Oracle (ORCL) is advancing boldly in the artificial intelligence (AI) arena, having officially unveiled its Oracle AI Data Platform, an ambitious all-in-one system designed to bridge generative models with enterprise data, workflows, and applications.

It’s a bold move, one that signals Oracle isn’t content to sit on the sidelines as Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) duke it out over the future of cloud and artificial intelligence. So, does this innovation mark the dawn of a new growth era for ORCL stock?

Oracle unveiled its new AI Data Platform, AI agents, and a suite of strategic partnerships at its AI World event in Las Vegas, sending shares up about 1.6% in intraday trading on Oct. 15. The AI Data Platform integrates Oracle Cloud Infrastructure, the Autonomous AI Database, and OCI Generative AI to help businesses prepare data for AI and transform processes. Oracle also announced new deals with the U.S. Air Force and the Choctaw Nation of Oklahoma, plus a new integration with Microsoft’s Azure IoT Operations and Microsoft Fabric to enhance supply-chain visibility.

Chief Technology Officer Larry Ellison framed the AI boom as a transformative moment “bigger than the railroads [or] the industrial revolution,” positioning Oracle’s growing data center footprint at the heart of the world’s next great technological leap.

About Oracle Stock

Best known for its pioneering relational database software and enterprise tools, Oracle has evolved into a powerhouse in cloud infrastructure, SaaS applications, hardware systems, and consulting services. Headquartered in Austin, Texas, the firm serves a global client base, and with a market capitalization of $707 billion, the company ranks among the world’s top software and cloud computing firms.

ORCL stock has been on a remarkable tear in 2025, with its trajectory capturing both investor attention and the market’s appetite for AI infrastructure plays. Over the past 52 weeks, shares have vaulted from a low of $118.86 to a high near $345.72, which was reached on Sept. 10 following its first-quarter fiscal 2026 earnings release, reflecting the volatile but powerful upswing in sentiment around its cloud and AI capabilities. ORCL stock is up 46% over the past year.

On a year-to-date (YTD) basis, ORCL has delivered a staggering gain of about 50%, making it one of the standout performers in the tech sector. What’s driving that momentum? A swelling backlog in cloud and AI contracts, bold strategic partnerships, and investor faith in the company’s ability to monetize its pivot to generative AI.

ORCL stock is currently trading at a significant premium over peers and its own historical average at 47.6 times forward earnings.

Steady Q1 Results

Oracle reported its Q1 fiscal 2026 financial results on Sept. 9, showcasing significant growth driven by strong demand for its cloud infrastructure and applications.

The company achieved total revenue of $14.9 billion, marking a 12% increase year-over-year (YOY). Cloud revenues, encompassing both Infrastructure as a Service (IaaS) and Software as a Service (SaaS), totaled $7.2 billion, up 28% YOY. Within this segment, cloud infrastructure revenue surged 55% to $3.3 billion, while cloud applications revenue rose 11% to $3.8 billion.

Notably, the company signed four multi-billion-dollar contracts with three different customers during the quarter, contributing to a Remaining Performance Obligation (RPO) of $455 billion, a 359% YOY increase.

Nnon-GAAP EPS increased 6% from the prior-year quarter to $1.47, while non-GAAP operating income reached $6.2 billion, up 9% YOY. The company also reported operating cash flow of $21.5 billion over the last 12 months, up 13% YOY.

Looking ahead, the company projects Oracle Cloud Infrastructure revenue to grow 77% to $18 billion for the fiscal year, with further increases to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. This growth is supported by the substantial RPO, indicating strong future revenue visibility.

Analysts remain optimistic, as they predict EPS to be around $5.41 for fiscal 2026, up 23% YOY, before surging by another 19% annually to $6.46 in fiscal 2027.

What Do Analysts Expect for Oracle Stock?

Last month, Bernstein SocGen reiterated an “Outperform” rating on Oracle with a $364 price target. The firm views Oracle as positioning itself to become the largest AI training vendor, potentially making it the third-largest hyperscaler by revenue and a leader in AI training Infrastructure-as-a-Service.

Citi also maintained a “Buy” rating on Oracle while raising its price target to $415. Citi cited broadening adoption of Oracle Cloud Infrastructure (OCI) driving growth. Citi projects a 30%-plus EPS CAGR from fiscal 2026 to 2030, driven by expense efficiencies and GPU margin scaling.

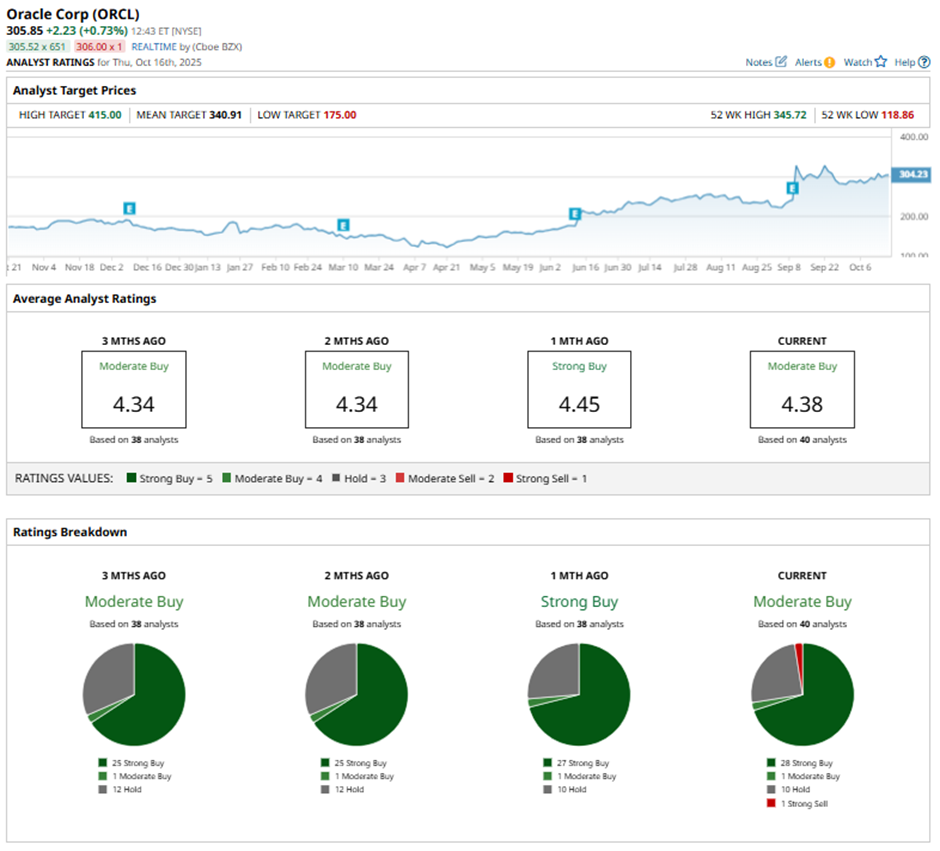

Oracle stock has a consensus “Moderate Buy” rating overall. Among the 40 analysts covering the tech stock, 27 recommend a “Strong Buy,” one gives a “Moderate Buy,” 10 analysts stay cautious with a “Hold” rating, and two give a “Strong Sell” rating.

While Oracle's average price target of $350.88 indicates potential upside of 40%, the Street-high target price of $430 suggests that the stock could rally as much as 72% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart