Big-box retailer Walmart (WMT) has spent more than a decade navigating the retail world under the leadership of Doug McMillon. He stepped into the CEO role in February 2014 and carried the company through a period defined by the pandemic, supply-chain strain, inflationary pressure, and tariff adjustments.

Through those demanding years, the company strengthened its identity as an e-commerce powerhouse while maintaining its reach as a household name. Now, though, a new transition sits at the center of Walmart’s story.

McMillon plans to retire early next year, stepping down as CEO on Jan. 31, 2026, although he will remain an executive officer and advisor through Jan. 31, 2027. His successor, John Furner — currently the Walmart U.S. CEO — will officially take charge on Feb. 1, 2026. Furner has earned respect across the industry for steering the company’s domestic operations since 2019.

Several analysts view this transition as a smooth baton pass. They point to Furner's deep experience, strong merchant instincts, and enthusiasm for innovation and artificial intelligence (AI) as markers of strategic continuity.

With a new leader stepping in, many investors are wondering whether the coming era will be an opportunity to scoop up WMT shares and ride the next leg of growth.

About Walmart Stock

Based in Bentonville, Arkansas, Walmart operates a vast global network of discount stores, supercenters, neighborhood markets, and Sam’s Club warehouses across 19 countries. With an approximately $802 billion market capitalization, the firm delivers groceries, apparel, electronics, and essentials through strong supply-chain scale, pricing power, and logistics efficiency.

Market enthusiasm reflects that stability. Over the past 52 weeks, shares of WMT have gained 23%. During the past six months, the stock has added 10%. Moreover, the price reached a fresh 52-week high of $109.57 on Oct. 16.

The momentum followed an announcement on Oct. 14 that showcased Walmart’s intent to redefine convenience. In the announcement, the company revealed a collaboration with OpenAI to bring shopping directly into the ChatGPT platform with an Instant Checkout feature that prioritizes speed and personalization.

WMT stock currently trades at 38.7 times forward adjusted earnings and 1.19 times sales, which signals a premium relative to industry averages. The valuation suggests the market is willing to pay up for Walmart’s scale, stability, and expanding digital and data-driven capabilities.

The company also has a legacy as a Dividend Aristocrat with 51 consecutive years of dividend increases. Walmart pays an annual dividend of $0.94 and delivers a yield of 0.91%. The next dividend payment is scheduled for Jan. 5, 2026, for shareholders on record as of Dec. 12, 2025.

A Closer Look at Walmart’s Q2 Earnings

Walmart reported its second-quarter fiscal 2026 earnings on Aug. 21. Revenue increased 4.8% year-over-year (YOY) to $177.4 billion and moved ahead of analyst expectations of $176.2 billion. Comparable sales for Walmart U.S. grew 4.6% excluding fuel, supported by strong results in grocery and health and wellness. Sams Club added to the momentum with comparable sales rising 5.9% excluding fuel.

Global e-commerce sales advanced 25% and U.S. e-commerce sales increased 26%. Both online purchasing and advertising contributed to the pace. The global advertising segment expanded 46% YOY and included contributions from Vizio, the smart television maker Walmart acquired for $2.3 billion last year. Walmart Connect, the company’s U S advertising business, grew 31% from the previous year’s period.

Adjusted EPS rose 1.5% from the prior year’s quarter to $0.68 but missed the Street estimate of $0.74. This marked the first quarterly earnings miss since May 2022. Management pointed to one-time expenses such as restructuring costs, increased insurance claims, and litigation settlements as the primary sources of pressure.

Even so, the balance sheet displayed stability with cash and cash equivalents rising to $9.4 billion as of July 31.

Looking ahead, Walmart’s management has lifted its full-year outlook and now expects net sales to grow 3.75% to 4.75%, up from its earlier range of 3% to 4%. It also increased its adjusted EPS forecast to $2.52 to $2.62 from the prior $2.50 to $2.60 range. Management also projected fiscal 2026 third-quarter net sales growth of 3.75% to 4.75% and operating income growth of 3% to 6%.

Analysts forecast the full fiscal year 2026 bottom line to jump 4% from the prior year to $2.62. The momentum is expected to continue in fiscal year 2027, with EPS predicted to grow another 11% from the previous year to $2.92.

What Do Analysts Expect for Walmart Stock?

Analysts maintain a positive outlook as Walmart enters this leadership transition. BTIG has assigned a “Buy” rating to WMT with a $120 price target. The firm expressed confidence that Doug McMillon has positioned the business for continued market share expansion and profitability. BTIG expects these trends to continue even as the broader retail environment manages economic uncertainty.

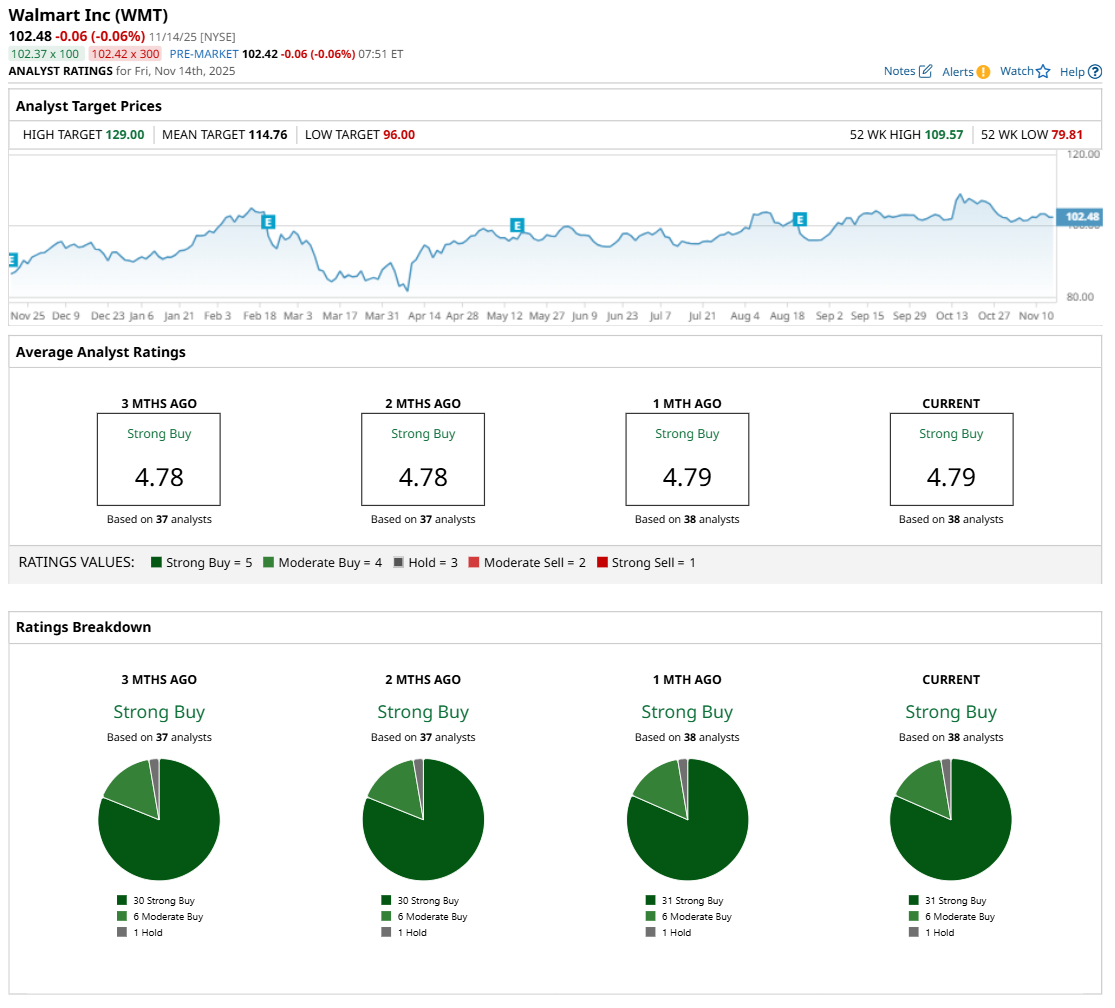

Analysts maintain an optimistic view, assigning WMT stock a consensus rating of “Strong Buy.” Among 37 analysts covering the stock, 30 recommend a “Strong Buy,” six recommend a “Moderate Buy,” and one recommends a “Hold.”

The average price target for WMT sits at $114.76, suggesting potential upside of 7%. Meanwhile, the Street-high target of $129 represents a potential gain of 20% from current price levels, underscoring long-term confidence in Walmart’s evolving strategy and expanding digital ecosystem.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Just Waved a Big ‘Green Flag’ for Taiwan Semi. Buy TSM Stock Here, Says Wedbush.

- Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?

- Nvidia Is a Leader in AI Computing, But Is NVDA Stock a Buy Now?