Valued at a market cap of $227.4 billion, T-Mobile US, Inc. (TMUS) is one of the largest wireless carriers in the United States, known for its nationwide 5G network and customer-focused, value-driven approach. Headquartered in Bellevue, Washington, the company offers mobile voice, messaging, and data services to consumers and businesses.

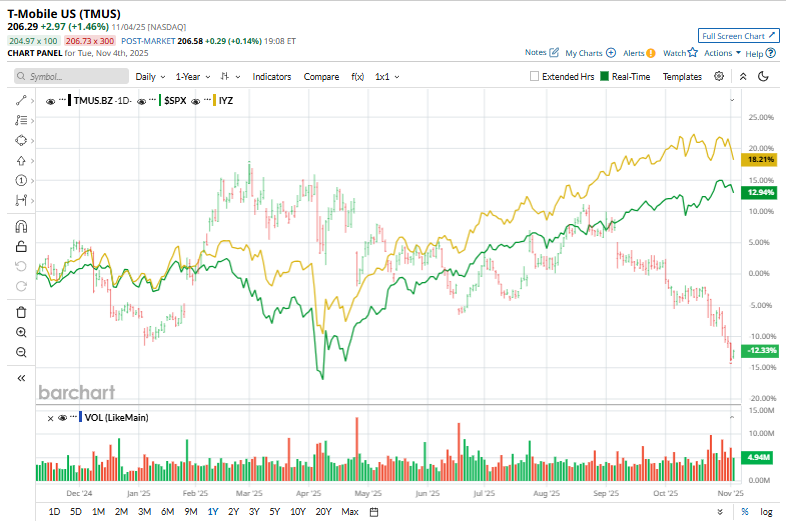

T-Mobile hasn’t exactly dialed up investor excitement lately. Over the past 52 weeks, TMUS stock has fallen 8%, while the broader S&P 500 Index ($SPX) has gained 18.5%. Moreover, on a YTD basis, TMUS is down 6.5%, compared to SPX’s 15.1% return.

Even within its own turf, the stock has struggled to keep pace with the iShares U.S. Telecommunications ETF’s (IYZ) 24% uptick over the past 52 weeks and 19.5% rise on a YTD basis.

On Oct. 23, T-Mobile released its FY2025 third-quarter earnings, and its shares dipped 3.3%. Its revenue improved 8.9% to $22 billion and service revenue climbed over 9%, supported by robust postpaid growth and record net additions of about 2.3 million customers, including 1 million postpaid phone adds. Core adjusted EBITDA increased around 6% to about $8.7 billion, though net income declined 11.3% to $2.7 billion, reflecting higher costs and heavier investment. The company boosted its full-year outlook for core adjusted EBITDA to $33.7 billion–$33.9 billion, underscoring confidence in sustained momentum.

For the current fiscal year, ending in December, analysts expect TMUS’ EPS to grow 6.1% year over year to $10.25. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

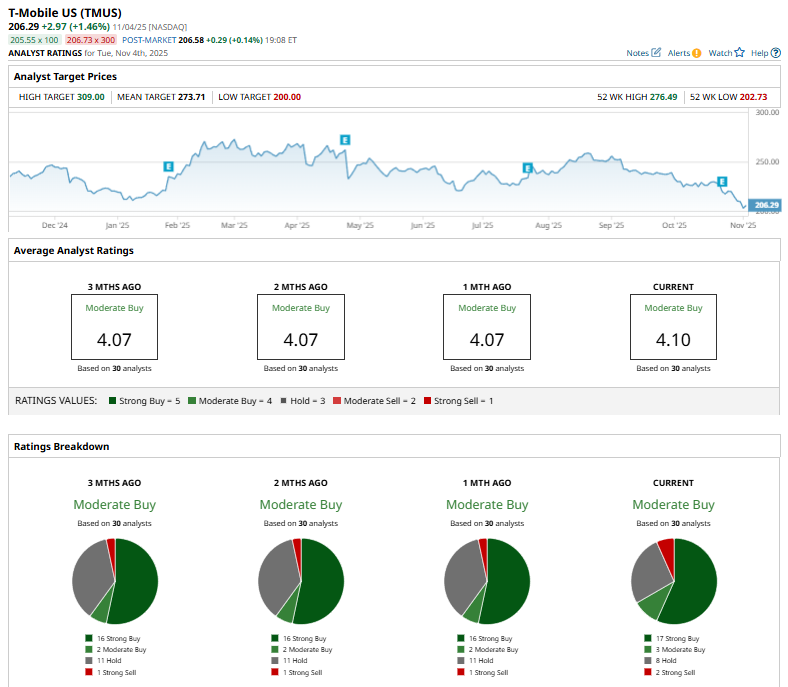

Among the 30 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 17 “Strong Buy,” three "Moderate Buy,” eight “Hold,” and two “Strong Sell” ratings.

This configuration is slightly more bullish than a month ago, with 16 analysts suggesting a “Strong Buy” rating.

On Oct. 16, Bernstein analyst Laurent Yoon reiterated a “Hold” rating on T-Mobile US and set a $265 price target.

The mean price target of $273.71 represents a 32.7% premium from TMUS’ current price levels, and the Street-high price target of $309 suggests an ambitious upside potential of 49.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?

- Dear IonQ Stock Fans, Mark Your Calendars for November 5