With a market cap of $215.9 billion, Salesforce, Inc. (CRM) is a leading California-based cloud computing company specializing in customer relationship management (CRM) software and enterprise cloud solutions. The company’s platform offers tools for sales, marketing, customer service, analytics, and business automation, helping companies manage customer interactions and drive growth.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks, and Salesforce fits this criterion perfectly. Known for its innovation and robust ecosystem, Salesforce serves businesses of all sizes across industries, making it a central player in the global cloud software and digital

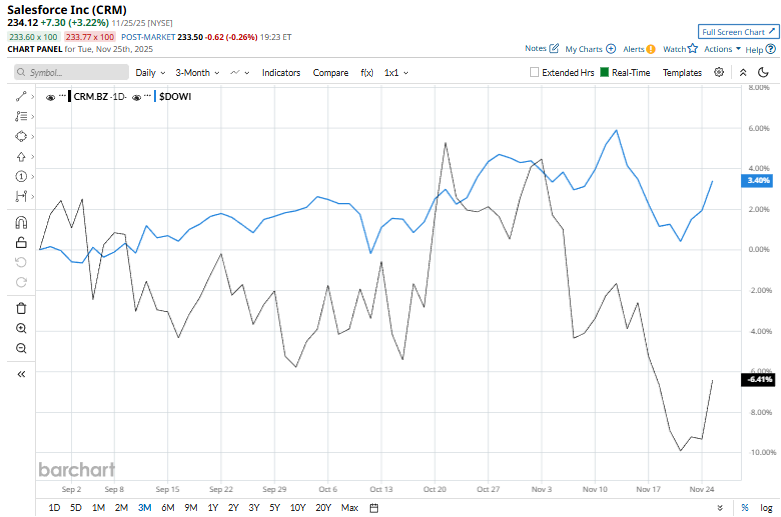

Despite its strengths, shares of the cloud giant declined 36.6% from its 52-week high of $369 touched on Dec. 4. Shares of Salesforce have dipped 5.6% over the past three months, underperforming the broader Dow Jones Industrial Average’s ($DOWI) 4% rise over the same time frame.

CRM has declined 30% year-to-date, underperforming the Dow Jones Industrial Average’s 10.7% gain. Over the past 52 weeks, Salesforce shares have dropped 31%, trailing the Dow’s 5.3% return.

The stock has been trading below its 50-day moving average since early March and recently slipped under its 200-day moving average in early November, signalling a sustained bearish trend.

On Sept. 3, Salesforce reported its Q2 2026 report with adjusted EPS of $2.91 and revenues of $10.2 billion, surpassing expectations. However, shares dropped 4.9% the following day after the company issued a Q3 revenue forecast of $10.24–10.29 billion, with the midpoint falling short of analyst estimates. The guidance highlighted slower-than-expected returns from its AI initiatives, including the new Agentforce platform, amid a challenging macroeconomic backdrop and cautious customer spending.

CRM has underperformed its rival, Intuit Inc. (INTU). Shares of Intuit have increased 14.9% over the past 52 weeks and 2.1% on a YTD basis.

Despite that, CRM stock has a consensus rating of “Moderate Buy” from 28 analysts covering it. Its mean price target of $831.29 indicates potential for an upswing of 28.3% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart