On Nov. 3, shares of Cipher Mining (CIFR) rocketed to a then 52-week high of $25.11, soaring 22% in a single session. This came as the company announced its jaw-dropping $5.5 billion high-performance computing deal with Amazon Web Services (AWS) in its most recent earnings release.

Founded in 2021, Cipher had once made its bread and butter by mining Bitcoin (BTCUSD). But with Bitcoin’s 2024 halving cutting block subsidies in two, Cipher saw the writing on the wall.

It has now struck a 15-year agreement with Amazon’s (AMZN) AWS to provide data center space and power for Amazon’s artificial intelligence (AI) workloads, a deal that starts bearing fruit in 2026. The first rent payment is due in August 2026, setting the stage for Cipher’s next act.

The shift is not coming out of thin air. Cipher has already been testing the waters with earlier data center agreements with Fluidstack and Alphabet’s (GOOG) Google Cloud. Its new infrastructure, featuring both air- and liquid-cooled racks, is built for the heavyweight champions of AI, those massive training clusters that demand serious power and precision.

From Bitcoin to big data, Cipher’s journey is a masterclass in adaptation, and this AWS partnership may just be its golden goose.

About Cipher Stock

Headquartered in New York, Cipher Mining (CIFR) is fast emerging as one of the most intriguing names in the technology and infrastructure playbook. The company operates industrial-scale data centers for Bitcoin mining and high-performance computing (HPC) hosting, standing at the crossroads of two of the most transformative technologies in the world.

With a market cap hovering near $9.8 billion, Cipher aims to be a global leader in mining growth, data center construction, and HPC hosting for tech giants. Over the past 52 weeks, CIFR shares have skyrocketed by 210%. In just six months, they have soared 610%.

And if that was not enough to grab attention, the last month alone has seen the stock jump 41%, with the stock up 13.3% in just the past five trading days.

Cipher Misses on Q3 Earnings

Cipher’s fiscal 2025 third-quarter earnings report, released on Nov. 3, came with its fair share of fireworks. While the company technically missed Wall Street’s expectations, the market’s reaction said otherwise.

Bitcoin mining revenue grew 197.5% year-over-year (YOY) to $72 million. Adjusted earnings swung dramatically, from a net loss of $0.01 per share last year to a profit of $0.10 per share this time. Analysts had aimed slightly higher, expecting $76.5 million in revenue and $0.11 per share.

Adjusted earnings stood at $40.7 million, a massive leap from the $3.4 million loss a year ago. The company mined 629 Bitcoin in the quarter, compared to 444 in the second quarter, with an average price per Bitcoin of $114,400 against $99,700 previously. Cipher’s Bitcoin treasury stood at approximately 1,500 coins as of September 30.

Cash and cash equivalents also swelled, thanks to $1.2 billion in net proceeds from its convertible offering. But perhaps the biggest showstopper was not the earnings; it was the AWS deal announced alongside it.

The company also revealed it secured ownership in a joint venture to develop a 1-gigawatt site in West Texas, named Colchis, reaffirming the company’s knack for sourcing and scaling massive infrastructure projects. It is this combination of operational growth and strategic foresight that has investors giving Cipher a longer leash on profitability.

Analysts expect Q4 fiscal 2025 to be a bit of a balancing act. Loss per share is projected to widen 200% YOY to $0.06, and for the full fiscal year, losses could expand 157.1% to $0.36. But the next quarter could bring some reprieve, with losses narrowing 54.6% from the prior year’s period to $0.05.

What Do Analysts Expect for Cipher Stock?

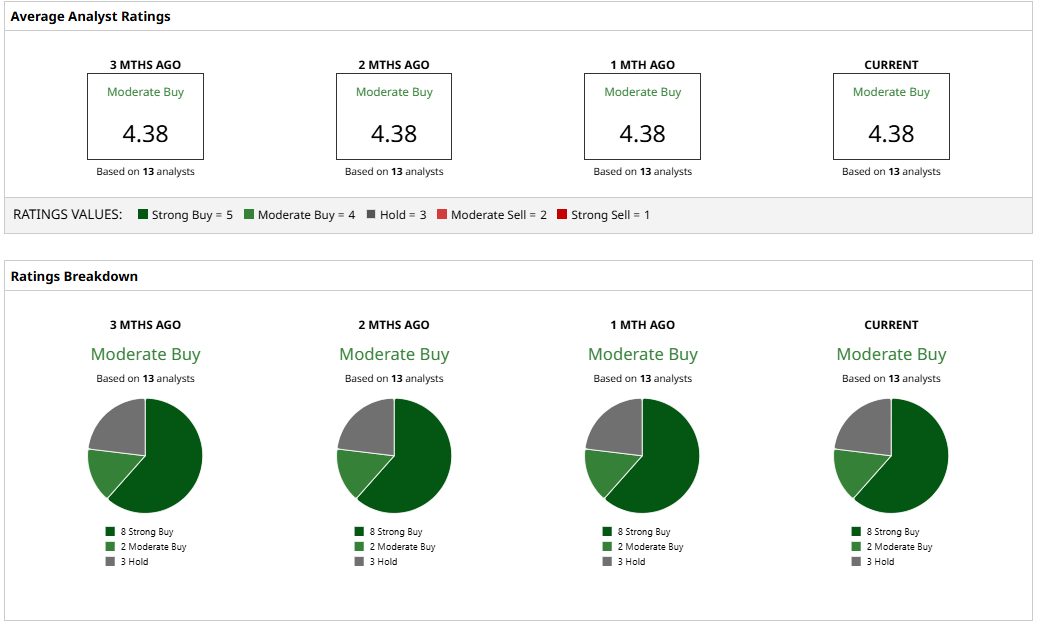

When it comes to analyst sentiment, the tone leans optimistic. The consensus rating for CIFR stands at “Moderate Buy.” Out of 13 analysts tracking the stock, eight recommend “Strong Buy,” two favor “Moderate Buy,” and three advise “Hold.”

CIFR currently trades 14% below its average price target of $24.51. Meanwhile, the Street-high target of $33 reflects potential gain of 57% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart