With a market cap of $119.3 billion, Interactive Brokers Group, Inc. (IBKR) operates as a leading automated electronic broker serving both institutional and individual investors worldwide. It provides low-cost trading, execution, custody, and portfolio management services across a wide range of asset classes, including stocks, options, futures, forex, bonds, mutual funds, ETFs, precious metals, and cryptocurrencies.

The Greenwich, Connecticut-based company's shares have outpaced the broader market over the past 52 weeks. IBKR stock has increased 82.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.7%. Moreover, shares of the company are up 59.3% on a YTD basis, compared to SPX’s 16.3% gain.

In addition, shares of Interactive Brokers have also outperformed the iShares U.S. Financials ETF's (IYF) 13.1% return over the past 52 weeks.

Despite net revenues rising 21% to $1.66 billion and EPS increasing to $0.59 for Q3 2025 on Oct. 16, shares of Interactive Brokers fell 3.3% the next day. Investors were cautious about the decline in the GLOBAL currency basket, which reduced comprehensive earnings by $33 million, and the 8% drop in other fees and services.

For the current fiscal year, ending in December 2025, analysts expect IBKR’s adjusted EPS to grow 14.8% year-over-year to $2.02. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

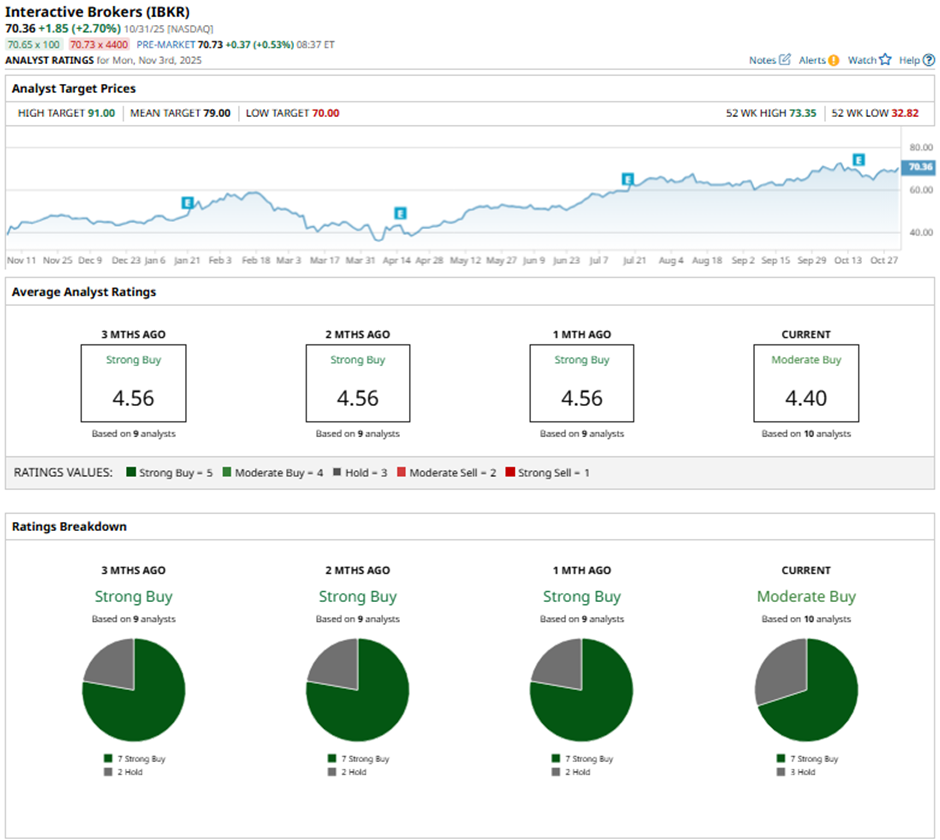

Among the 10 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings and three “Holds.”

On Oct 18, BofA raised its price target on Interactive Brokers to $77 and maintained a “Buy” rating.

The mean price target of $79 represents a 12.3% premium to IBKR’s current price levels. The Street-high price target of $91 suggests a 29.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart