New York-based Mastercard Incorporated (MA) is a global payments technology company. It operates one of the world’s largest networks for processing electronic payments, enabling transactions between consumers, merchants, financial institutions, and governments. The company also develops security solutions, digital payment tools, and data-driven services that support commerce across more than 210 countries and territories.

Mastercard is firmly in the league of giants. With a market capitalization hovering around $485 billion, it easily clears the “mega-cap” bar, a title reserved for only the most powerful players worth over $200 billion. That massive market footprint underscores Mastercard’s scale, influence, and heavyweight status in the global financial ecosystem.

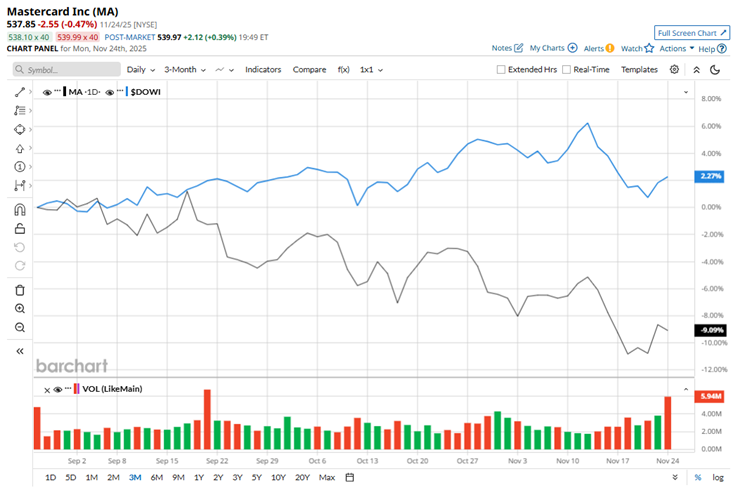

Mastercard may be a powerhouse in the payments world, but its recent stock performance tells a different story. Over the past three months, shares have slid 10.2%, pulling back about 10.6% from its August 52-week high of $601.77. Meanwhile, the Dow Jones Industrial Average ($DOWI) has inched higher by 2.3%, making Mastercard’s slump stand out even more on Wall Street’s scoreboard.

Looking at the bigger picture, Mastercard’s stock performance remains somewhat choppy. Shares are up a modest 2.1% in 2025, but the past six months tell a different tale, with the stock down 4.6%. Meanwhile, the Dow Jones has been quietly stacking gains, up 9.2% this year and 9.7% over the same six-month stretch.

Technical indicators are signaling a sharp momentum shift. After spending much of the year comfortably above the 200-day moving average with some fluctuation in between, Mastercard’s stock has slipped below this key level since late October, a classic warning sign that the trend has flipped from strength to sudden weakness.

Given the recent price action, MA shareholders aren’t exactly thrilled right now. Concerns about a potential U.S. recession continue to weigh on the stock, as any slowdown in consumer spending and transaction volumes hits right at the heart of Mastercard’s business model. On top of that, competition from newer fintech payment options, including stablecoins, has been pulling some investor attention away from traditional networks like MA.

Still, the company’s financial performance is holding up well. The company’s Q3 earnings report, released on Oct. 30, delivered a clear beat versus Wall Street expectations. Net revenue climbed 17% year over year (YOY) to $8.6 billion, supported by resilient consumer and business spending. Adjusted earnings per share also impressed, rising nearly 13% to $4.38, surpassing analyst estimates of $8.5 billion in revenue and $4.31 per share.

In a competitive financial sector, Visa Inc. (V), Mastercard’s closest rival, has managed to edge ahead this year, posting a 4.2% gain year-to-date (YTD). But the picture isn’t entirely rosy on that side either. Over the past six months, Visa’s shares have dropped 6.9%, an even steeper pullback than Mastercard’s.

Despite Mastercard’s weak price action relative to the broader market, Wall Street remains bullish, with the stock earning a consensus “Strong Buy” rating from the 37 analysts in coverage, and the mean price target of $659.38 suggests shares could climb roughly 22.6% from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart