Valued at a market cap of $88.3 billion, New York-based Coinbase Global, Inc. (COIN) is the largest U.S. cryptocurrency exchange. It provides a platform for trading digital assets, offering services for consumers, institutions, and developers in the global crypto economy.

Coinbase Global's shares have outpaced the broader market over the past 52 weeks. COIN stock has increased 82.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 19.6%. Moreover, the stock is up 34.6% on a YTD basis, compared to SPX’s 16.5% gain.

In addition, shares of Coinbase Global have also surpassed the iShares U.S. Financials ETF's (IYF) 14.3% return over the past 52 weeks.

Shares of Coinbase climbed 4.7% following its Q3 2025 results on Oct. 30, as the company reported net income of $1.50 per share, surpassing expectations. Transaction revenue nearly doubled to $1.05 billion amid heightened crypto volatility that boosted trading volumes. Investors were also encouraged by a 34.3% rise in subscription and services revenue to $746.7 million and the Deribit acquisition, which strengthened Coinbase’s foothold in the derivatives market.

For the current fiscal year, ending in December 2025, analysts expect COIN’s adjusted EPS to decline 42.9% year-over-year to $4.34. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

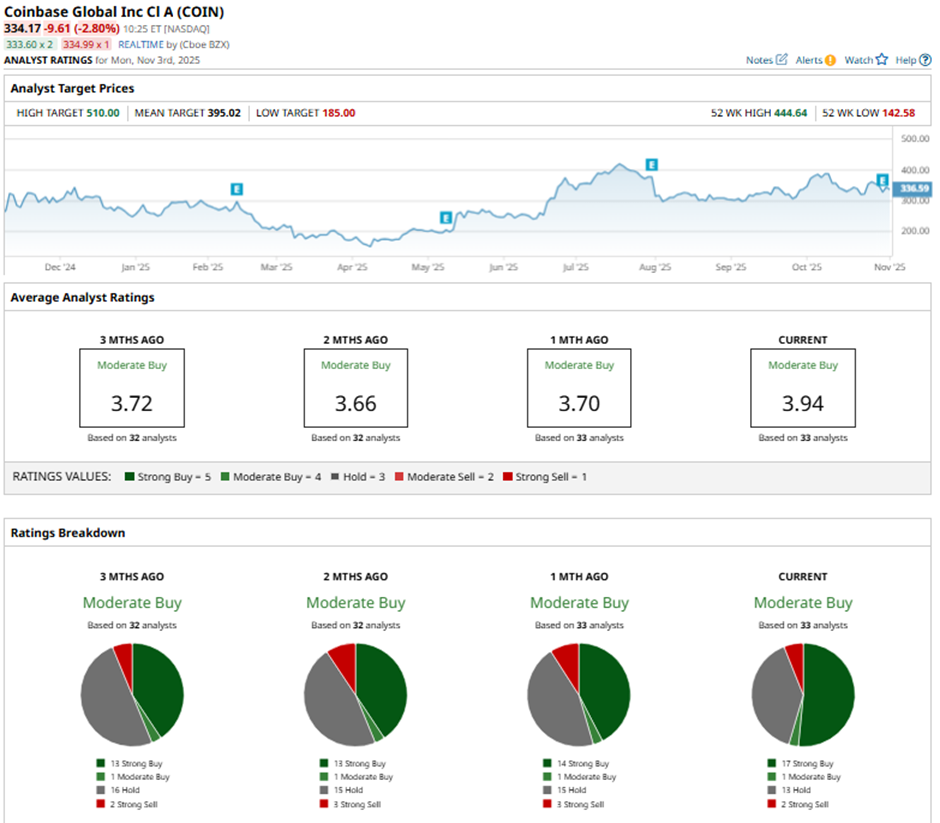

Among the 33 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and two “Strong Sells.”

This configuration is more bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Oct. 31, BTIG raised its price target on Coinbase to $420 and maintained a “Buy” rating.

The mean price target of $395.02 represents an 18.2% premium to COIN’s current price levels. The Street-high price target of $510 suggests a 52.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $9.7 Billion Reason to Buy IREN Stock Right Now

- This Analyst Is Warning that a Popular AI Data Center Stock Could Plunge More Than 30% from Here

- Rare Earth Mining Stocks Are Taking Over Wall Street. Here’s 1 ETF to Buy to Profit.

- Athletic Apparel Icon Nike (NKE) Offers an Informational Arbitrage Opportunity