Apple (AAPL) may have wowed Wall Street with its upbeat forecast, but not everyone is convinced the rally can last. After the iPhone maker projected a stronger-than-expected fiscal first quarter, signaling renewed growth and a surge in iPhone 17 Pro demand, shares initially popped before slipping back.

While some analysts, like Citi’s Atif Malik, hailed the results as proof of a powerful upgrade cycle and raised their price targets, Needham’s Laura Martin struck a cautious tone.

In a note following the earnings, Martin said Apple’s stock “won’t work until there is an iPhone replacement cycle,” warning that despite Apple’s massive moat, high valuation and mounting competition could keep the stock grounded until consumers start upgrading in force.

About Apple Stock

Apple, based in California, stands as a forward-looking company and a worldwide leader in hardware, software, and services. Its portfolio spans iconic devices like the iPhone, iPad, Mac, and Apple Watch, alongside widely used platforms such as the App Store, iCloud, Apple Music, and Apple TV+. The company currently boasts a market cap of $4 trillion and a Magnificent Seven status.

Apple surpassed the $4 trillion mark amid the recent stock surge tied to strong demand for the iPhone 17 series, and optimistic guidance and recently peaked at $277.32 on Oct. 31. Over the past 52 weeks, the stock has shown solid, albeit not spectacular, gains with a total return of 20.9%. Year-to-date (YTD) performance has been positive, but it remains somewhat muted compared to the highest-growth tech peers. The stock has gained 7.9% this year.

With the share price near its recent high and the valuation elevated, much of the upside may already be baked in, reinforcing analyst caution that without a fresh catalyst (like a broad iPhone replacement cycle), further meaningful gains could be harder to achieve.

The stock is trading at a premium at 33.4 times forward earnings, compared to the sector median and its historical average.

Steady Q4 Results

Apple released its fiscal Q4 2025 results on Oct. 30, for the quarter ended Sept. 27. The company reported total revenue of $102.5 billion, representing an 8% year-over-year (YOY) increase. Its earnings per share (EPS) came to $1.85, up 13% on an adjusted basis from the prior year and ahead of expectations. AAPL reported total revenue of $416.2 billion for the full year, representing 6.4% growth YOY.

In terms of business segments, the iPhone division generated approximately $49 billion in revenue for the quarter, marking a 6.1% increase and accounting for nearly half of the company’s quarterly sales. Mac revenue rose about 12.7% to roughly $8.7 billion, while iPad revenue was essentially flat at about $7 billion. The Wearables, Home & Accessories segment also saw flat performance, around $9 billion.

Meanwhile, the Services segment achieved an all-time high of $28.8 billion, growing about 15.1% YOY.

The company’s guidance was especially striking. Apple projected revenue growth of 10% to 12% in the upcoming holiday quarter (December quarter), driven by an anticipated double-digit increase in iPhone revenue and its “best ever” quarter for the product line. Gross margin for that period was expected to range between 47% to 48%, while Apple also noted ongoing investments in artificial intelligence (AI) and product development, highlighting that while hardware continues to anchor the business, services and ecosystem strength remain a central focus.

Analysts covering Apple predict its EPS to rise by 9.2% YOY to $2.62 in the first quarter. Further, the consensus estimate of $8.11 for fiscal 2026 indicates an increase of 8.7% YOY, before improving by around 11.7% annually to $9.06 in fiscal 2027.

What Do Analysts Expect for Apple Stock?

Needham analyst Laura Martin maintained a “Hold” rating on Apple, acknowledging its strong guidance and competitive moat but questioning the sustainability of iPhone 17 demand. She cautioned that Apple’s high valuation, slowing growth, and rising competition could limit upside.

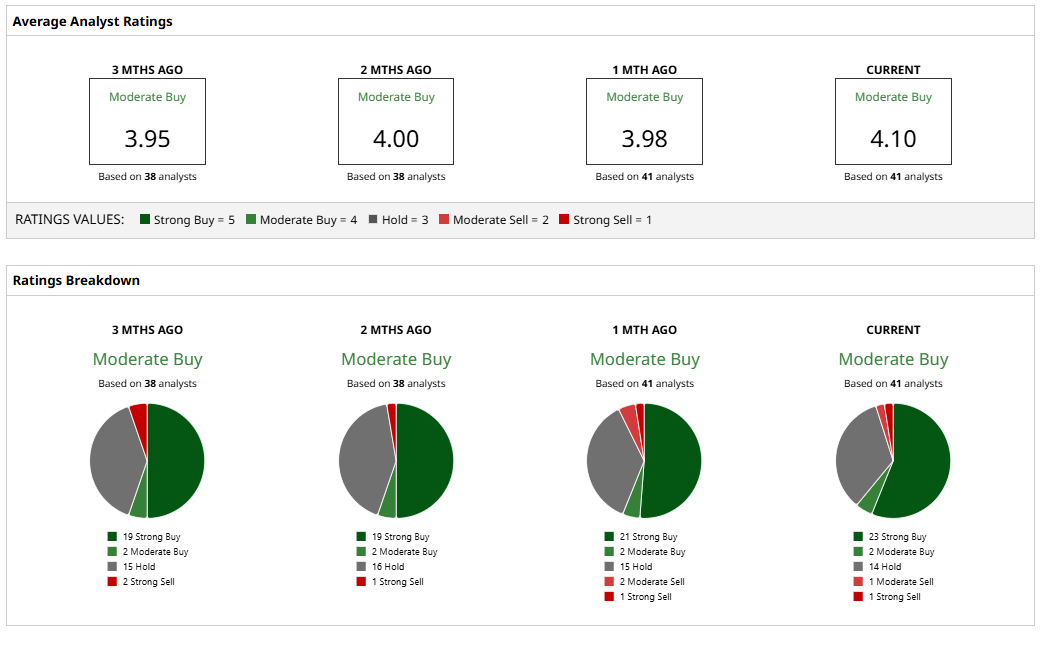

However, Apple stock has a consensus “Moderate Buy” rating overall. Out of 41 analysts covering the tech giant, 23 recommend a “Strong Buy,” two give a “Moderate Buy,” 14 analysts stay cautious with a “Hold” rating, one “Moderate Sell,” and one has a “Strong Sell” rating.

Its average price target of $277.61 represents just over 2% upside potential from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Cloud Could Grow More Than 50% in 2026. Should You Buy GOOGL Stock Here?

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

- 2 Chart Indicators to Confirm Stock Breakouts & Reversals with Heikin Ashi Candlesticks

- Dear Opendoor Stock Fans, Mark Your Calendars for November 6