President Donald Trump, via his policies and social media platforms, has great influence over the stock market. And his latest broadside against the nation’s health insurers is worthy of attention. Trump's Nov. 18 Truth Social post slammed “big, fat, rich insurance companies” and the Affordable Care Act subsidies they receive.

Trump has long wanted to end the Affordable Care Act, or Obamacare. However, the ACA subsidies are a contentious issue at present, as Marketplace tax credits are set to expire at the end of the year. And Trump appears determined to reject any solution that sends billions to insurance companies to lower premiums.

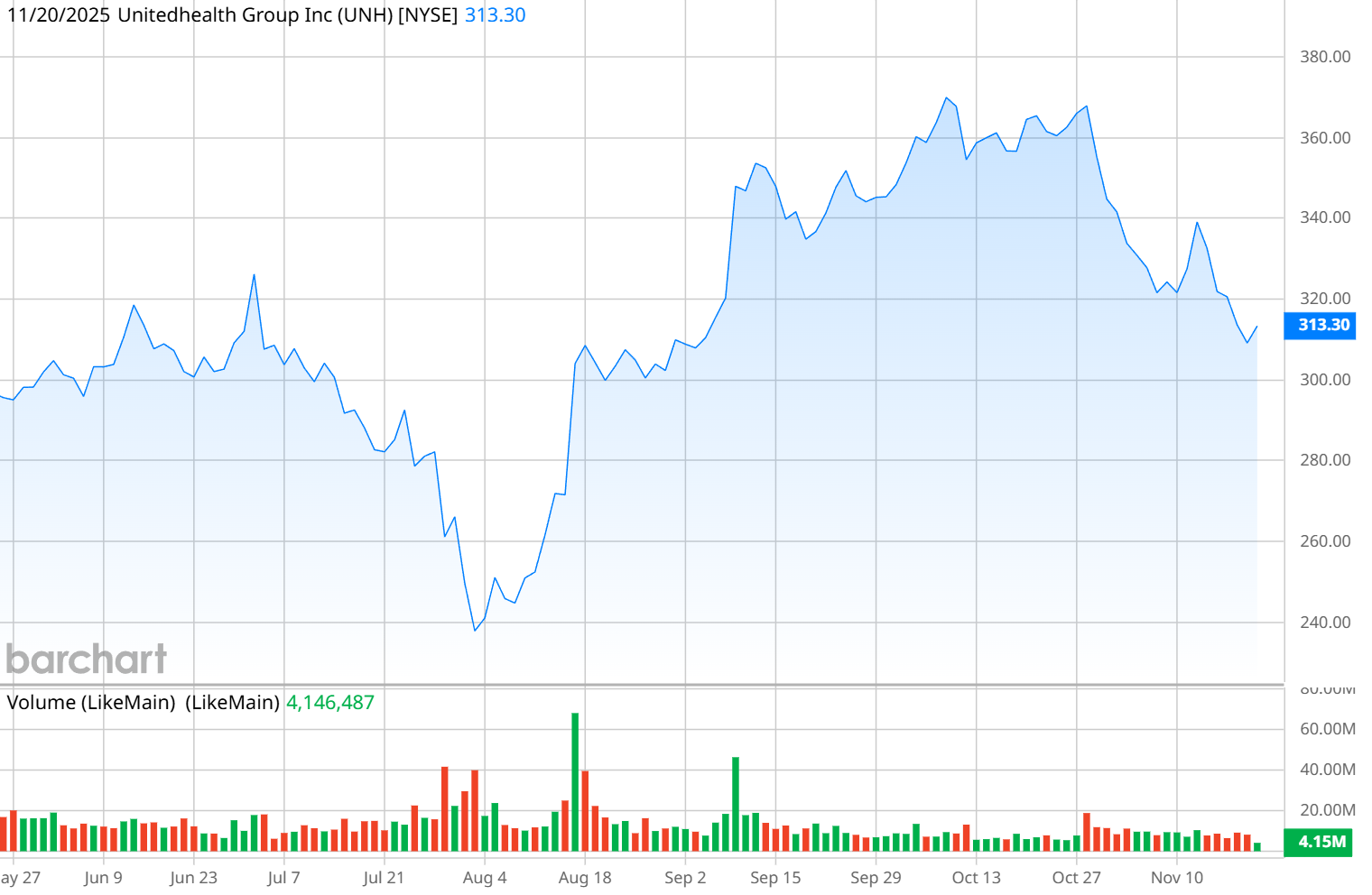

UnitedHealth Group (UNH), which is the parent company of the nation’s biggest health insurer, UnitedHealthcare, saw its stock drop nearly 15% in the last month. Based on the political climate, is UNH stock a buy or a sell right now?

About UnitedHealth Group Stock

Minnesota-based UnitedHealth Group is a leading healthcare stock that operates in the managed care marketplace. It operates both employer and individual accounts, as well as Medicare and Medicaid accounts. It also operates Optum, which provides technology-enabled healthcare services, pharmacy services, and data analytics. The company has a market capitalization of $280 billion.

Shares are down 48% in the last 12 months, which is far worse than the 16.5% loss suffered by Cigna Group (CI) and the 23.25% loss by Humana (HUM) in the same period. By comparison, the benchmark S&P 500 Index ($SPX) is up 11% in the last year.

UNH has a price-earnings ratio of 14.9x, below the industry average P/E of 20.7x. Its forward P/E of 19.25x, however, is higher than the sector’s average of 18.5x, which indicates that investors are anticipating stronger performance next year.

The company’s dividend yield of 2.8% is significantly better than the sector average of 1.5%. UnitedHealth Group’s next dividend of $2.21 per share will be paid Dec. 16 to shareholders of record as of Dec. 8.

UnitedHealth Group Beats on Earnings

Investors were no doubt relieved when UnitedHealth Group returned to its winning ways in its third-quarter report. Because it’s not been like that at all this year. UNH stock missed expectations in the first quarter for the first time since the 2008 financial crisis, and followed that up with an even deeper miss in Q2.

There were several issues – the company took on new Medicare Advantage patients, but miscalculated badly on costs. Management said that UnitedHealth Group misjudged costs by $6.5 billion, which ate into the company’s profit margin and cut deeply into earnings.

On top of that, the Justice Department began a criminal probe into alleged Medicare fraud and billing practices within Medicare Advantage plans. UnitedHealth Group acknowledged the investigation in July and said it would authorize a third-party review of its business practices.

However, after all that, Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) disclosed that it took out a huge stake in UNH stock, purchasing 5 million shares. It was a classic Buffett purchase, considering his appetite for insurance companies and the above-average dividend.

And UnitedHealth Group is making huge strides in fixing its problems, including planned premium increases in 2026 and 2027, using artificial intelligence to control costs, and possibly narrowing some networks.

In the third quarter, UNH reported revenue of $113.2 billion, up 12% from a year ago. Earnings were $4.3 billion, down 47.9% from last year and $2.92 per share, versus analysts’ expectations for $2.75 per share.

“We remain focused on strengthening performance and positioning for durable and accelerating growth in 2026 and beyond, and our results this quarter reflect solid execution toward that goal,” CEO Stephen Hemsley said. The company raised full-year guidance from $16 per share to $16.25.

What Do Analysts Expect for UnitedHealth Group Stock?

Analysts are bullish on UNH stock, with a consensus “Moderate Buy” rating for the last several months. Of the 25 analysts currently covering the stock, 17 are recommending buying, and only one has a “Sell” rating, with the rest recommending that investors hold.

The mean price target of $387.73 represents 23% upside, with the most bullish analyst’s target of $440 suggesting that a 40% gain is possible. However, the low target of $198 warns of a possible 37% drop.

However, considering analysts’ sentiment, the company’s plan to improve its profit margins, and the government’s failure for the last decade to end the Affordable Care Act, which is a politically popular program, I don’t think that long-term investors should be worried that Trump will be able to injure health insurers like UnitedHealth Group. I think the stock is a buy.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart