Over the last 60 days, over $25 billion in insider transactions have flooded the stock market across multiple sectors, and overwhelmingly, they’ve been sell orders.

At first glance, billions of dollars in outflows from corporate insiders sounds like a bad omen.

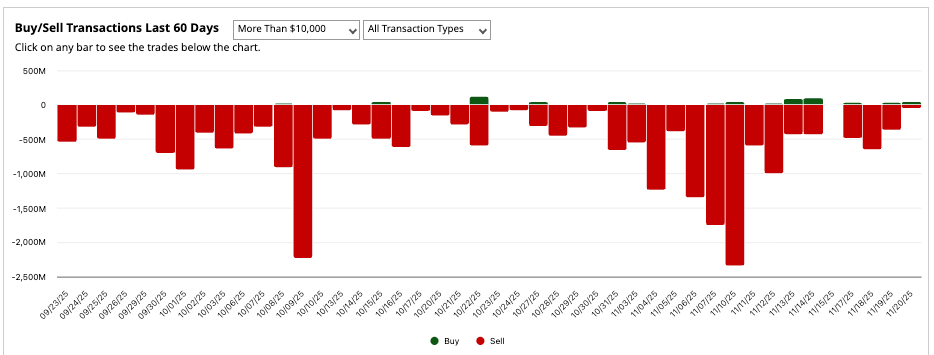

Barchart’s insider trading data allows investors to dig deeper into these sales and what they actually mean. The chart below is a snapshot of insider trades over the last two months, and as you can see, it is mostly red, indicating net outflows.

A sum of all sale transactions over the past 60 days reveals insiders dumped an alarming $25.187 billion in company stock.

Many investors view insider buying as a positive indicator that things are going well, and that executives are bullish on their own company. On the flip side, insider selling is taken as a big red flag.

But it is important to take a closer look at these huge outflows and see what’s actually happening.

Upon examining three of the biggest sales from Rollins (ROL), Corebridge Financial (CRBG), and Dell Technologies (DELL) insiders, it is clear that things aren’t always so black and white.

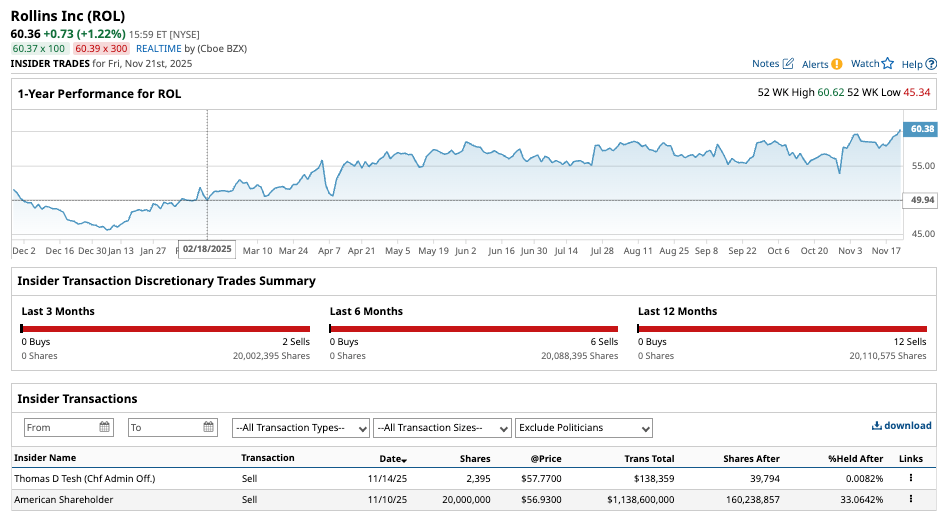

Rollins (ROL)

Rollins, known for owning multiple pest control and environmental services brands, saw a major insider sale recently that raised eyebrows.

The sale:

- 20 million shares sold on Nov. 10, 2025

- Price: $56.93 per share

- Total value: $1.14 billion

- Seller: Gary W. Rollins Voting Trust (beneficial owner holding 33% of shares)

- Remaining holdings: 160.2 million shares

Yet Rollins’ share price has been hitting all-time highs this year, with positive year-to-date returns. The company also completed a recent $1 billion equity raise.

This might have been an executive getting some liquidity or simply preparing to make another investment. We don’t know for sure.

What we do know is that the share price didn’t falter, and the market received news of the sale positively.

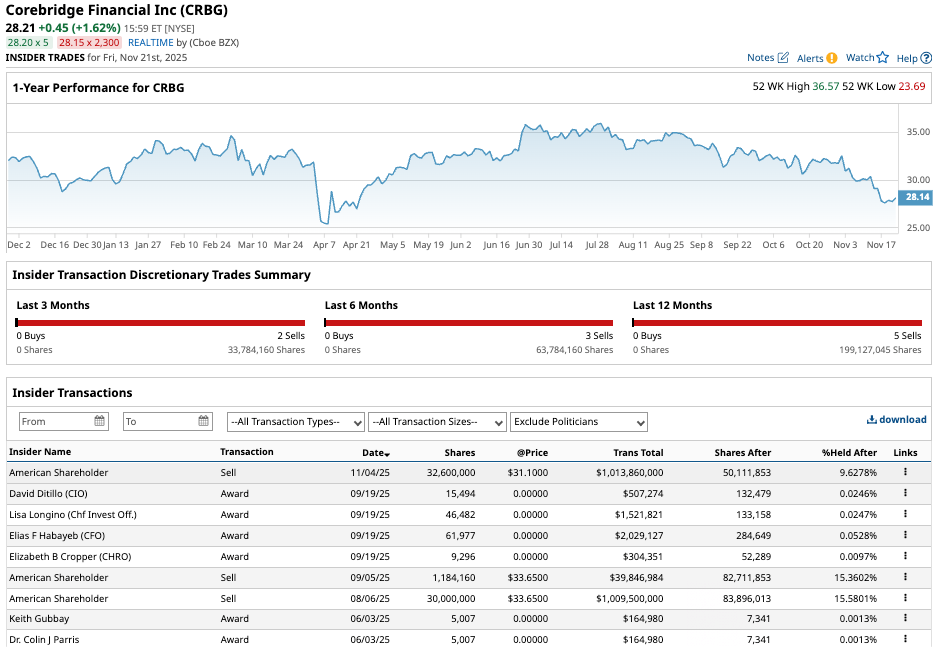

Corebridge Financial (CRBG)

Corebridge is a popular financial services firm handling consumer financing and insurance products. The top level shows 32.6 million shares sold by an insider for over $1 billion.

The sale:

- 32.6 million shares sold in secondary offering

- Price: $31.10 per share

- Total value: Approximately $1.01 billion

- Seller: AIG (beneficial investor with 10% stake)

But according to this press release from Corebridge, the sale was actually by AIG, one of its major beneficial investors, in a secondary offering.

The company itself plans to repurchase approximately $500 million in common stock with cash on hand.

The market took this as a bullish signal because one of its major investors was enabling the company to repurchase its own shares.

So again, merely looking at the headline that an insider sold $1 billion of stock could read as a bearish signal.

But upon examining the press release, this is a much more positive story.

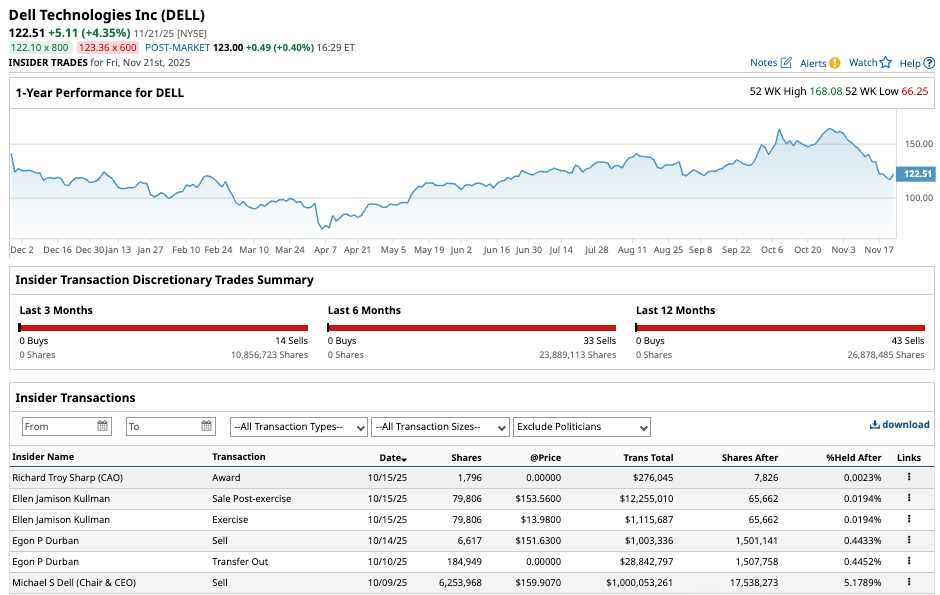

Dell Technologies (Dell)

Dell Technologies has seen significant insider selling, and although the share price is up 5% year to date, it has fallen from its all-time high, which was set around the time Michael Dell sold.

The sale:

- 6.25 million shares sold on Oct. 9, 2025

- Price: $159.91 per share

- Total value: $1 billion

- Seller: CEO Michael S. Dell

- Additionally, the Michael and Susan Dell Foundation sold 2.72 million shares for $425 million

Dell is competitive in the AI space and has been growing substantially in that business.

Analysts are the shakiest on these sales compared to those at Rollins and Corebridge, but the market remains cautiously optimistic.

Michael Dell remains the company's largest individual stockholder with a net worth north of $138 billion as of 2025.

Insider Sales Aren’t Always Bad – But Shouldn’t Be Ignored

Insider selling is often presented as a one-dimensional metric: insider buying equals good for the share price, insider selling equals bad.

But as famous investor and fund manager Peter Lynch said, “Insiders sell for all kinds of reasons. They want to buy a new vacation home. They want to send a kid to college. But they only buy for one reason, which is they think the stock is going up.”

Many executives and insiders initiate scheduled sales that execute automatically. These trades happen regardless of market conditions, and remove some of the speculation that there is an issue with the stock. For example, Jeff Bezos funds his space company Blue Origin with proceeds from annual scheduled Amazon (AMZN) share sales.

And as shown with Corebridge, insider selling can be a strategic financial move to enable the company to repurchase shares or raise capital.

Sell, Stay, or Buy?

While there has been an overwhelming amount of insider sales over the last 60 days, it’s also worth noting that valuations have been consistently at all-time highs for many major asset classes – creating ample opportunity for insiders to take profit.

So what’s the bottom line?

Insider buying and selling isn’t an end all, be all indicator. Investors can use insider trades as a research metric, but they should always ask why and dig deeper into the details.

On the date of publication, Justin Estes did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.