Block, Inc. (XYZ), headquartered in Oakland, California, is a fintech and financial-services company that builds technology ecosystems around payments, commerce and financial services. The company operates platforms such as Square for merchants, Cash App for peer-to-peer payments and broader consumer financial services, and other ventures, including “buy now, pay later” and streaming/entertainment. Block’s market cap is around $44.9 billion.

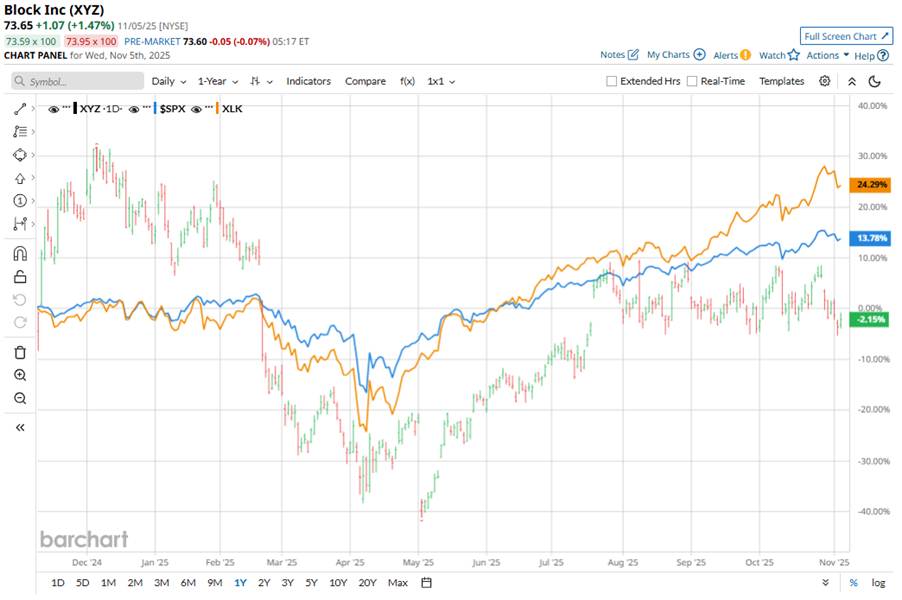

Shares of Block have significantly underperformed the broader market. XYZ stock has plunged 13.3% on a year-to-date (YTD) basis and increased 1.8% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 15.6% surge in 2025 and 17.5% gains over the past year.

Zooming in further, XYZ has also lagged behind the Technology Select Sector SPDR Fund’s (XLK) 26.9% uptick in 2025 and 30.1% gain over the past 52 weeks.

Block’s shares have been under pressure in 2025 primarily because of softness in consumer-driven segments, especially via its Cash App business. Weak discretionary spending, heightened competition, and a challenging macro backdrop and muted growth have raised investor concerns about whether growth will re-accelerate as hoped.

For the full fiscal 2025, ending in December, analysts expect Block’s EPS to be $1.02, down 69.7% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

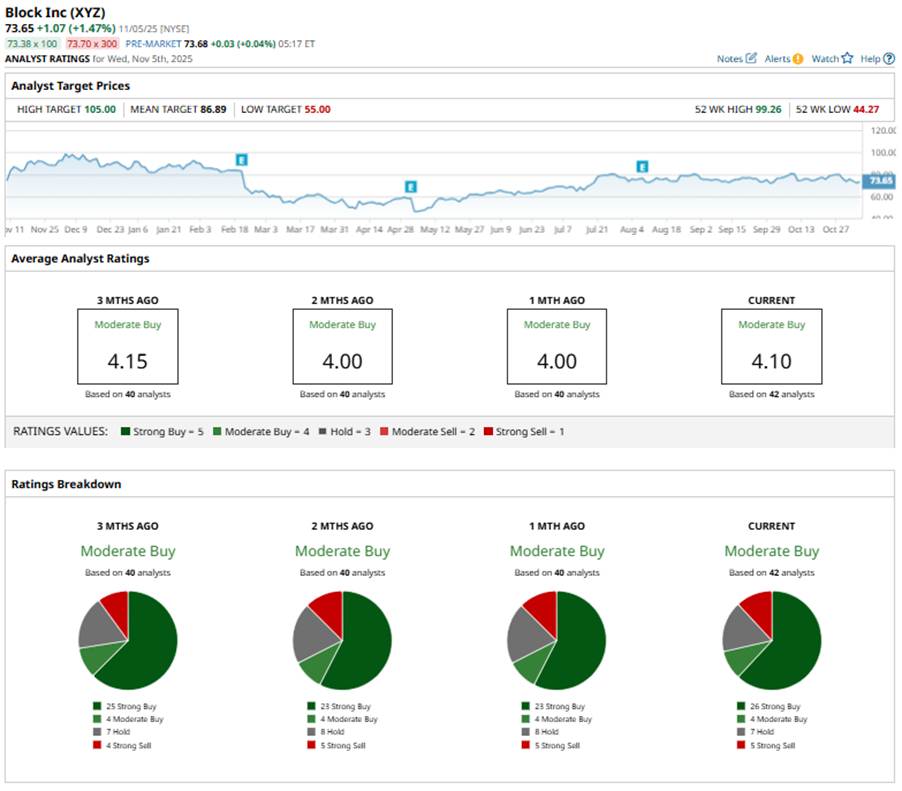

The stock holds a consensus “Moderate Buy” rating overall. Of the 42 analysts covering the stock, opinions include 26 “Strong Buys,” four “Moderate Buys,” seven “Holds,” and five “Strong Sell” ratings.

This configuration is slightly more bullish than two months ago, when there were 23 “Strong Buy” ratings.

Last month, UBS maintained its “Buy” rating and $95 price target on Block, citing strong momentum across its Square and Cash App ecosystems.

XYZ’s mean price target of $86.89 represents an 18% premium to current price levels, while the Street-high target of $105 suggests a 42.6% upside potential.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Expect Growth at Amazon to ‘Accelerate.’ Does That Make AMZN Stock a Buy Now?

- Google Cloud Could Grow More Than 50% in 2026. Should You Buy GOOGL Stock Here?

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

- 2 Chart Indicators to Confirm Stock Breakouts & Reversals with Heikin Ashi Candlesticks