Every investor loves to talk about profits, but the best traders talk about protection. That’s the heart of hedging: managing risk before it manages you.

In his video How to Hedge Your Portfolio with Options (Before It’s Too Late!), Rick Orford explains how investors can use long puts as “insurance” against market losses — and how to find and price those trades directly using Barchart’s Long Put Screener.

What Is Hedging, and Why Does It Matter?

Hedging simply means protecting your unrealized profits from downside risk, whether that’s a potential market correction or another unexpected event.

Think of it like insurance for your investments. You pay a small amount upfront to protect a much larger position.

“Like insurance, you hope you never need it,” Rick says. “But it’s good to know it’s there.”

The Power of the Long Put

A put option gives the buyer the right (but not the obligation) to sell the underlying asset at a predetermined price (the strike price) before the expiration date.

Buying a long put protects you from downside risk, because if your stock collapses, you can still sell it at the strike price you chose.

Let’s walk through Rick’s example:

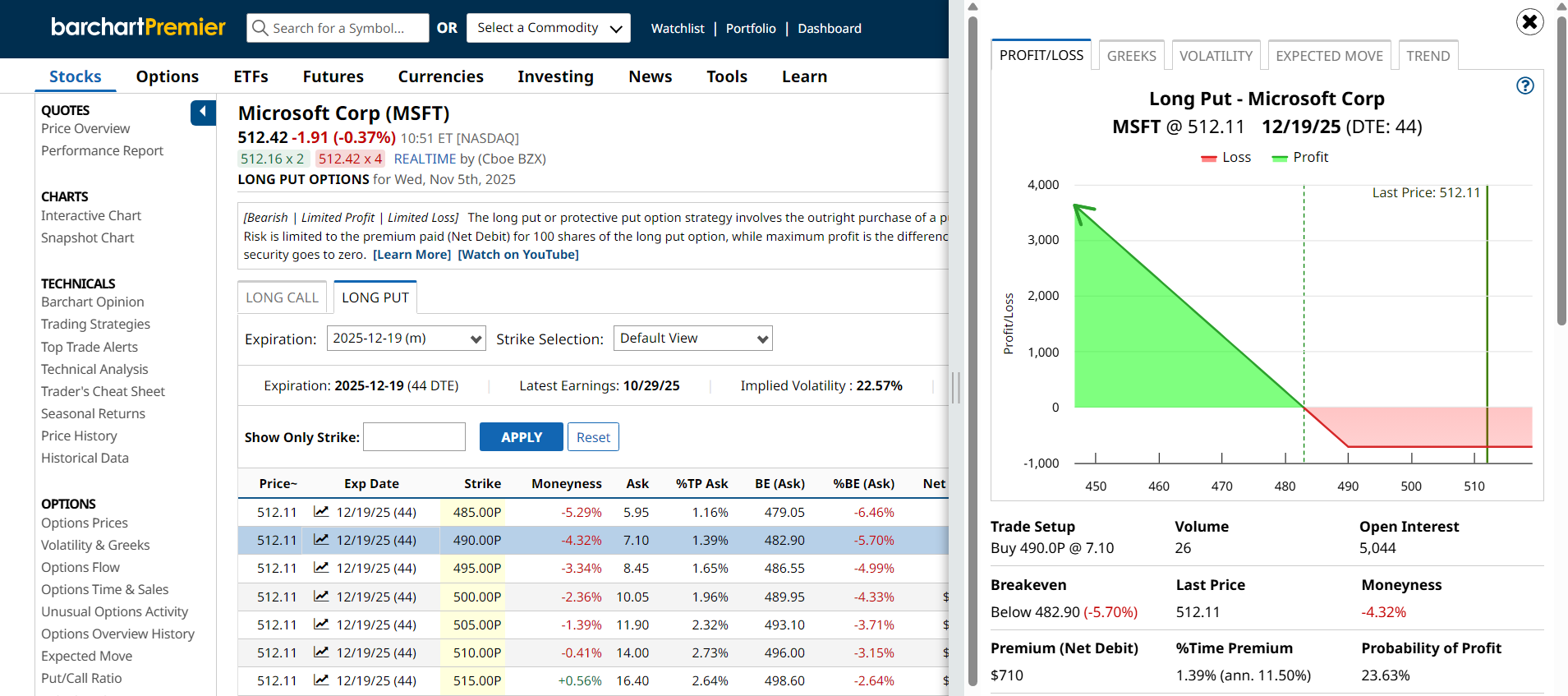

- You own 100 shares of Microsoft (MSFT) purchased at $500 per share.

- Without a hedge, if MSFT drops to $450, you could lose $50 per share — a $5,000 hit.

- But by hedging with a $490-strike put, you secure the right to sell those MSFT shares at no less than $490 anytime before expiration, should the stock fall below that price.

That means no matter how far the stock falls, your maximum loss is capped.

That downside protection isn’t free, of course. In this example, the $490 put might cost a premium of $17.50 per share ($1,750 per contract), but it can save you from much larger losses.

“If Microsoft drops, your long put protects you just like insurance,” Rick explains. “You might spend a little upfront, but you’re preserving capital.”

Using Barchart’s Long Put Screener

Finding the right hedge doesn’t have to be complicated. Rick walks through the process step-by-step using Barchart’s options tools.

Here’s how:

- Search for the asset you’re looking to hedge, such as MSFT.

- On the left-hand menu or dropdown, click “Long Calls / Puts.”

- Select “Long Put.”

- Adjust the expiration date to your preferred time frame for protection (for example, Dec. 19) and review the available strike prices.

- You’ll instantly see the cost (premium), delta, volume, implied volatility, plus profit/loss charts — giving you all the data you need to make an informed decision.

Explore Barchart’s Long Put Screener →

Stop-Loss vs. Long Put: What’s Better?

A stop-loss order automatically sells your stock if the shares drop below a set price, but it doesn’t guarantee execution during fast market swings or opening gaps. A long put, on the other hand, locks in your exit price through expiration, no matter what happens.

That’s why many traders prefer puts as “stop-loss insurance.” You keep ownership of your shares (and any potential rebound) while capping your downside risk.

How to Build a Smarter Hedge Portfolio

For larger portfolios, you can use puts to protect:

- Individual stocks like MSFT, Apple (AAPL), or Nvidia (NVDA)

- Broad-based indexes, including SPY and QQQ

- Or a mix of both, depending on your exposure & upcoming event risk

If you want to offset the cost of your put hedge, you can also use strategies like protective collars. This two-legged strategy involves selling calls to collect income while buying puts for protection.

You can explore Protective Collar setups using Barchart’s Options Screener tools →

The Takeaway

You don’t have to predict the next market crash, but it makes sense to prepare for it.

“Hedging doesn’t eliminate risk,” Rick reminds viewers. “It manages it — and that’s what smart investors do.”

Watch the Clip: How to Hedge with Long Puts →

- Watch the Full Video: How to Hedge Your Portfolio with Options

- Explore Long Put & Married Put Options Screeners on Barchart

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Worried About an AI Bubble? Here's Exactly How to Limit Stock Risk by Hedging With Put Options

- Volatility Alert: 10 Stocks Showing High IV Percentile

- You Can Now Bet on 4x Upside in S&P 500 Stocks with This ETF. Should You?

- Royal Caribbean’s (RCL) Options Implosion Offers Up a Massive Informational Arbitrage Trade