Valued at a market cap of $46.6 billion, Exelon Corporation (EXC) is a Chicago, Illinois-based utility company that transmits, distributes, and delivers electricity and natural gas across multiple U.S. regions. The company is recognized for its strong focus on reliability, affordability, and sustainability in meeting the energy needs of millions of customers.

This utility company has underperformed the broader market over the past 52 weeks. Shares of EXC have gained 16.2% over this time frame, while the broader S&P 500 Index ($SPX) has soared 17.7%. Nonetheless, on a YTD basis, the stock is up 22.5%, outpacing SPX’s 16.3% rise.

Zooming in further, EXC has also outpaced the Utilities Select Sector SPDR Fund’s (XLU) 12.7% return over the past 52 weeks and 17.7% surge on a YTD basis.

On Jul. 31, Exelon’s shares surged 1.5% after its mixed Q2 earnings release. While its revenue of $5.4 billion fell short of the consensus estimates by 1.8%, its adjusted EPS of $0.39 exceeded analyst expectations by 5.4%, which might have bolstered investor confidence. However, its bottom line fell 17% from the prior-year quarter, due to lower utility earnings.

Exelon reaffirmed its fiscal 2025 adjusted operating earnings guidance of $2.64 to $2.74 per share, and operating EPS compounded annual growth in the 5% to 7% range from 2024 to 2028.

For the current fiscal year, ending in December, analysts expect EXC’s EPS to grow 7.2% year over year to $2.68. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

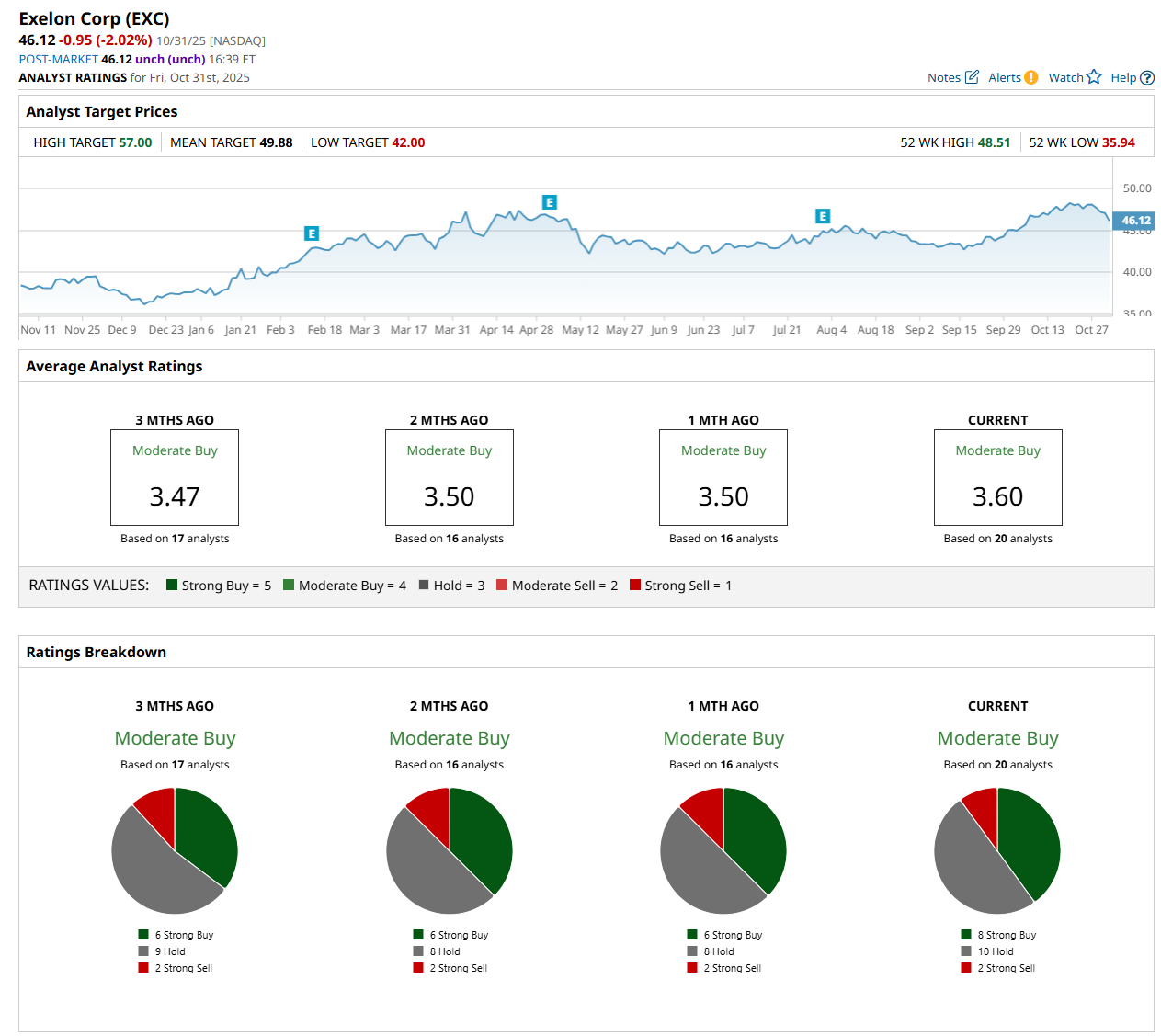

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” 10 "Hold,” and two "Strong Sell” ratings.

This configuration is more bullish than a month ago, with six analysts suggesting a “Strong Buy” rating.

On Oct. 27, Wells Fargo & Company (WFC) initiated coverage of Exelon, with an "Overweight" rating and $52 price target, implying a 12.7% potential upside from the current levels.

The mean price target of $49.88 represents an 8.2% premium from EXC’s current price levels, while the Street-high price target of $57 suggests an upside potential of 23.6%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart