Santa Clara, California-based Applied Materials, Inc. (AMAT) provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. With a market cap of $184 billion, Applied Materials operates through Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Applied Materials fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the semiconductor equipment & materials industry. AMAT is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world.

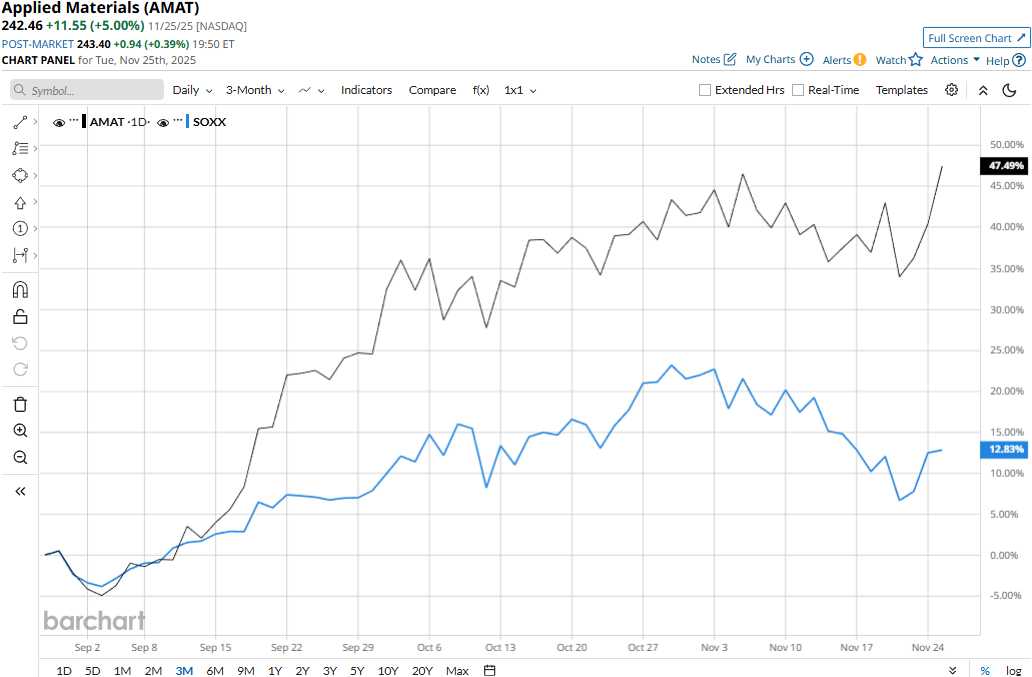

AMAT touched its 52-week high of $244.62 in yesterday’s trading session, before slightly pulling back. Meanwhile, AMAT stock prices have soared 49.7% over the past three months, outpacing the industry-focused iShares Semiconductor ETF’s (SOXX) 14.1% gains during the same time frame.

Applied Materials’ performance has remained impressive over the long term as well. AMAT stock prices have soared 49.1% on a YTD basis and 38.9% over the past 52 weeks, outpacing SOXX’s 31.6% gains in 2025 and 29.9% returns over the past year.

AMAT stock has traded consistently above its 50-day and 200-day moving averages since mid-September, underscoring its bullish trend.

Applied Materials’ stock prices gained 1.3% in the trading session following the release of its better-than-expected fiscal 2025 results on Nov. 13. Because of continued adoption of AI and investment in advanced semiconductors and wafer fab equipment, Applied Materials’ topline has continued to increase. For fiscal 2025, the company reported $28.4 billion in net revenues, up 4.4% year-over-year. Meanwhile, its adjusted EPS soared 8.9% year-over-year to $9.42, beating the consensus estimates by a small margin.

Despite its solid rally, AMAT stock has notably underperformed its peer Lam Research Corporation’s (LRCX) 110.3% gains in 2025 and 106.1% surge over the past 52-week period.

Among the 34 analysts covering the AMAT stock, the consensus rating is a “Moderate Buy.” However, as of writing, AMAT is trading above its mean price target of $239.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart