The Max S&P 500 4X Leveraged ETN (SPYU) is the first and only exchange-traded product in the U.S. market that applies leverage to target a daily return of… wait for it… 400% of the S&P 500 Index’s ($SPX) return. There are 4x and even 5x ETFs in Europe, and if you are wondering how the folks there ended up with access to all of that “juice” before we in the United States did, I’m right there with you.

But you see, I don’t look at SPYU as some wild and crazy ETF, with its fancy 400% feature. Instead, I look at it as something of a substitute for buying S&P 500 call options. Except that I’m trading off a few things, willingly.

First, SPYU has an expiration date, but it is not until 2043. More on that in a moment. A call option expires in somewhere between a day and a few years, and its price each day reflects that fact.

SPYU does have a lot of volatility, and is subject to the “math of investing loss” rule. In other words, if the S&P 500 drops a few percentage points in a day, that means SPYU is down 10% or more. That means I need more than a 10% gain just to get back to even.

SPYU is an exchange-traded note (ETN), and while that risk has not reared its ugly head often or in a while, an ETN has one potentially big disadvantage compared to an ETF. Unlike an ETF, ETNs have counterparties. That means counterparty risks. What risks? That the note issuer, Bank of Montreal in this case, could not make good on its backing of SPYU. This is one of those low-probability but always possible things to consider when the fund name includes “ETN” instead of "ETF.”

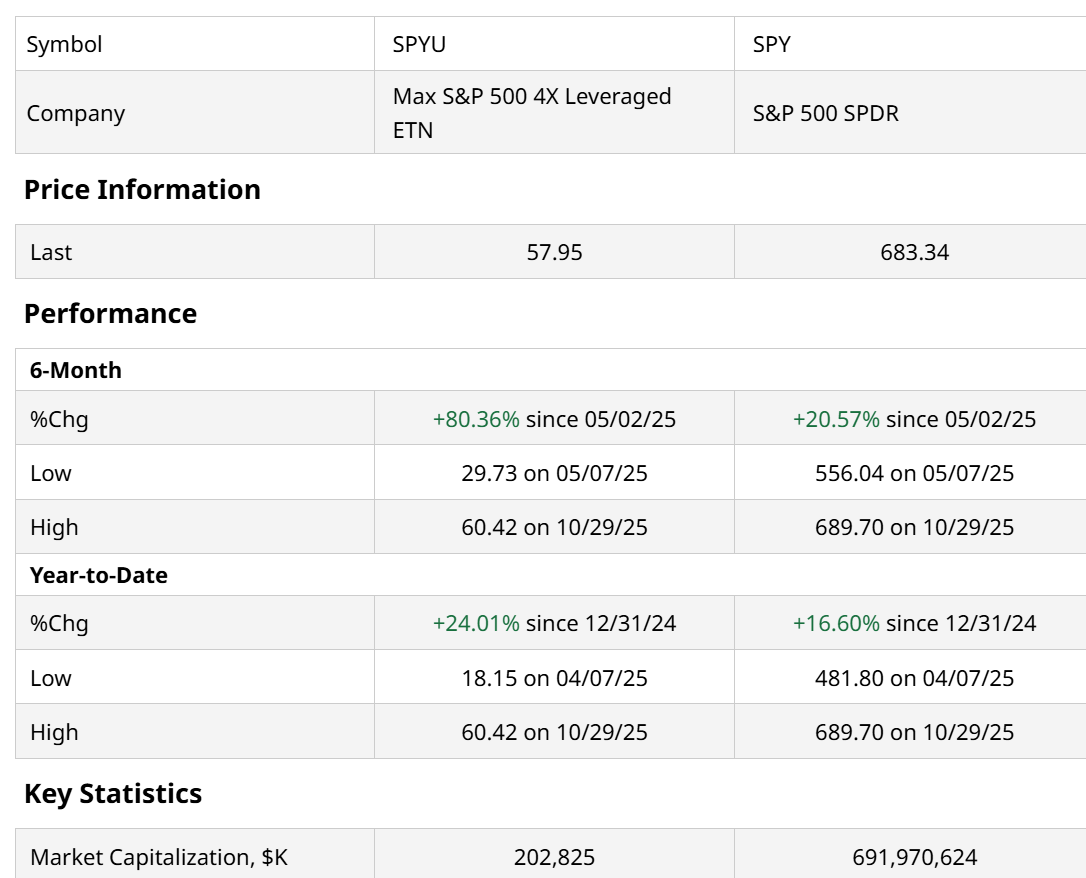

The best way to visualize a unicorn like SPYU is to compare it side by side to an unleveraged S&P 500 ETF such as the SPDR S&P 500 Trust ETF (SPY).

The 6-month return is just about 4 times that of the unleveraged ETF. Just as expected.

However, when we look at the year-to-date period, we realize that expecting SPYU to perform to that 4:1 ratio over any time period longer than a single day is a mistaken assumption. Remember, leveraged or “geared” ETFs are set up for daily trading, even intraday. That said, holding them longer can and does work out, if everything goes in the right direction.

With SPYU, that right direction is up. And since the market bottomed just over 6 months ago, and the S&P 500 has had smooth sailing since, that 4:1 ratio stayed intact. That’s unusual.

The return for the full calendar year of 2025 so far incorporates the wild activity of March and April. Those gyrations screw up the math. And that left SPYU up less than 1.5x that of SPY over a 10-month period of time.

This is all good to keep in mind, and necessary before even contemplating using an exotic ETF like SPYU. It is sizable enough for many investors at $200 million in assets. But the key is not only if it should be used, but how to use it. Here’s how I use it, when I do own it.

A Substitute for Buying S&P 500 Call Options

Let’s go back to May 2 of this year, when SPY stood around $567 a share, and SPYU traded at around $32 a share. That’s 6 months ago, as in that comparison table above. We know that SPY returned about 20% since that time, and SPYU gained about 80%.

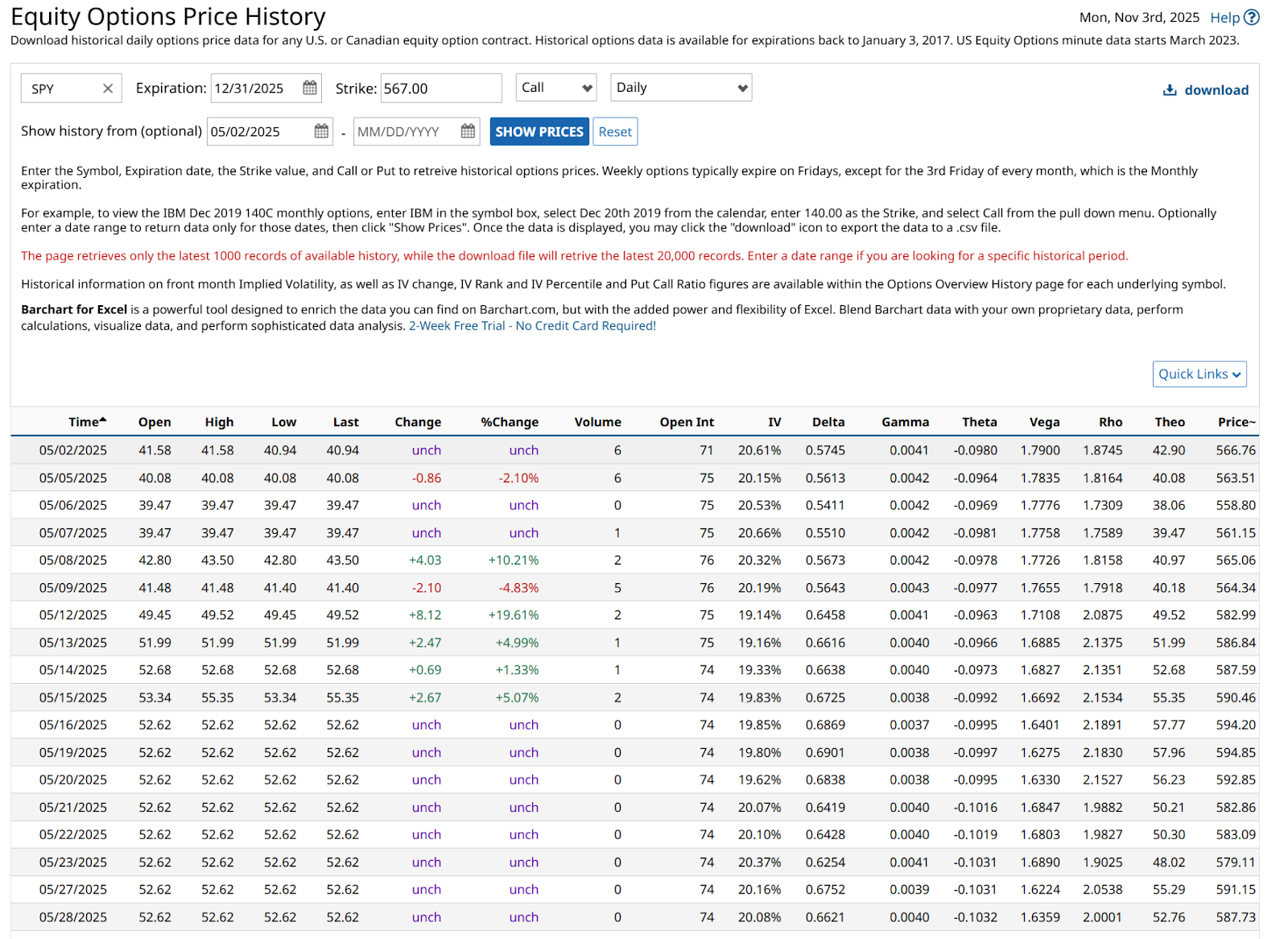

But instead, what if I had decided back then to buy an at-the-money call option on SPY, expiring at the end of this year. Here’s how it started.

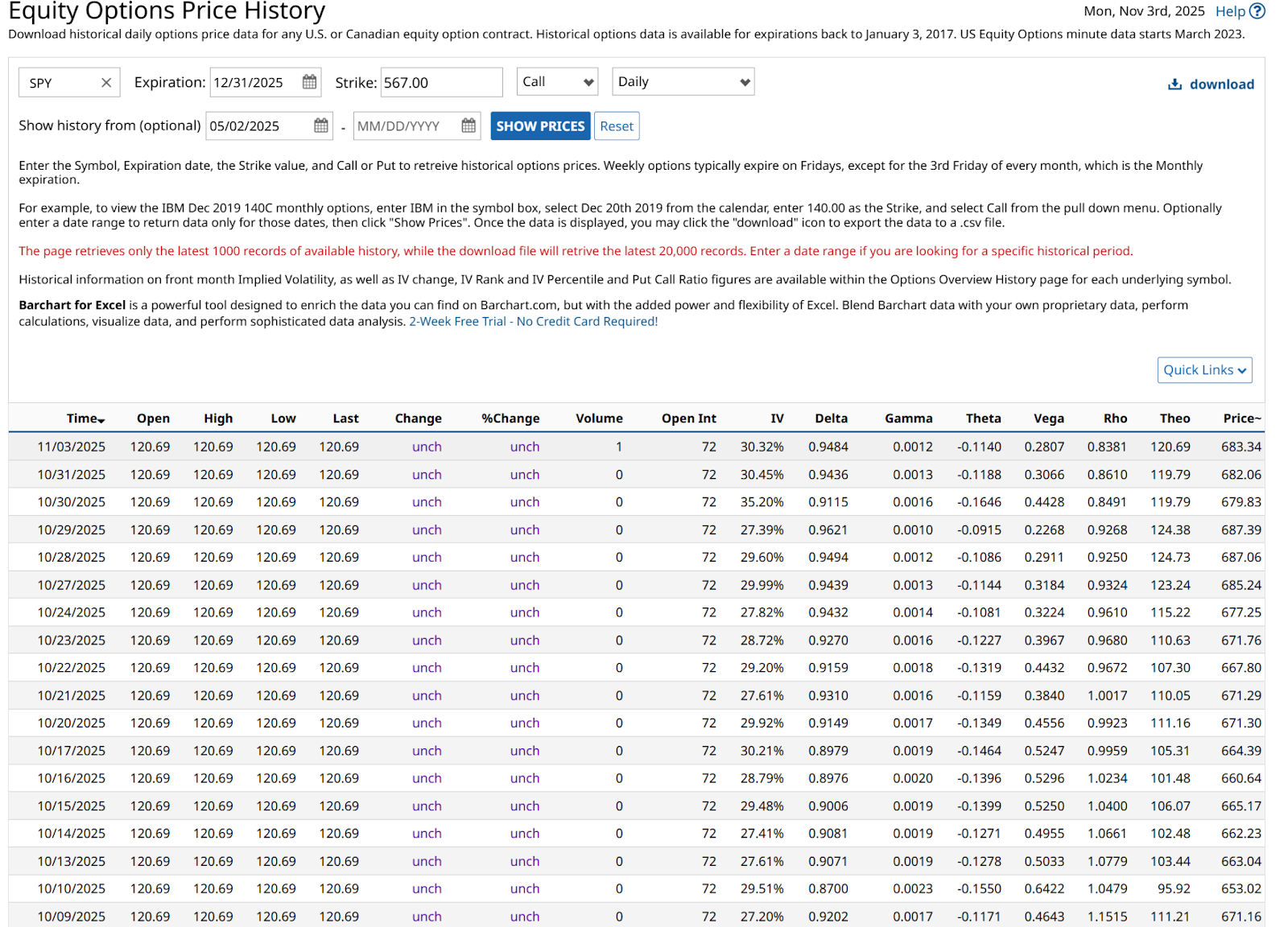

And here’s how it was going, as of Monday’s close:

SPYU vs. At-the-Money Call Options on SPY

We can see that for about $40 a share, or $4,000 per 100 shares, I could have bought the right to buy SPY for $56,700 back then. That $4,000 was the premium I paid up front to not have to shell out a lot more cash to participate in a potential SPY runup.

Today, that option would be worth around $12,000. And 100 shares of SPY would be worth about $68,300.

The net is an unrealized profit of $8,000. A triple. Or, in leveraged ETF terms, a 3x return.

But SPYU returned 4x that of SPY. However, to be in position for that far back in May, my capital commitment to buy SPYU would have been much, much more.

The choice is up to each investor. The tradeoffs are many, and it is a personal choice. But when we start to think of leveraged ETFs as simply a different set of reward and risk tradeoffs, trading and investing starts to be more strategic and measured.

And less about reckless risk taking. Imagine that: a 4x leveraged ETP as a form of risk management. Speaking for myself only, that’s a big part of how I invest. Especially with cash yields being so high.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as on Substack.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart