Westlake, Texas-based Charles Schwab Corporation (SCHW) operates as a financial holding company. With a market cap of $161.2 billion, Charles Schwab provides various services, including wealth management, securities brokerage, banking, asset management, custody, and financial advisory.

Companies worth $10 billion or more are generally described as "large-cap stocks." Charles Schwab fits this bill perfectly. Given the company holds trillions in client assets and employs over 32,000 people, its valuation above this mark is not surprising. The company serves over 36 million active brokerage accounts and strives to disrupt Wall Street’s traditional approaches by finding ways to improve the investing experience for its clients.

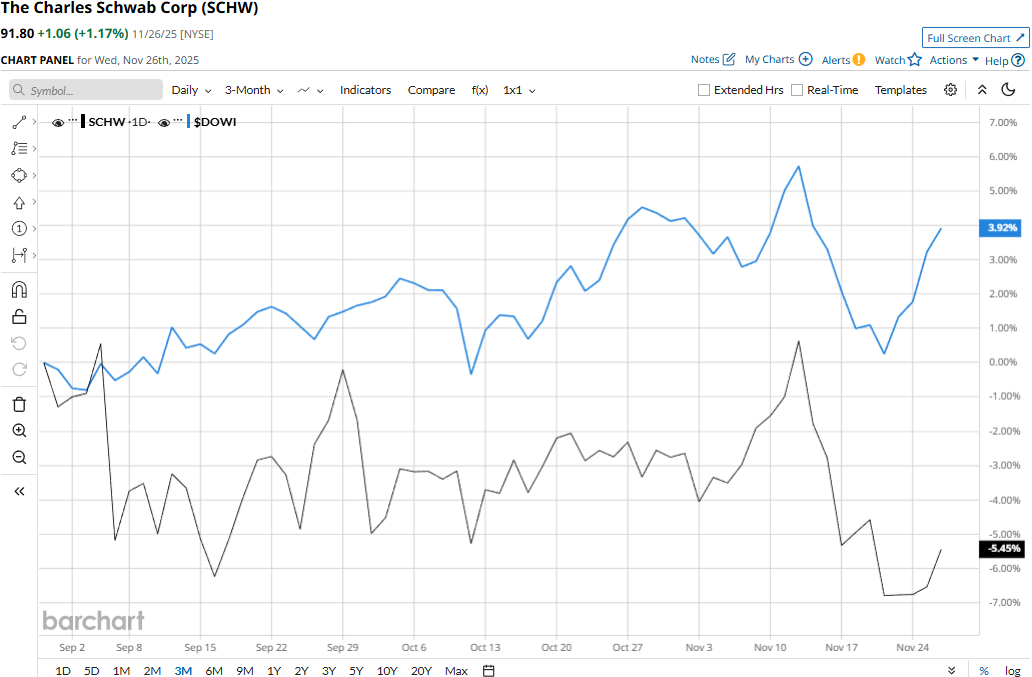

SCHW touched its all-time high of $99.59 on Jul. 29 and is currently trading 7.8% below that peak. Meanwhile, SCHW has dropped 5.6% over the past three months, notably lagging behind the Dow Jones Industrial Average’s ($DOWI) 4.4% uptick during the same time frame.

However, Charles Schwab has notably outperformed over the longer term. SCHW stock has soared 24% on a YTD basis and gained 11.6% over the past year, compared to the Dow’s 11.5% gains in 2025 and 5.7% returns over the past 52 weeks.

SCHW stock has traded above its 200-day moving average since mid-April and dropped below its 50-day moving average in mid-November, underscoring its overall bullish trend and recent downturn.

Despite reporting better-than-expected results, Charles Schwab’s stock prices observed a 98 bps dip in the trading session following the release of its Q3 results on Oct. 16. The company registered a solid 17% surge in client assets compared to the year-ago quarter, reaching $11.6 trillion. Meanwhile, it brought in $137.5 billion in core net new assets in Q3, bringing the YTD assets gathering to $355.5 billion, up 41% year-over-year.

Driven by these positives, SCHW’s overall net revenues grew 26.6% year-over-year to $6.1 billion, beating the Street’s expectations by 3%. Meanwhile, its adjusted EPS skyrocketed 70.1% year-over-year to $1.31, surpassing the consensus estimates by 5.7%. Following the initial dip, SCHW stock remained in the positive territory for the next three trading sessions.

Despite its solid performance, Charles Schwab has underperformed compared to its peer, Morgan Stanley’s (MS) 33.6% gains in 2025 and 27.9% returns over the past 52 weeks.

Among the 23 analysts covering the SCHW stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $112.30 suggests a 22.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?