The market can be a fickle beast. One moment, it is cheering; the next, it is sulking. On Oct. 29, when Microsoft (MSFT) dropped its latest earnings, the crowd gasped as shares slipped about 2.9% the following day. Funny thing is that the company beat expectations.

Investors were simply spooked by Microsoft’s growing appetite for capital expenditures, which shot up 74% year-over-year (YOY) in the most recent quarter. Half of that spending went straight into GPUs and CPUs, fuel for Azure’s unrelenting hunger. CFO Amy Hood added that capital expenditure growth will accelerate even further this fiscal year.

But the smarter money, people like Morgan Stanley’s analyst Keith Weiss, saw the drop not as a red flag but as an open door. He called Microsoft a “Buy” on any pullback, highlighting its resilient margins and unstoppable artificial intelligence (AI) growth. CEO Satya Nadella echoed that tone.

Morgan Stanley went a step further, saying the company’s “durability of top-line demand and the potential for further margin expansion” remain underappreciated.

So, as Microsoft continues to plant its flag across the AI frontier and analysts call every dip a buying opportunity, one cannot help but wonder if the market’s little tantrum was merely the calm before another climb.

About Microsoft Stock

From its Redmond, Washington-based headquarters, the nearly $3.8 trillion titan powers the backbone of modern life. Microsoft’s Windows keeps the global workforce ticking, Microsoft 365 fuels productivity, Azure drives the cloud, and Xbox keeps billions entertained after hours.

LinkedIn connects professionals, while GitHub gives developers a playground to innovate. However, despite the growing empire, MSFT’s shares have seen their fair share of mood swings, but long-term, it keeps smiling. Over the past 52 weeks, MSFT shares climbed 19%.

MSFT currently trades at 32.58 times forward adjusted earnings and 13.57 times sales, placing it comfortably above most of its industry peers. The premium signals the market’s confidence in the company’s prospects.

Microsoft Surpasses Q1 Earnings

On Oct. 29, Microsoft unveiled its financial results for its first quarter of fiscal 2026, which surpassed estimates on the top and bottom line. Revenue surged 18.4% YOY to $77.7 billion, soaring past the $75.3 billion Street consensus. Every business segment pulled its weight and then some.

The Intelligent Cloud unit, home to Azure, clocked $30.9 billion in revenue, a 28.2% jump from a year ago. Azure revenue grew 39% in constant currency, just a point shy of buy-side dreams, but still proof of accelerating demand.

Productivity and Business Processes, the segment housing Office and LinkedIn, brought in $33 billion, up 16.6% YOY. The More Personal Computing unit, which includes Windows, search ads, devices, and gaming, chipped in with 4.4% growth, reaching $13.8 billion.

Commercial bookings told their own tale, leaping an eye-popping 111% YOY, while current remaining performance obligations climbed 35%. Operating margins expanded by 230 basis points from last year. Net income swelled 12% to $27.7 billion, while EPS rose 13% to $3.72, outpacing the $3.67 analysts had forecast.

Looking ahead, the company expects fiscal Q2 revenue between $79.5 billion and $80.6 billion, with Azure growth of 37% at constant currency. Meanwhile, analysts anticipate Q2 EPS to jump 19.2% YOY to $3.85. For the full fiscal year 2026, they project EPS growth of 15.6% to $15.77, and another 15.9% rise to $18.28 in fiscal year 2027.

What Do Analysts Expect for Microsoft Stock?

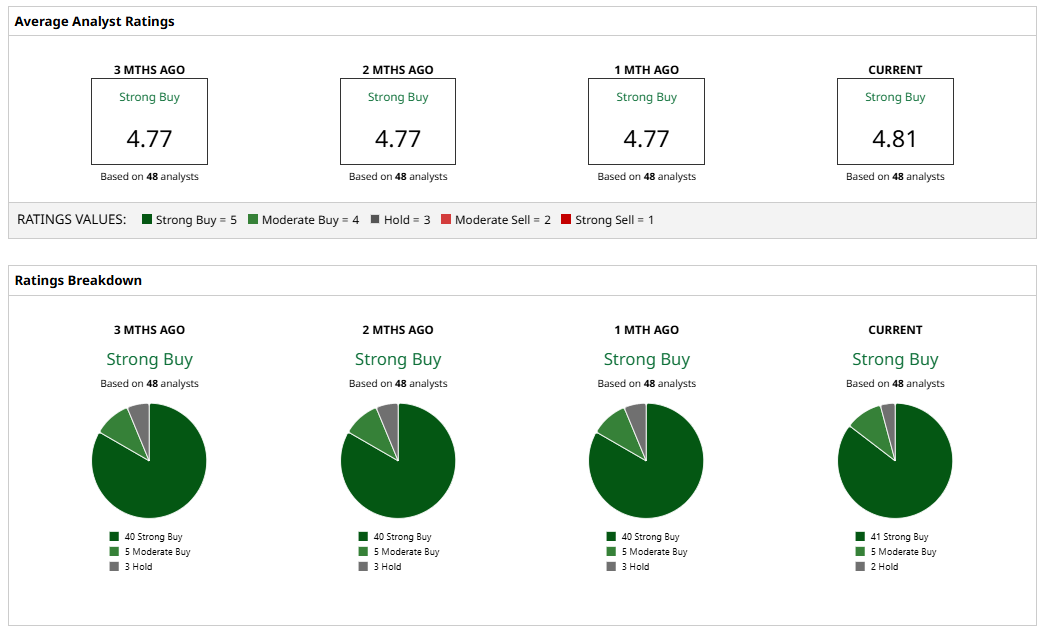

Out of 48 analysts, 41 recommend “Strong Buy,” five lean toward “Moderate Buy,” and two suggest to “Hold” onto the stock.

The average price target of $633.25 implies potential upside of 27%, while the Street-high target of $700 reflects potential gain of 40% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here