One of the previous beneficiaries of the dot-com surge, shares of Cisco (CSCO) have had quite the journey over the course of two and a half decades. This is a company that's seen incredible cycles as a key provider of infrastructure and equipment to the IT sector. When it was the rise of the internet, Cisco surged in value. Now, with the rise of AI and other innovative technologies, Cisco does appear to be poised for another boom-driven rally in its share price.

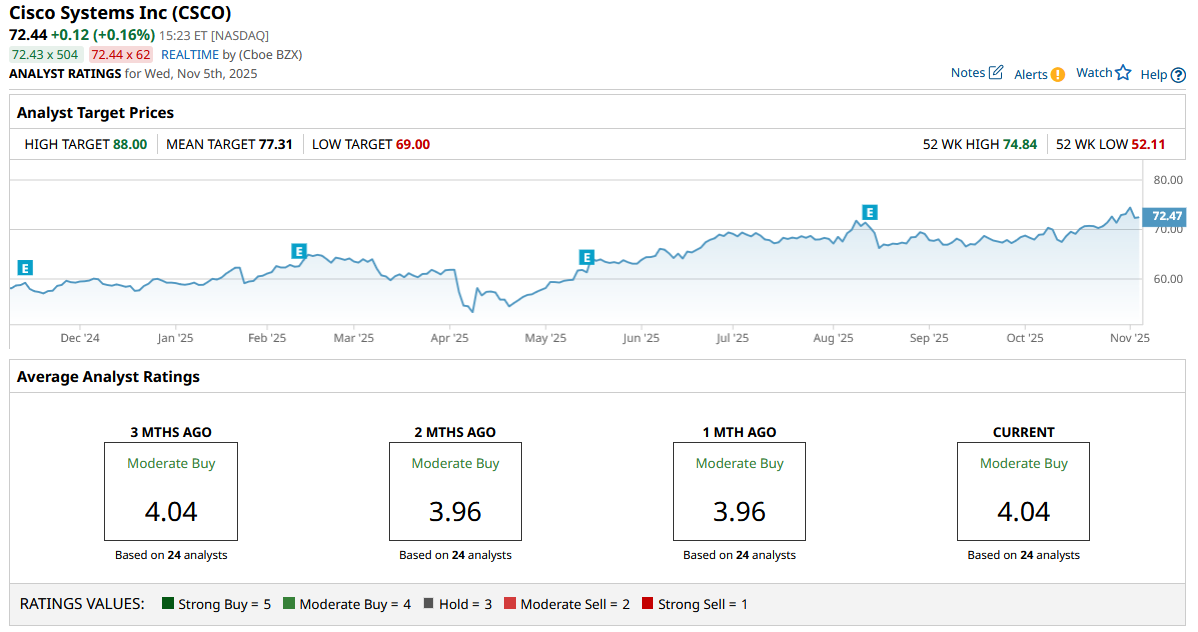

At least, some of the experts on Wall Street are anticipating such a move. A recent note from analysts at UBS, which upgraded CSCO stock to a “Buy” from “Hold” and included a price target increase to $88 per share (the highest on the Street), has some investors wondering just how high Cisco could fly from here.

Let's dive into whether the recent market exuberance we've seen will play out in an entirely different fashion than the dot-com surge or if this latest price target hike is an indication that expectations have gotten too frothy too quickly.

There Are Fundamentals to Back Up This Argument

What I like most about the piece from UBS assessing Cisco's share price appreciation potential is that the analysis put forward is built upon a fundamental bottom-up valuation approach.

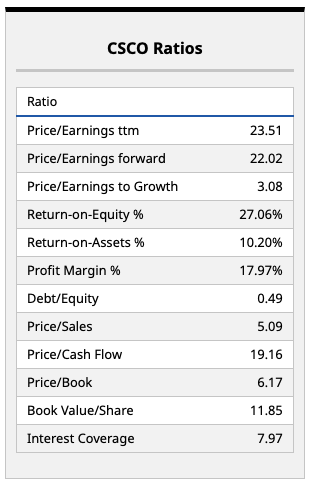

Analysts at UBS estimate that Cisco will earn between $4.34 per share and $4.62 per share in 2027. As such, the investment firm's target of $88 per share implies a forward price/earnings multiple of just under 20 times at the midpoint of its forward earnings range.

That's not bad for most tech stocks, let alone companies like Cisco with clear AI catalysts. And given the chart above showing current multiples for CSCO stock, if the company can indeed grow its earnings in the fashion analysts believe, this is a stock that could get cheaper as its price rises, due entirely to the earnings picture strengthening for the smart switch maker.

What Does the Rest of the Analyst Community Think?

Aside from analysts at UBS, there happen to be 23 other analysts who have rated the company. They give CSCO stock a consensus “Moderate Buy” rating. Currently, the average price target on the stock stands at $76.58, which implies upside of around 5% from here.

That's certainly not bad, considering the run Cisco has been on of late. And it does appear that this recent price upgrade may not necessarily be reflected in the updated consensus numbers above, so I'd expect as new analyst notes come in on Cisco, we'll see the company's price target rise.

We're in the midst of a rather vicious bull market rally in any company tied to AI, and until that stops, Cisco will be an intriguing company to pay attention to.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?