Comcast Corporation (CMCSA) is a leading global media, entertainment, and telecommunications conglomerate based in Philadelphia, Pennsylvania. Comcast operates across multiple segments, including broadband and connectivity (residential and business), video services, media networks and studios (through its ownership of NBCUniversal), streaming, as well as theme parks and entertainment venues. Comcast has a market cap of around $96.8 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Comcast fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the communication services sector.

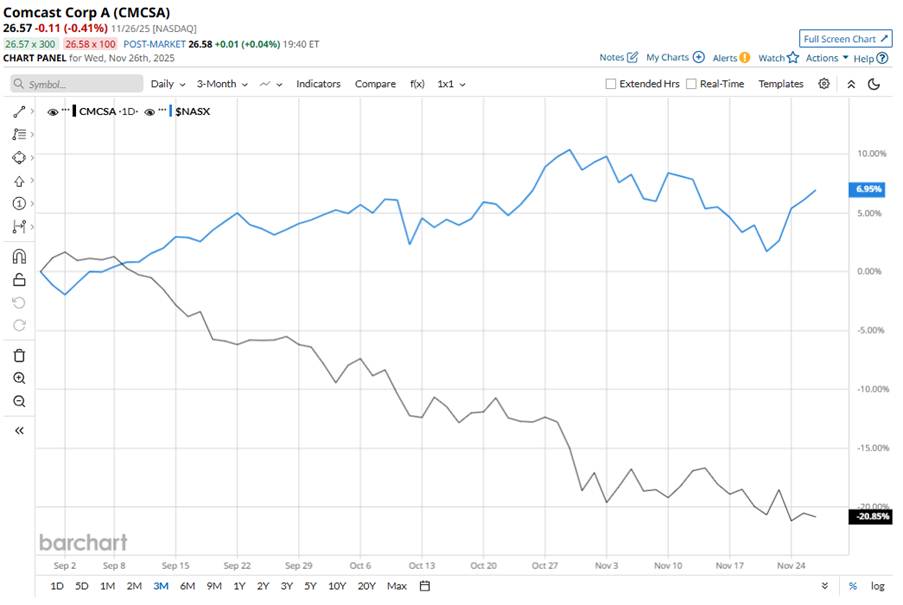

CMCSA stock has plummeted 38.9% from its 52-week high of $43.45 touched on Dec. 3, 2024. Meanwhile, the stock declined 21.1% decline over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 7.8% surge during the same time frame.

In the longer term, CMCSA stock has declined 29.2% on a YTD basis and 37.7% over the past 52 weeks, lagging behind NASX’s 20.2% gains in 2025 and 21.1% surge over the past year.

To confirm the downtrend, CMCSA stock has remained consistently below its 200-day moving average over the past year. Moreover, the stock has largely traded below the 50-day moving average, with occasional fluctuations.

Comcast’s share price has been under pressure this year largely because its core broadband business is losing momentum amid market saturation, rising competition from fiber and fixed-wireless providers, and an acceleration of “cord-cutting.” At the same time, rising operating costs have squeezed margins, while the market remains skeptical about near-term growth catalysts.

However, Comcast has performed better than its peer, Charter Communications, Inc. (CHTR), with a 41.7% decline in 2025 and a 48.8% plunge over the past 52 weeks.

Among the 31 analysts covering CMCSA stock, the consensus rating is a “Moderate Buy.” Its mean price target of $35.66 suggests a 34.2% upside potential.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart