth up to $4 billion over ten years. The win is not just about the numbers. Under this contract, Amentum will tackle systems engineering, cybersecurity, integration, logistics, sustainment, operations, and program management. This work will upgrade America’s launch infrastructure, increase cadence, and boost national security, as well as space exploration and commercial launches.

Securing the Remotely Piloted Aircraft Maintenance Support contract also fueled AMTM’s momentum. The Air Force awarded Amentum a deal with a ceiling value of $995 million to maintain MQ-9 Reaper systems. These unmanned aerial systems support modern warfare, carrying advanced sensors, weapons, control stations, and satellite links.

Amentum’s reach extends beyond the skies. The company broke ground on the Radiation Combined Environment (RCE) Test Facility in Odon, Indiana. This work with the Naval Surface Warfare Center, Crane Division (NSWC Crane), aims to advance microelectronics for the Department of Defense. That milestone crowns more than four decades of work with NSWC Crane and pulls Amentum even deeper into the core of next-generation defense microelectronics.

Street Sees Bright Growth Path for AMTM

Wall Street has set its sights on AMTM’s upcoming earnings, with the next report lined up for Nov. 25. For the September quarter, analysts see average EPS at $0.57, which marks a strong jump from the prior year’s $0.47. That’s a projected growth rate of 21.28%.

Meanwhile, the December quarter forecast sits at $0.54, up from $0.51 a year earlier, pointing to a 5.88% increase. For the full fiscal year ending September 2025, consensus expects $2.12 in EPS, a step up from $2.01 last year, implying a 5.47% rise.

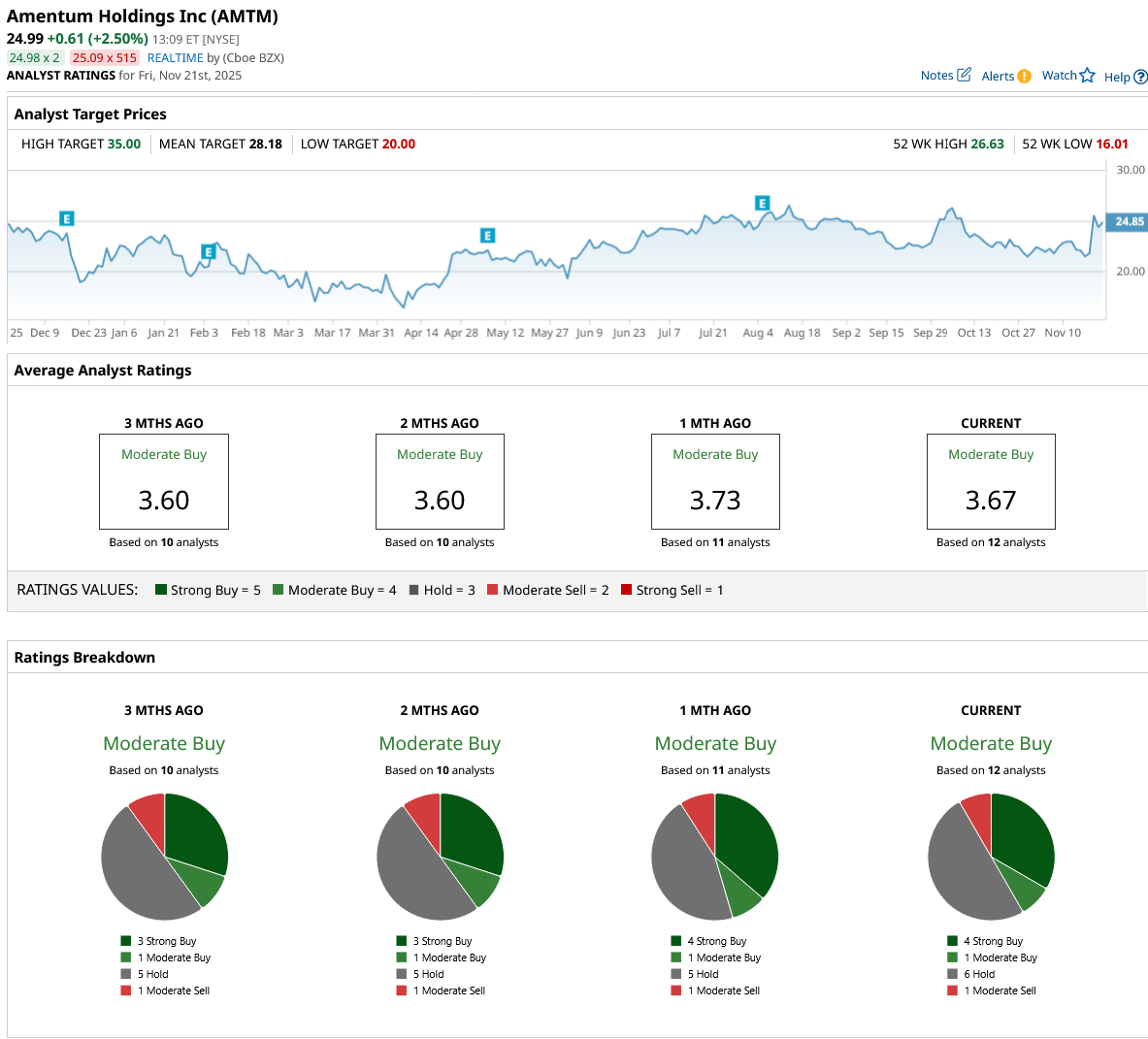

Investor focus sharpens thanks to more than just EPS growth. A total of 11 analysts have weighed in, and while their views vary, the consensus lands on a “Moderate Buy” rating. The average price target is $28.18. That points to an expected upside of nearly 13% from here.

Conclusion

AMTM keeps delivering contract wins and strong growth, which only fuels the story around this stock. With 11 analysts weighing in and a consensus price target above where shares trade today, the odds favor AMTM moving higher over the next year. Continued positive earnings surprises and steady government support make a climb seem likely. Those watching for momentum and defensive strength have plenty of reasons to keep this name on their watchlist.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’

- Wall Street Is Betting on Nuclear Energy, But Legendary Investor Peter Thiel Just Ditched This 1 Key Power Stock

- With $1.6 Billion in Jeopardy, Should You Buy, Sell, or Hold Plug Power Stock Here?

- As Musk Hints That Tesla Could Make Its Own AI Chips, Should You Buy TSLA Stock?