New York-based Verizon Communications Inc. (VZ) is a leading telecommunications company that provides wireless voice, data, broadband, and fiber services to consumers, businesses, and government clients. Valued at a market cap of $169.5 billion, the company operates a nationwide 5G wireless network and offers connectivity solutions, internet services, and streaming bundles through its Verizon Wireless and Fios brands.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and VZ fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the telecom services industry. The company’s continued investment in 5G infrastructure, enterprise mobility, and network reliability underpins its competitive positioning, while its strong brand and scale provide consistent cash flows.

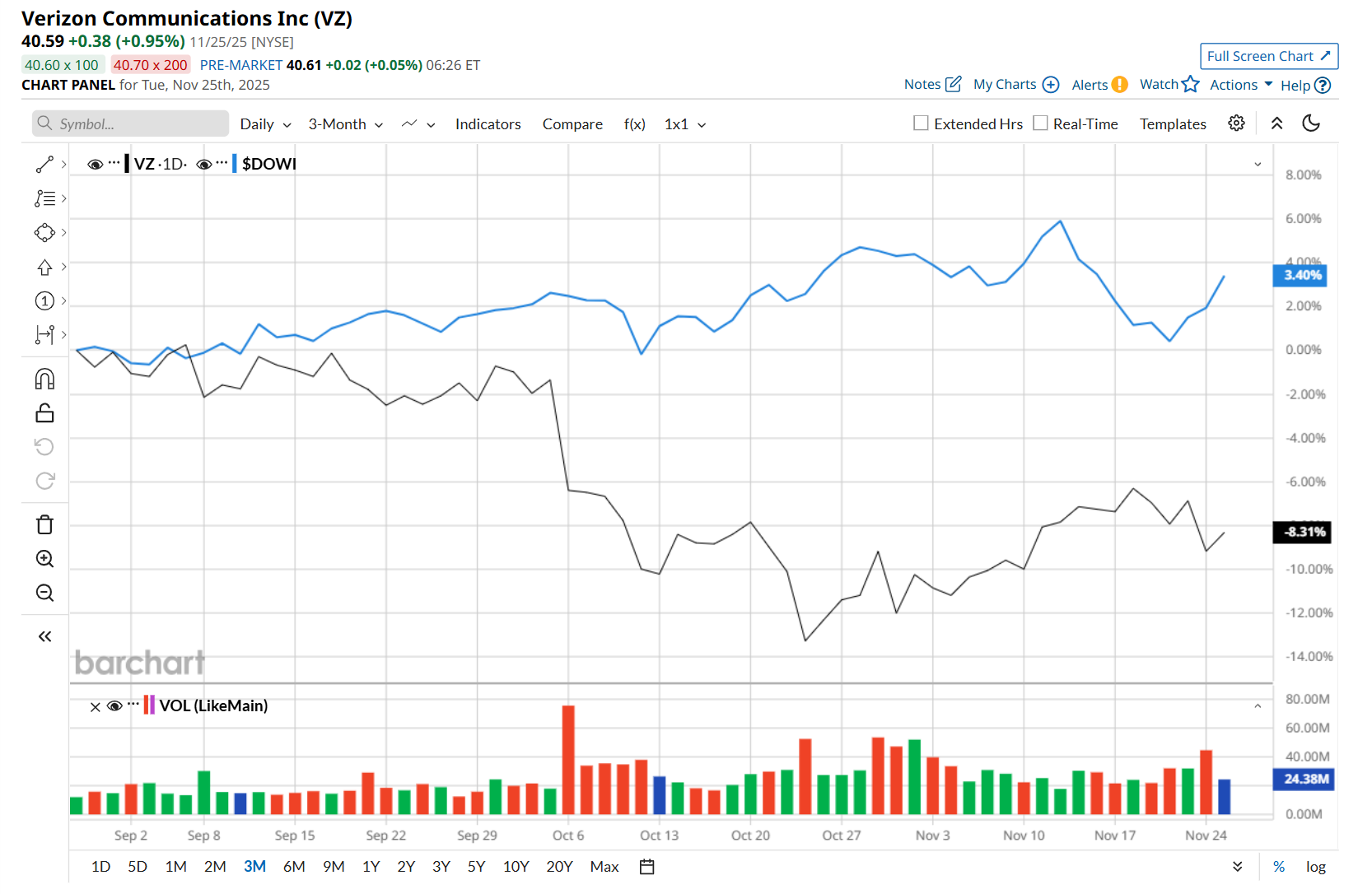

Despite its notable strength, this telecom giant has dipped 14.3% from its 52-week high of $47.36, reached on Mar. 10. Shares of VZ have declined 8.2% over the past three months, considerably underperforming the Dow Jones Industrial Average’s ($DOWI) 4% uptick during the same time frame.

In the longer term, VZ has fallen 7.7% over the past 52 weeks, trailing behind DOWI's 5.3% return over the same time period. Moreover, on a YTD basis, shares of VZ are up 1.5%, compared to DOWI’s 10.7% surge.

To confirm its bearish trend, VZ has been trading below its 200-day and 50-day moving averages since early October.

On Oct. 29, VZ reported mixed Q3 earnings results, and its shares surged 2.3% as its adjusted EPS came in at $1.21, up 1.7% from the year-ago quarter and ahead of analyst estimates. However, its operating revenue also rose about 1.5% year over year to $33.8 billion, but missed Wall Street expectations by 1.1%. VZ also raised its dividend for the 19th consecutive year, further bolstering investor confidence.

VZ has also notably lagged behind its rival, AT&T Inc. (T), which gained 12% over the past 52 weeks and 13.6% on a YTD basis.

Despite VZ’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 28 analysts covering it, and the mean price target of $47.30 suggests a 16.5% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Stock Is a ‘Must Own’ Now Before ‘Hundreds of Billions in Value’ Changes Hands, According to This 1 Analyst

- Analysts Like Credo Going Into Earnings — Time to Buy CRDO Stock?

- What Dell’s Q3 Numbers Mean for Your Portfolio: Buy, Sell, or Hold?

- Alibaba’s Profits Have Nosedived: Is BABA Still a Buy on AI and Instant Commerce Push?