Beyond Meat (BYND) investors should mark Nov. 11 on their calendars, as the plant-based meat company has pushed back its third-quarter earnings release by a week to address a significant accounting issue.

The delay comes as management requires additional time to calculate a material non-cash impairment charge related to certain long-lived assets. However, the company cannot yet reasonably quantify the amount.

The earnings postponement triggered an immediate market reaction, with shares plunging 16% on Monday. This setback occurs during an already turbulent period for Beyond Meat, which has recently experienced significant price swings that have captivated meme stock traders and short sellers alike.

Two weeks ago, Beyond Meat shares embarked on a remarkable rally, surging almost 150% in a single day, marking their best trading session ever. The explosive move followed the stock's addition to the Roundhill Meme Stock ETF (MEME), which appeared to trigger a massive short squeeze as hedge funds scrambled to cover positions.

BYND stock continued to surge after Beyond Meat announced an expanded distribution partnership at Walmart (WMT) stores nationwide. BYND stock closed trading at $1.39 on Monday and was down over 7% in pre-market trading today. It is currently down about 0.4% in afternoon trading.

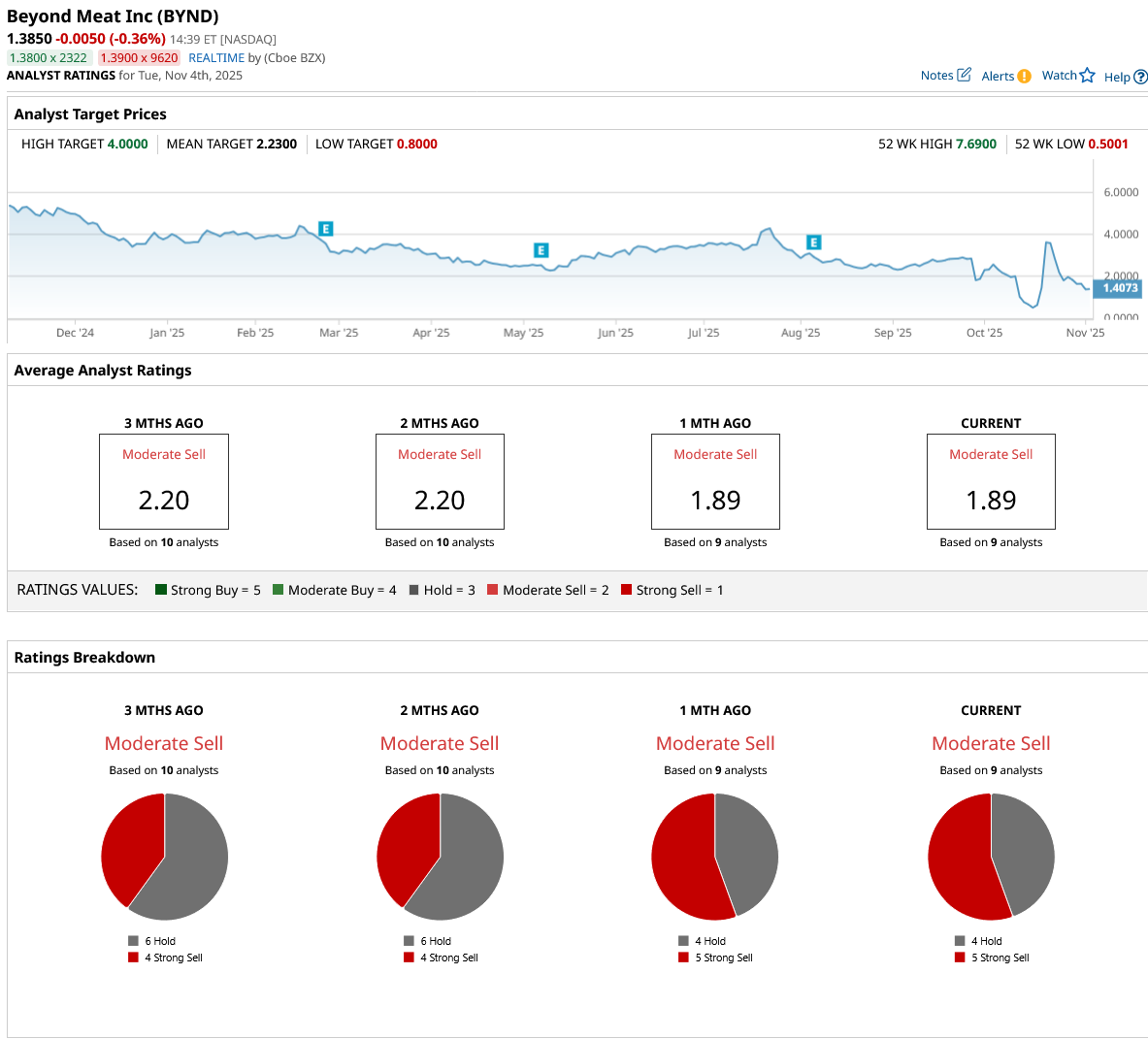

Beyond Meat faces serious fundamental challenges, having posted losses in each of the past five years. The stock has collapsed from its 2019 post-IPO high above $230 per share to a 52-week low of $0.50 in 2025.

BYND Stock Is Down 99% From Its All-Time Highs

Despite the recent rally, Beyond Meat stock is down 99% from its all-time high and has grossly underperformed the broader markets. Beyond Meat delivered deeply disappointing results in Q2, as it continues to struggle with a high cash burn rate and declining sales.

Beyond Meat reported revenue of $75 million in the June quarter, representing a 20% year-over-year (YoY) decline. The top line was well below management estimates and a sharp reversal from the marginal growth seen in late 2024.

Sales originating from the U.S. declined by 27% YoY, primarily due to premium pricing of products, slowing demand, and a challenging macroeconomic environment. Management also acknowledged that misinformation about product health benefits has become deeply ingrained and difficult to counter despite their efforts.

International foodservice sales declined 26% as promotional activity from the prior year waned and certain quick-service restaurant partners paused or discontinued their burger offerings. These distribution losses are expected to continue to impact results for the foreseeable future, according to management commentary.

Gross margin compressed to just 11.5% from 14.7% in the prior year period, indicating poor fixed cost absorption due to lower volumes, an unfavorable product mix, and accelerated depreciation charges resulting from the suspension of China operations.

While management claims underlying manufacturing costs are improving, these gains remain completely obscured by structural business challenges. The company announced another workforce reduction and brought in turnaround specialist John Boken from AlixPartners as interim chief transformation officer, signaling the severity of operational problems.

Beyond Meat aims to report a positive EBITDA in the second half of 2026, driven by cost savings and revenue stabilization.

What Is the BYND Stock Price Target?

Beyond Meat's revenue increased from $88 million in 2018 to $464 million in 2021. It is forecast to end 2025 with sales of $284 million, representing a 13% YoY decline.

Out of the nine analysts covering BYND stock, four recommend “Hold” and five recommend “Strong Sell.” The average BYND stock price target is $2.23, indicating an upside potential of over 60% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart