With a market cap of $96.2 billion, Duke Energy Corporation (DUK) is one of the largest U.S. electric and gas utilities, serving millions of customers across the Southeast and Midwest. Headquartered in Charlotte, North Carolina, it operates about 50,000 MW of power capacity and focuses on regulated electric and natural gas services.

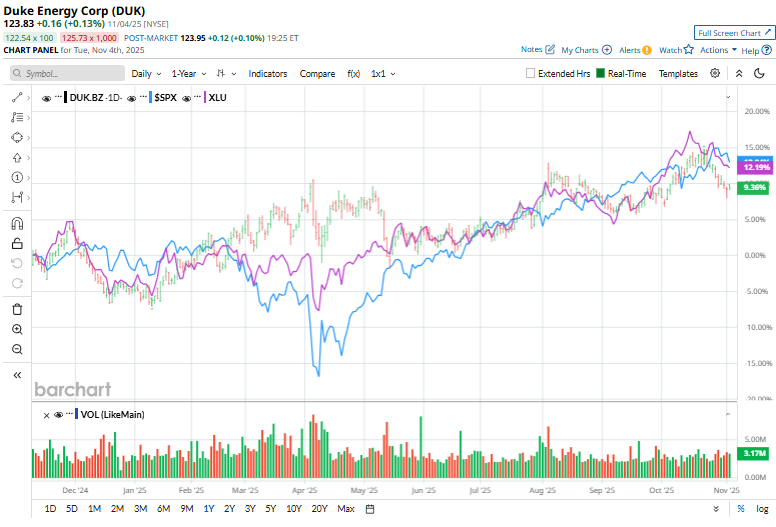

Duke Energy’s stock hasn’t kept pace with the broader market’s power surge. DUK stock has gained 10.1% over the past 52 weeks and 14.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 18.5% gains over the past year and 15.1% returns in 2025.

Even within its own lane, the story remains the same. DUK has lagged behind the Utilities Select Sector SPDR Fund’s (XLU) 15.1% surge over the past 52 weeks and 17.4% gains in 2025.

Duke Energy has lagged behind the broader market over the past year, largely due to the pressures that come with being a capital-intensive, regulated utility at a time when investors are favoring faster-growing tech and AI-driven sectors. The company has raised its long-term capital-spending plans and intends to issue equity to help fund these investments, creating dilution and financing concerns.

For the full fiscal 2025, ending in December, analysts expect DUK to deliver an EPS of $6.33, up 7.3% year-over-year. However, the stock has a mixed earnings surprise history. It has missed the Street’s bottom-line estimates in one of the past four quarters, and surpassed the projections on three other occasions.

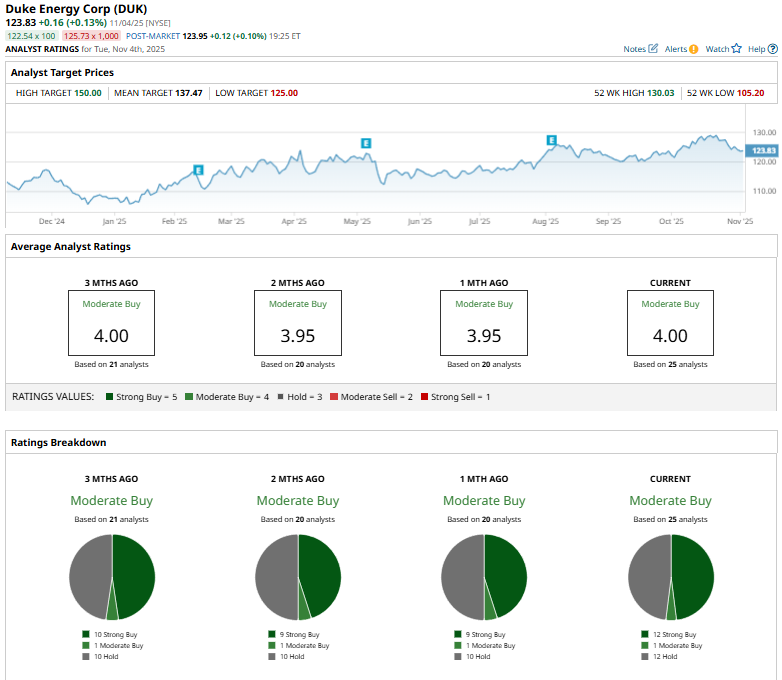

The stock has a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, 12 recommend “Strong Buy,” one suggests “Moderate Buy,” and 12 advocate “Hold” ratings.

This configuration is slightly more upbeat than it was a month ago, when nine analysts issued “Strong Buy” recommendations.

On Oct. 14, JPMorgan Chase & Co.’s (JPM) Jeremy Tonet reaffirmed a “Hold” rating on Duke Energy and kept the price target at $136.

Duke’s mean price target of $137.47 suggests a modest 11% upside potential. Meanwhile, the Street-high target of $150 represents a notable 21.1% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Volatility Alert: 10 Stocks Showing High IV Percentile

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?