D-Wave Quantum (QBTS) is a global leader in quantum computing systems, software, and services. As the first commercial supplier of quantum computers, D-Wave uniquely develops both quantum annealing and gate-model quantum computers, targeting real-world industrial and research applications. With systems available both via cloud and on-premises, D-Wave’s technology addresses optimization, artificial intelligence, and complex research challenges.

Founded in 1999 and headquartered in Palo Alto, California, the company has solved over 200 million problems on its quantum platforms so far.

About QBTS Stock

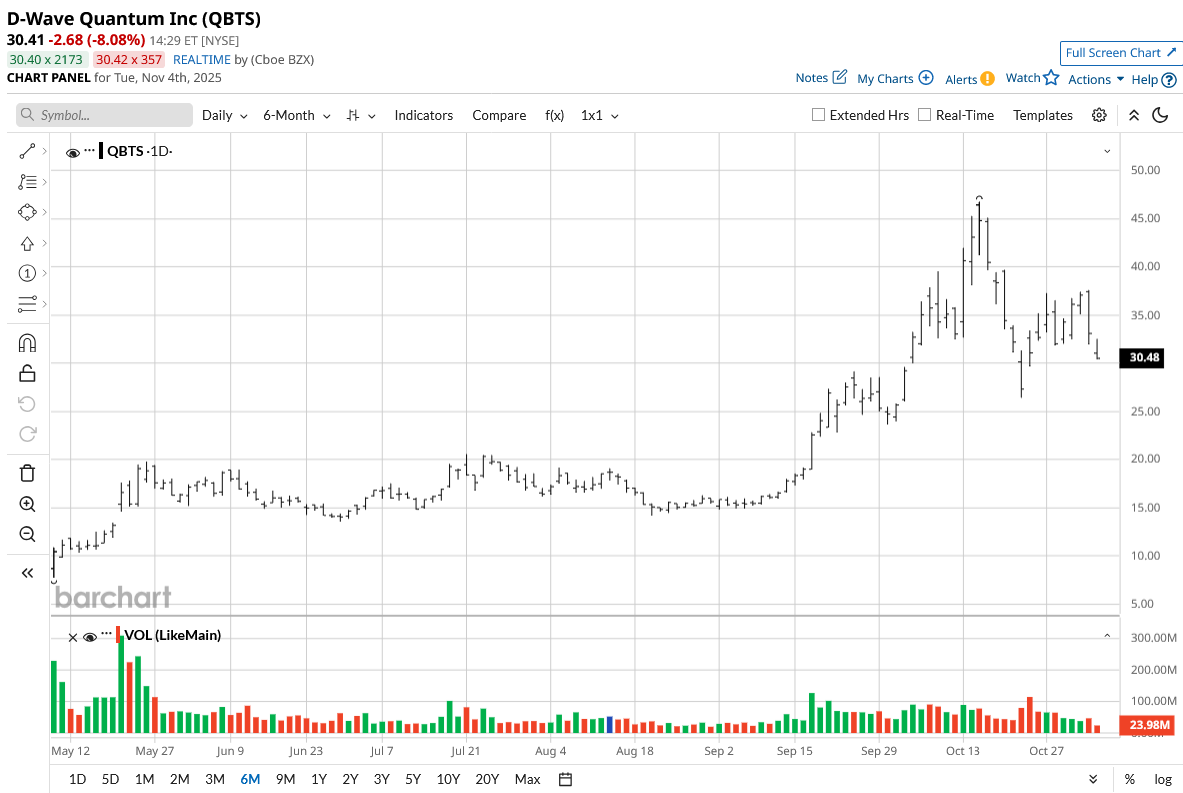

QBTS stock has shown remarkable growth in 2025, up approximately 265% year-to-date (YTD) but dipping about 4% over the last five days, reflecting strong investor interest in quantum computing technology and supported by technological advancements and increasing market adoption.

In the longer term, the six-month gain is over 288%, while the 52-week increase exceeds 2950%, significantly outperforming its relevant benchmark, the Russell 2000, which posted modest gains of 10% in the same period.

The stock exhibits high volatility typical of emerging tech sectors, with frequent sharp advances and corrections. Despite short-term pullbacks, D-Wave has maintained a strong upward trajectory fueled by growing demand for quantum computing solutions and cloud-based hybrid quantum-classical services.

D-Wave Quantum Results

D-Wave Quantum published Q2 2025 results on Aug. 6, reporting a revenue of $3.1 million, a 42% increase year-over-year (YoY) that exceeded analyst expectations by 22%. However, EPS fell short, with a loss per share of $0.08 compared to the estimated loss of $0.05, largely due to non-cash warrant revaluation charges and increased operating expenses.

Operating expenses rose 41% to $28.5 million, reflecting investments in personnel and R&D. Gross margin held steady at approximately 64%, with adjusted EBITDA loss widening to $20 million. Despite losses, D-Wave ended the quarter with record cash reserves of about $815 million, bolstered by a $400 million equity raise completed in July 2025, providing a strong financial foundation for future growth.

Looking ahead, D-Wave emphasized continued investment in developing its quantum computing platform and expanding commercial applications while remaining cautious on near-term profitability due to ongoing R&D and scaling costs. The company highlighted its recent commercial release of the sixth-generation Advantage2 system and new developer tools aimed at advancing quantum AI innovation, positioning itself strongly in the emerging quantum tech sector.

Analyst Bullish on QBTS

B. Riley has maintained its “Buy” rating on D-Wave Quantum with a price target of $33, which is on par with the market range. The firm highlighted a recent €10 million ($11.6 million) agreement with Swiss Quantum Technology (SQT) to deploy D-Wave’s latest Advantage2 quantum computer as part of its Quantum-as-a-Service (QaaS) offerings. This deal includes upgrade-to-purchase options priced between $20 million and $40 million per system, further driving revenue potential.

Analysts at B. Riley expect D-Wave’s consensus earnings for Q3 and Q4 2025 to be achievable despite typical risks inherent in large deals. Operating expenses are expected to rise around 15% in the second half of 2025, primarily due to continued investments in research, development, and marketing. Effective management of adjusted EBITDA losses remains a priority, given the company’s $828 million in cash reserves, which provide a runway of over four years.

D-Wave Quantum is scheduled to report its third-quarter 2025 financial results on Nov. 6, before the market opens.

Should You Buy QBTS Stock?

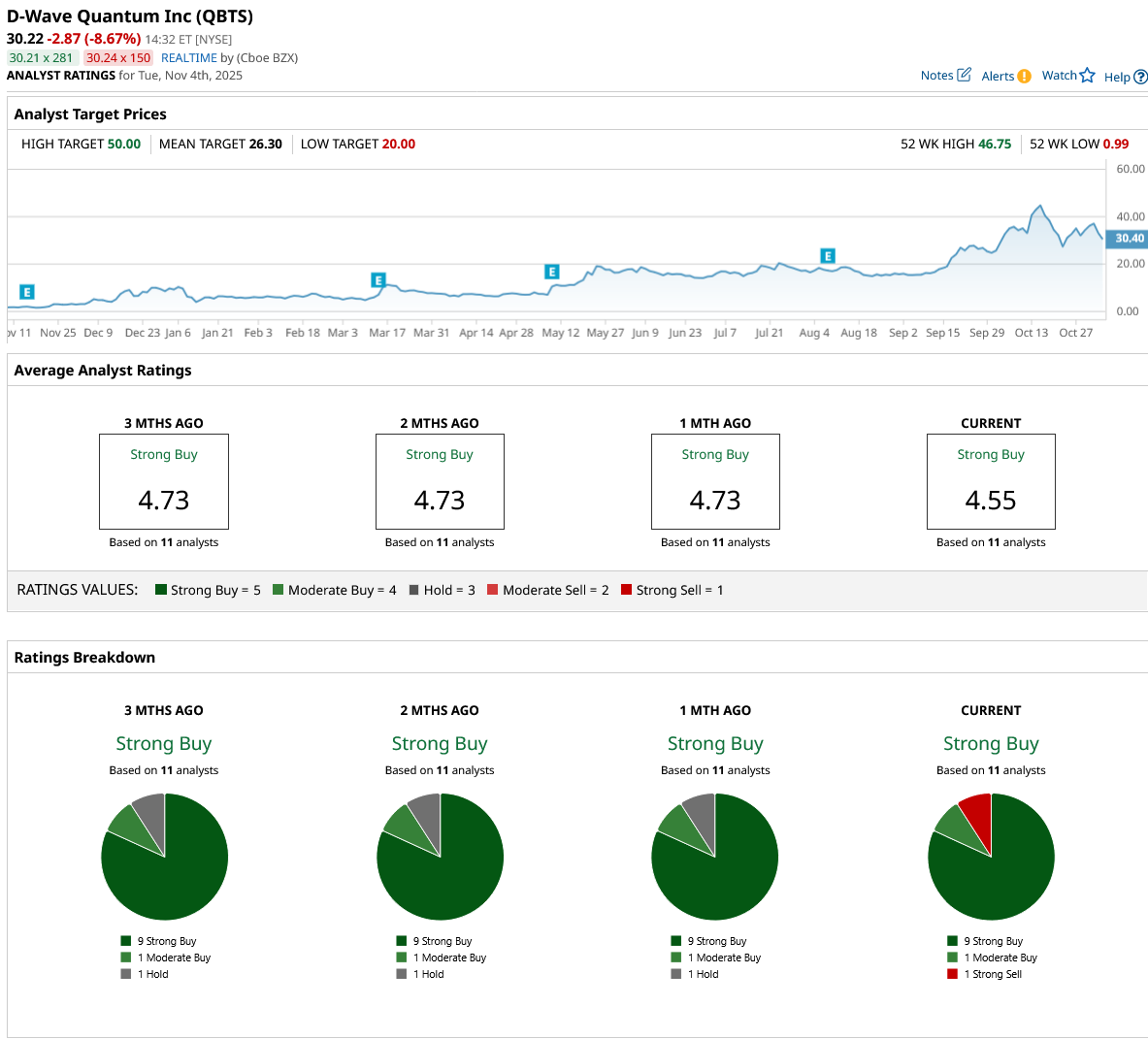

D-Wave Quantum has strong interest from market experts with a consensus “Strong Buy” rating with a mean price target of $26.30, reflecting a downside of 13% from the market rate.

QBTS stock has been rated by 11 analysts with nine “Strong Buy” ratings, one “Moderate Buy” rating, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart