The Amazon (AMZN) bears learned a lesson last week—you can’t count out AMZN stock, even in a so-called down year.

Despite its position as a leading e-commerce and cloud computing company, AMZN stock underperformed the market for much of the year. Last month it was the worst-performing member of the “Magnificent Seven” cohort. But that all changed on Oct. 30, when Amazon posted its third-quarter results, and suddenly, investors were reminded why Amazon earned its reputation as a money-maker after all.

"Despite playing a bit of catch-up, AWS has secured significant AI capacity over the next several years," Barclays' Ross Sandler wrote in a research note. “We expect growth to accelerate from here.”

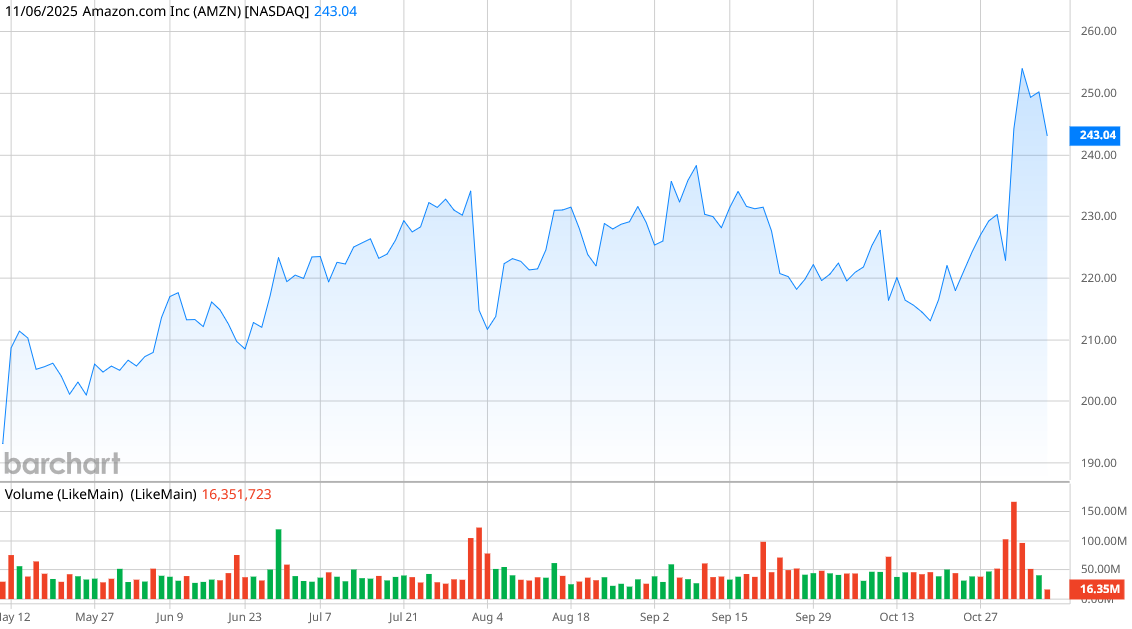

AMZN stock rose by a full 9% since its earnings report, and the stock is now showing gains of 11% on the year—still under the Nasdaq Composite ($NASX), but outperforming its peers, including Apple (AAPL), Meta Platforms (META), and Tesla (TSLA).

As you consider your portfolio headed into 2026, should Amazon be on your buy list? It’s not too late to jump on this ship.

About Amazon Stock

Headquartered in Seattle, Amazon is the operator of the world's most dominant e-commerce platform. From its start as an online bookseller in 1995, Amazon expanded its reach by selling software, video games, and home products before opening its platform to third-party sellers.

Today, you can get virtually anything on Amazon’s e-commerce platform and have it delivered, sometimes in a matter of hours.

But the company is also a dominant cloud computing hyperscaler—with a 30% market share, Amazon Web Services (AWS) is the biggest cloud computing platform, topping Microsoft (MSFT) Azure and Alphabet’s (GOOG) (GOOGL) Google Cloud.

In the past year, Amazon’s shares are up 17.7%, but its year-to-date (YTD) performance has been much lower as the company’s been battling with the impact of trade policy and tariffs. The Nasdaq Composite is up 22% in the last 12 months, just outpacing Amazon.

Amazon’s price-to-earnings ratio is 35.3, which seems pretty frothy on its face. But when you look at the five-year P/E mean of 75, Amazon appears to be fairly priced.

Amazon Beats on Earnings

Amazon desperately needed a good third-quarter earnings report, and fortunately for investors, it delivered in a big way.

Revenue of $180.1 billion was up 13.4% from a year ago. And more importantly, Amazon was able to translate that into improved profits, with net income of $21.18 billion, up 16.9% from last year. Diluted earnings per share were $1.95, up a whopping 36% from Q3 2024 and beating analysts’ expectations of $1.58.

But here’s the thing to remember about Amazon: even though its e-commerce sales are through the roof, Amazon gets the vast majority of its profits from the smaller cloud computing division. Amazon.com saw combined North American and international sales of $147.16 billion, but operating costs of $141.17 billion meant Amazon only saw profits of $5.98 billion—a lot of money, but the profit margin was only 4%. Meanwhile, AWS revenue was $33 billion, and the operating expenses were $21.57 billion, meaning Amazon took home $11.43 billion from AWS and enjoyed a profit margin of 34.6%.

So, it’s no wonder why people are more excited about AWS than Amazon’s e-commerce numbers. “AWS is growing at a pace we haven’t seen since 2022, re-accelerating to 20.2% YOY,” CEO Andy Jassy said. “We continue to see strong demand in AI and core infrastructure, and we’ve been focused on accelerating capacity—adding more than 3.8 gigawatts in the past 12 months.”

Amazon issued fourth-quarter guidance for sales between $206 billion and $213 billion, which would be 10% to 13% better than a year ago. The upper range of its operating income guidance, which is $21 billion to $26 billion, also compares favorably to the $21.2 billion Amazon recorded in Q4 2024.

What Do Analysts Expect for AMZN Stock?

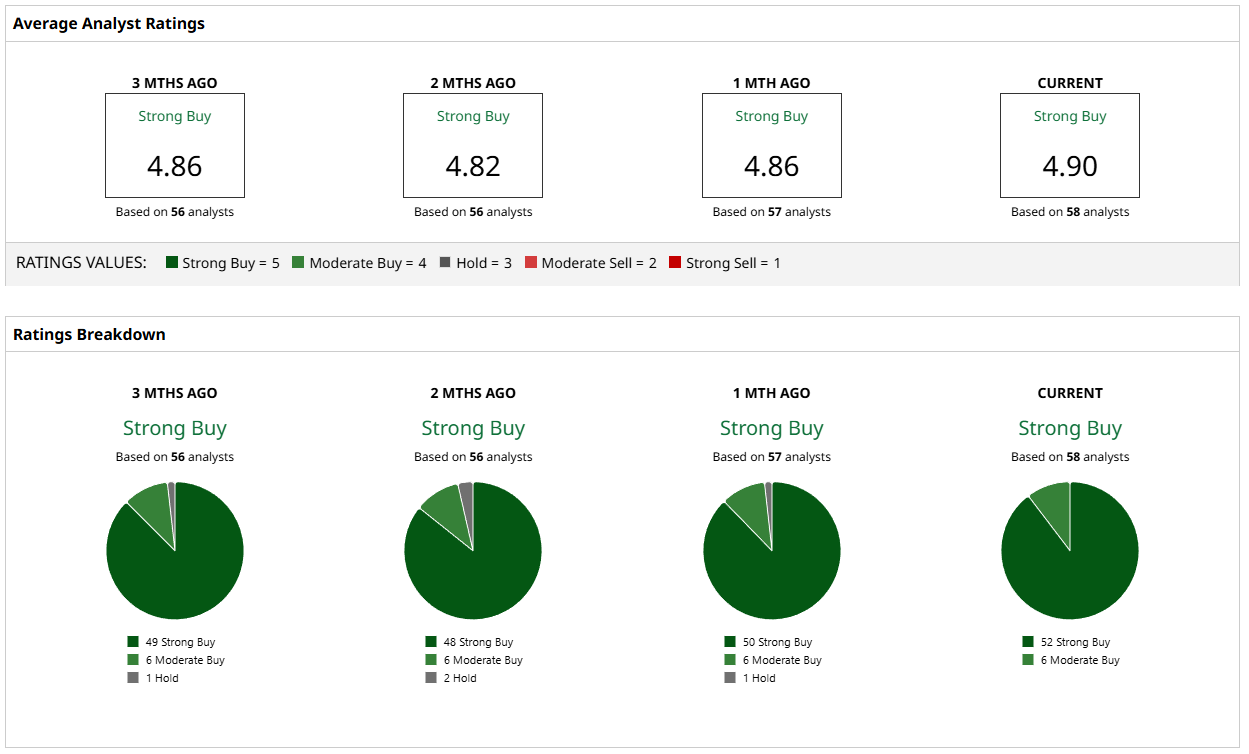

It is virtually unanimous—of the 58 analysts covering AMZN stock, 52 of them rate it as a “Strong Buy,” and the other six rate it as a “Moderate Buy.” And over the last three months, sentiment for Amazon stock has just increased.

Analysts have a mean price target of nearly $295, which would be a 21% jump in stock price. There is very little downside, as the lowest target only suggests a potential 5% drop, while the most bullish high target of $340 dangles the possibility of a 40% gain.

But here’s the bottom line: cloud computing is the fuel that will drive AMZN stock higher. Grand View Research suggests that we are just in the opening phase of the data center buildout, with the cloud computing market expected to increase from $752 billion in 2024 to $2.4 trillion by 2030. Amazon will be right in the middle of that. It’s worth a buy right now.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Lemonade Options Showing Unusual Activity—Potential for Holiday Income?

- Analysts Expect Growth at Amazon to ‘Accelerate.’ Does That Make AMZN Stock a Buy Now?

- Google Cloud Could Grow More Than 50% in 2026. Should You Buy GOOGL Stock Here?

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?