Exton, Pennsylvania-based West Pharmaceutical Services, Inc. (WST) designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products. With a market cap of $18.6 billion, West Pharmaceutical’s operations span the Americas, Europe, the Middle East, Africa, and the Indo-Pacific.

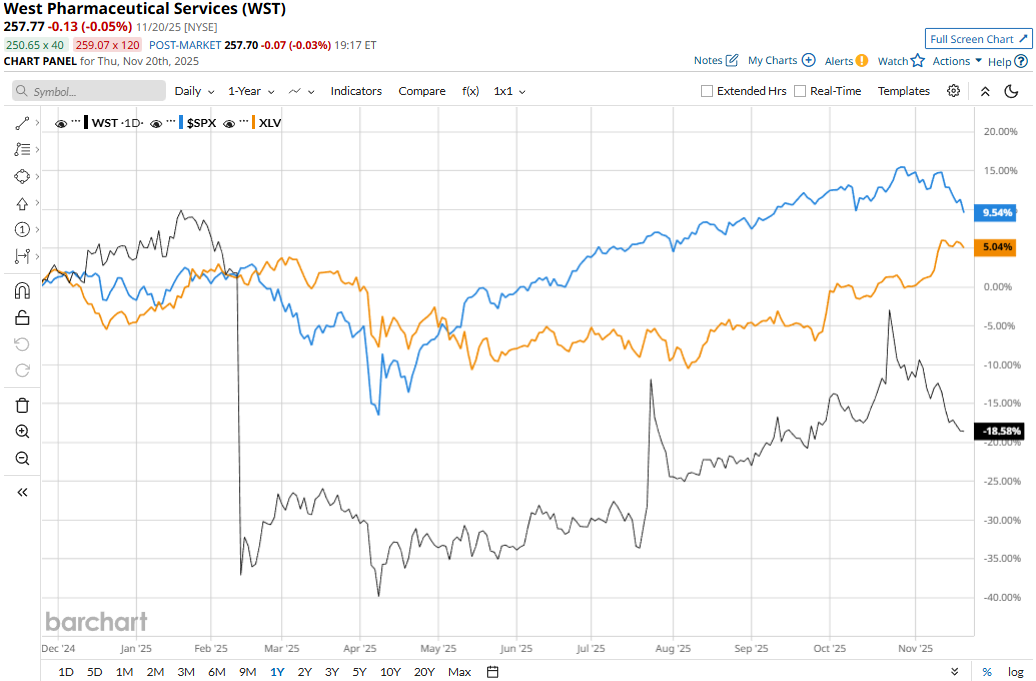

The contract manufacturer has substantially lagged behind the broader market over the past. WST stock prices have plunged 17.3% over the past 52 weeks and 21.3% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.5% gains over the past year and 11.2% returns in 2025.

Narrowing the focus, WST has also underperformed the sector-focused Healthcare Select Sector SPDR Fund’s (XLV) 6% uptick over the past 52 weeks and 10.1% gains in 2025.

West Pharmaceutical Services’ stock prices soared 10.9% in a single trading session following the release of its better-than-expected Q3 results on Oct. 23. Driven by organic growth, its net sales for the quarter surged 7.7% year-over-year to $804.6 million, beating the Street’s expectations by 2.4%. Meanwhile, its adjusted EPS inched up 5.9% year-over-year to $1.96, coming in 17.4% above the consensus estimates.

For the full fiscal 2025, ending in December, analysts expect WST to deliver an adjusted EPS of $7.07, up 4.7% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

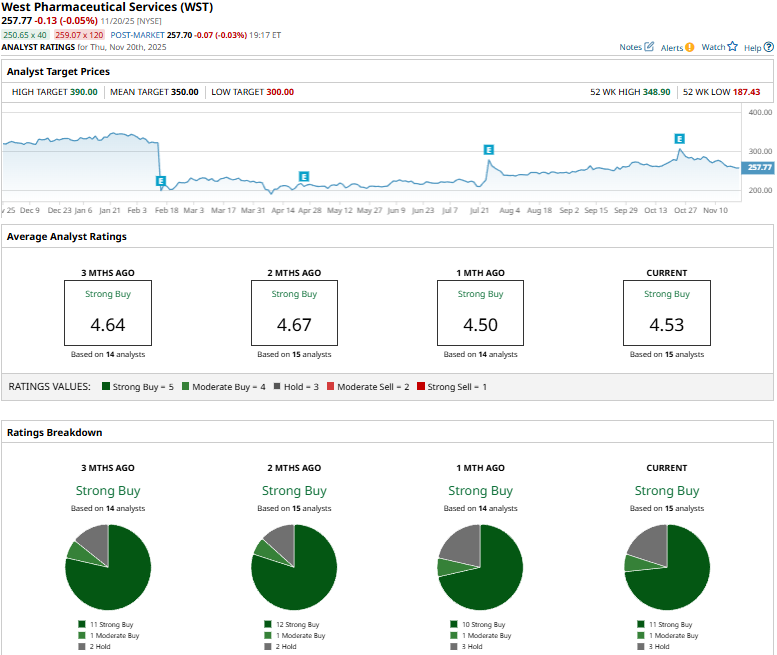

Among the 15 analysts covering the WST stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buys,” one “Moderate Buy,” and three “Holds.”

This configuration is slightly more optimistic than a month ago, when 10 analysts gave “Strong Buy” recommendations.

On Oct. 29, TD Cowen analyst Brendan Smith initiated coverage of WST with a “Buy” rating and set a price target of $350.

WST’s mean price target of $350 represents a 35.8% premium to current price levels. Meanwhile, the street-high target of $390 suggests a notable 51.3% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart