Valued at a market capitalization of $12.8 billion, IDEX Corporation (IEX) is a diversified industrial technology company known for producing highly engineered components and mission-critical solutions used across niche applications. The Illinois-based company’s businesses span fluid and metering technologies, health and science technologies, and fire, safety, and rescue equipment.

IDEX has faced challenges in the stock market. The stock is down 25% over the past year and has fallen 18.5% year-to-date, putting it well behind the S&P 500 Index ($SPX), which has gained 11% and 12.3% over the same periods, respectively.

Zooming in, the stock has also lagged the Industrial Select Sector SPDR Fund’s (XLI) 6.4% rally over the past 52 weeks and 13.6% return this year.

On Oct. 29, IDEX shares popped 3.9% after the company released its third-quarter earnings, that delivered a stronger-than-expected mix of growth and profitability. Net sales rose 10% to about $879 million, with 5% organic growth and record quarterly orders. Margin performance was also solid, with adjusted EBITDA margin expanding to roughly 27%, helping push adjusted EPS up 7% year over year to $2.03. Its record orders of $880 million increased 13% on a reported basis and 7% organically. As a result, management reaffirmed its full-year outlook and continued returning capital through steady share repurchases, reinforcing investor confidence and contributing to the stock’s post-earnings jump.

For the fiscal year 2025, ending in December, Wall Street analysts expect IDEX’s EPS to remain flat at $7.89 on a diluted basis. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

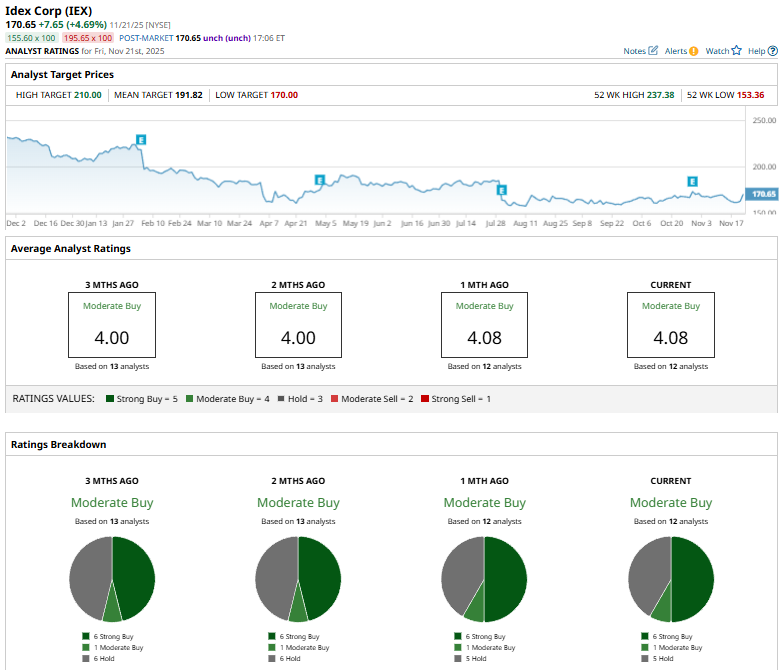

Among the 12 Wall Street analysts covering IDEX’s stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and five “Hold” ratings.

On October 30, 2025, RBC Capital’s Deane Dray kept his “Outperform” rating on IDEX intact but reduced the price target from $200 to $195, a 2.5% adjustment that underscores tempered expectations despite continued confidence in the stock.

IDEX’s mean price target of $191.82 indicates a 12.4% upside over current market prices. The Street-high price target of $210 implies a potential upside of 23.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- GDP, Retail Sales and Other Can't Miss Items this Week

- Chevron's Latest 5-Yr Plan Implies a Major Dividend Hike - CXX Stock Looks Cheap

- Wall Street Is Betting on a Nuclear Renaissance. Here Are the 3 Top-Rated Nuclear Energy Stocks to Buy Now.

- The Saturday Spread: Using Data Science to Pick Out the Most Compelling Discounts (NVO, SOFI, FAST)