New York-based VICI Properties Inc. (VICI) operates as a REIT, engaged in owning, acquiring, and developing gaming, hospitality, and entertainment destinations. With a market cap of approximately $32 billion, VICI owns one of the largest portfolios of market-leading leisure destinations, including Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas.

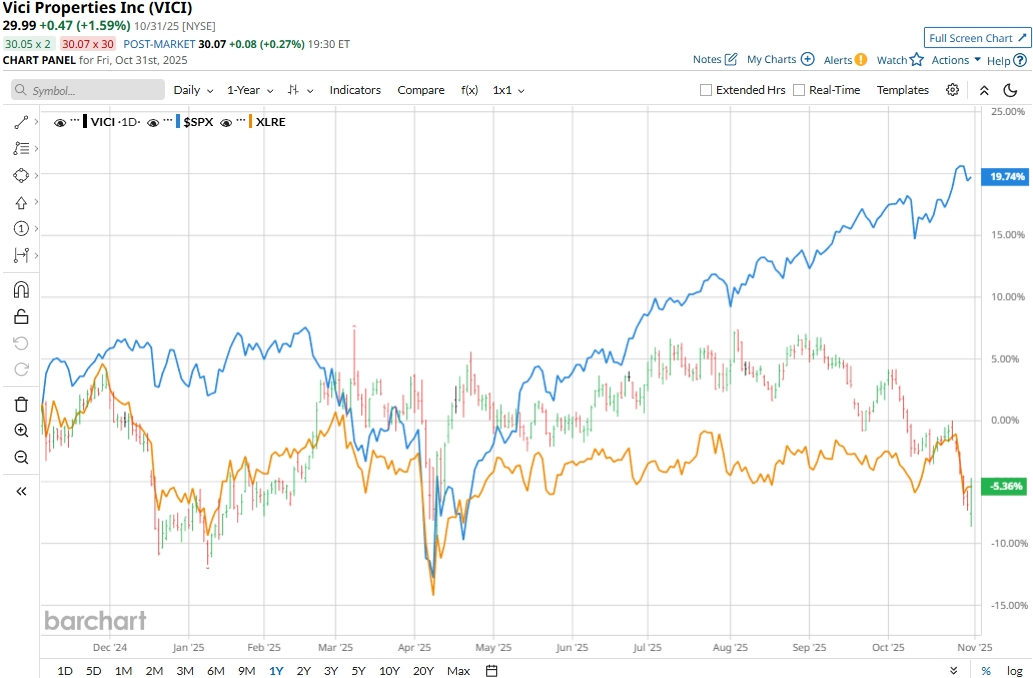

Despite its strengths, the stock has notably underperformed the broader market. VICI stock prices have gained a modest 2.7% on a YTD basis and declined 7.5% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% surge over the past year.

Narrowing the focus, VICI has slightly outpaced the sector-focused Real Estate Select Sector SPDR Fund’s (XLRE) marginal 57 bps uptick on a YTD basis, but marginally underperformed XLRE’s 7% decline over the past 52 weeks.

VICI Properties’ stock prices observed a 1.6% uptick in the trading session following the release of its impressive Q3 results on Oct. 30. The recent drop in VICI’s stock prices can be attributed to the broader downturn in the real estate space. The company’s fundamentals have continued to remain robust, which has been demonstrated by the company’s 7.4% growth in aggregate adjusted funds from operations (AFFO) over the past 12 months, while its share count inched up by just 2.1%.

In Q3, VICI’s topline grew 4.4% year-over-year to $1 billion, exceeding the consensus estimates by 43 bps. Meanwhile, its AFFO per share grew by 5.3% to $0.71, surpassing the Street’s expectations by 1.6%.

For the full fiscal 2025, ending in December, analysts expect VICI to deliver an AFFO of $2.37 per share, up 4.9% year-over-year. Further, the company has a solid AFFO surprise history. It has surpassed the Street’s AFFO estimates in each of the past four quarters.

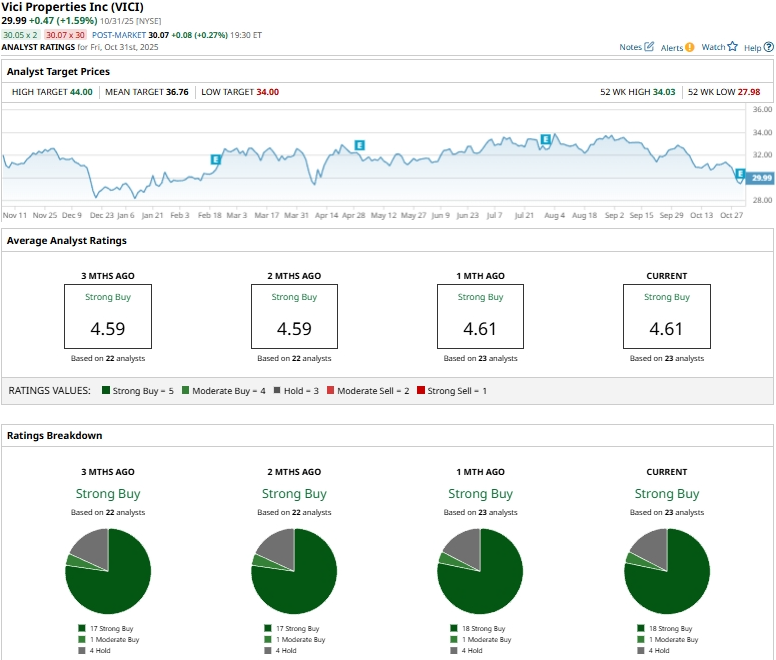

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buys,” one “Moderate Buy,” and four “Holds.”

This configuration is slightly more optimistic than two months ago, when 17 analysts gave “Strong Buy” recommendations.

On Oct. 31, Stifel analyst Simon Yarmak maintained a “Buy” rating on VICI, but lowered the price target from $35 to $34.

VICI’s mean price target of $36.76 suggests a 22.6% upside potential. Meanwhile, the street-high target of $44 represents a notable 46.7% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart