With a market cap of $164.1 billion, Accenture plc (ACN) is a global professional services company, delivering strategy, consulting, technology, and operations services across major regions worldwide. It provides capabilities spanning systems integration, cloud, AI, security, software engineering, and industry-specific business process services.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Accenture fits right into that category. The company serves a wide range of sectors and partners with organizations like AWS to support transformative digital initiatives.

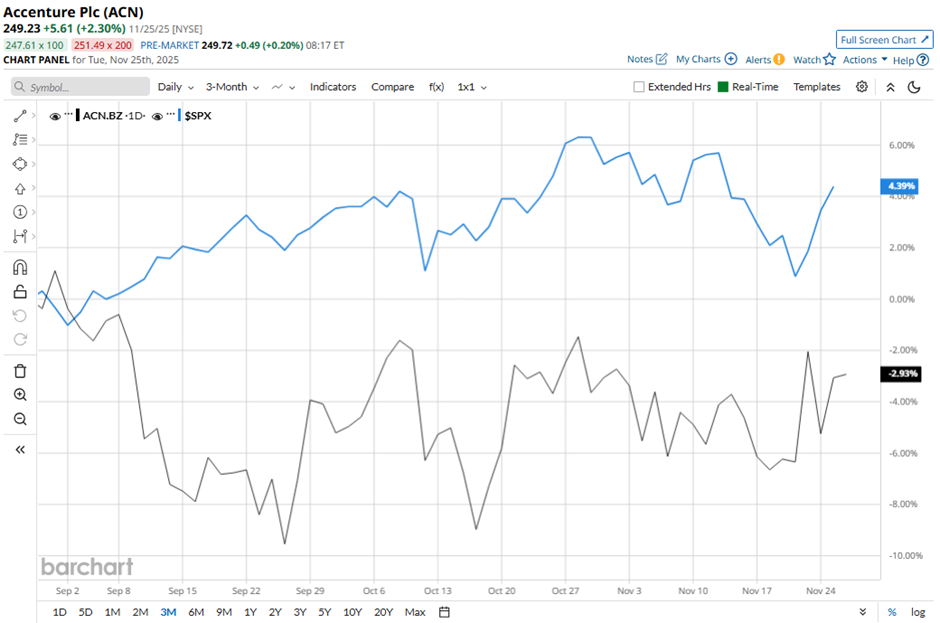

Shares of the Dublin, Ireland-based company have fallen 37.4% from its 52-week high of $398.35. Accenture’s shares have declined 2.4% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 5.1% gain over the same time frame.

In the longer term, ACN stock is down 29.2% on a YTD basis, underperforming SPX’s over 15% rise. Moreover, shares of the consulting company have dropped 31.4% over the past 52 weeks, compared to the 13% return of the SPX over the same time frame.

The stock has been trading below its 200-day moving average since March.

Accenture posted Q4 2025 results on Sept. 25. The company reported better-than-expected adjusted EPS of $3.03 and up 8.6% year-over-year. Revenue also exceeded expectations at $17.6 billion, rising 7.3% and supported by strong performance in key segments such as financial services and products. Investor sentiment further improved as Accenture reported robust $21.3 billion in bookings and issued upbeat fiscal 2026 guidance, with projected Q1 revenues of $18.10 billion - $18.75 billion, well above consensus. However, the stock fell 2.7% on that day.

In comparison, rival Broadcom Inc. (AVGO) has outpaced ACN stock. AVGO stock has surged 67.4% on a YTD basis and 135.5% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on Accenture. It has a consensus rating of “Moderate Buy” from the 24 analysts in coverage, and the mean price target of $284.29 is a premium of 14.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart