EOG Resources, Inc. (EOG), headquartered in Houston, Texas, is a leading independent oil and gas company focused on efficiently exploring, developing, and producing hydrocarbons. Its operations are concentrated mainly in key U.S. basins, such as the Permian Basin, Eagle Ford, and Bakken, leveraging advanced drilling technologies, including hydraulic fracturing and horizontal drilling.

With a diversified portfolio, a commitment to sustainability, and a market capitalization of $56.68 billion, EOG maximizes resource potential and operational efficiency while upholding environmental responsibility and creating long-term shareholder value.

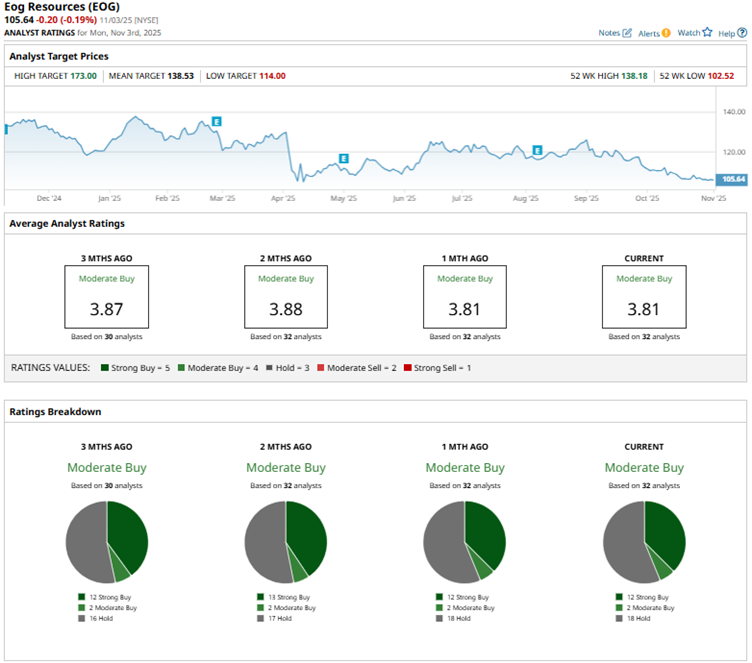

Influenced by market conditions and sector-wide challenges, the stock has been facing a tough time on Wall Street. Over the past 52 weeks, the stock has declined by 12.6%, and it has also decreased by 4.7% over the past six months. It had reached a 52-week high of $138.18 in January, but is down 23.6% from that level.

The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 19.6% over the past 52 weeks and 20.5% over the past six months. Turning our focus to the company’s own energy sector, we see that the stock has underperformed here as well, while the Energy Select Sector SPDR Fund (XLE) is up marginally over the past 52 weeks and 7.5% over the past six months.

For the second quarter of fiscal 2025, EOG’s oil, NGLs and natural gas production were all above its guidance midpoints. The company’s revenue of $5.48 billion, although 9.1% lower year-over-year (YOY), was higher than the analyst-expected $5.46 billion figure. Its adjusted net income per share of $2.32, although lower than the year-ago period’s $3.16, was higher than the expected $2.21. Post its Encino acquisition, the company also revised its full-year total capital expenditures outlook to a range of $6.2 billion to $6.4 billion.

Wall Street analysts show concern about EOG’s bottom-line trajectory, giving a mixed outlook. For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect EOG’s EPS to drop 14.5% YOY to $9.93 on a diluted basis. However, EPS is expected to increase 1.4% to $10.07 in fiscal 2026.

For Q3 (which is set to be reported on Nov. 6 after the market closes), EPS is projected to decrease 15.9% annually to $2.43. On the other hand, the company has a solid history of surpassing consensus EPS estimates, topping them in all four trailing quarters.

Among the 32 Wall Street analysts covering EOG’s stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, two “Moderate Buys,” and 18 “Holds.” The ratings configuration is less bullish than it was two months ago, with 12 “Strong Buy” ratings, down from 13 in the previous configuration.

Last month, Scott Hanold from RBC Capital kept the “Buy” rating on EOG, with a price target of $145. Just a few days earlier, Jefferies analyst Lloyd Byrne also maintained a “Buy” rating on the stock, while setting a price target of $144.

EOG’s mean price target of $138.53 indicates a 31.1% upside over current market prices. The Street-high price target of $173 implies a potential upside of 63.8%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart