The recent selloff in tech stocks, especially more profoundly seen in the twin chipmaking giants, Nvidia (NVDA) and AMD (AMD), has come as a long-awaited reason for cheer for the AI bears. After raising fears of an AI bubble and circular deals failed to suck the spirits out of the AI party in a meaningful manner, a more concrete and visible aspect of overvaluation has finally convinced some market participants to opt for profit booking in these seminal names.

Consequently, even after reporting a beat on both the revenue and earnings front in its latest quarterly results, shares of AMD are down by almost 5% over the past week. However, the company's “Financial Analyst Day” on Nov. 11 has the potential to arrest this slide, with the stock returning to its normal upward trajectory again.

About AMD

Often regarded as “the other player” of the AI chip market when compared to its much bigger peer, Nvidia, AMD was founded much earlier, in 1969. It designs and markets chips by focusing on high-performance and adaptive computing, spanning CPUs, GPUs, and specialized accelerators.

Valued at a market cap of $405.8 billion, AMD stock has doubled this year with an upmove of almost exactly 100% on a year-to-date (YTD) basis.

Financial Analyst Day: A Good Omen

Notably, AMD held its last “Financial Analyst Day” on June 9, 2022. The stock is up by almost 160% since then, as AMD went on to become one of the foremost chipmakers globally and the second-largest player in the GPU market.

Notably, the 2022 meeting flagged the roadmap for the Instinct MI300, offering a large uplift in AI/training performance vs. prior generations, while it also marked a shift toward data center and AI infrastructure as a major profit pool going forward. Both played out quite well, with the strategic shift towards data centers bringing in billions of dollars in revenue for the company and becoming AMD's largest revenue segment.

For the 2025 event, analysts are expecting AMD to reveal next-generation roadmaps, such as client and server CPUs (Zen 6, Zen 7) and future GPU/accelerator architectures (Instinct MI500-series, perhaps UDNA-based) beyond what has already been publicly previewed. Further, any updates on the upcoming generation of chips beyond the MI400 series, scalable rack-scale AI platforms, network interconnects, and packaging technologies (e.g., chiplets, advanced nodes) are expected as well.

AMD's Strong Q3

The post-earnings decline in the company's stock was transient at best and is an opportunity for investors to enter the stock at cheaper valuations. Notably, AMD has increased its revenue and earnings by 31.09% and 34.99%, respectively, over the past five years, and its showing in the most recent quarter exceeded expectations as well.

In Q3 2025, AMD reported revenues of $9.25 billion, which denoted a growth of 36% from the previous year. Revenues for the data center segment came in at $4.3 billion, a year-over-year (YoY) growth of 22%, while the other crucial segment of Client and Gaming soared by 73% in the same period to $4 billion.

Earnings went up by 30% on a YoY basis to come in at $1.20 per share, surpassing the Street's expectations of $1.17 per share. Notably, this marked the fourth consecutive quarter of earnings beat from the company.

Further, the company announced several notable partnerships in the quarter with the likes of Oracle (ORCL), IBM (IBM) and Cisco (CSCO). However, the one that grabbed the most headlines was the one with ChatGPT-maker OpenAI, wherein AMD will deploy 6 GW of the company's GPUs to develop OpenAI's next-generation AI infrastructure.

Cash flows provided no source of complaints as well, as net cash from operating activities in the quarter almost tripled to $1.8 billion from $628 million in the prior year. Overall, AMD closed the quarter with a cash balance of $4.81 billion, which was much higher than its short-term debt levels of $873 million as well as long-term debt of $2.35 billion.

Thus, AMD's robust financial standing, coupled with its cohesive computing platform, encompassing EPYC processors, Instinct accelerators, the ROCm open-source toolkit, and Helios server configurations, positions the company to seize a larger slice of the burgeoning AI infrastructure market. Through engagements with major cloud providers like Microsoft Azure, Google Cloud, and Oracle, alongside specialized AI developers such as Cohere, Zyphra, and Character.AI, plus national initiatives including UAE-based G42 and the U.S. Department of Energy, AMD is broadening its customer mix. This strategy spreads risk and lessens exposure to traditional boom-and-bust cycles in other areas.

Analyst Opinion on AMD Stock

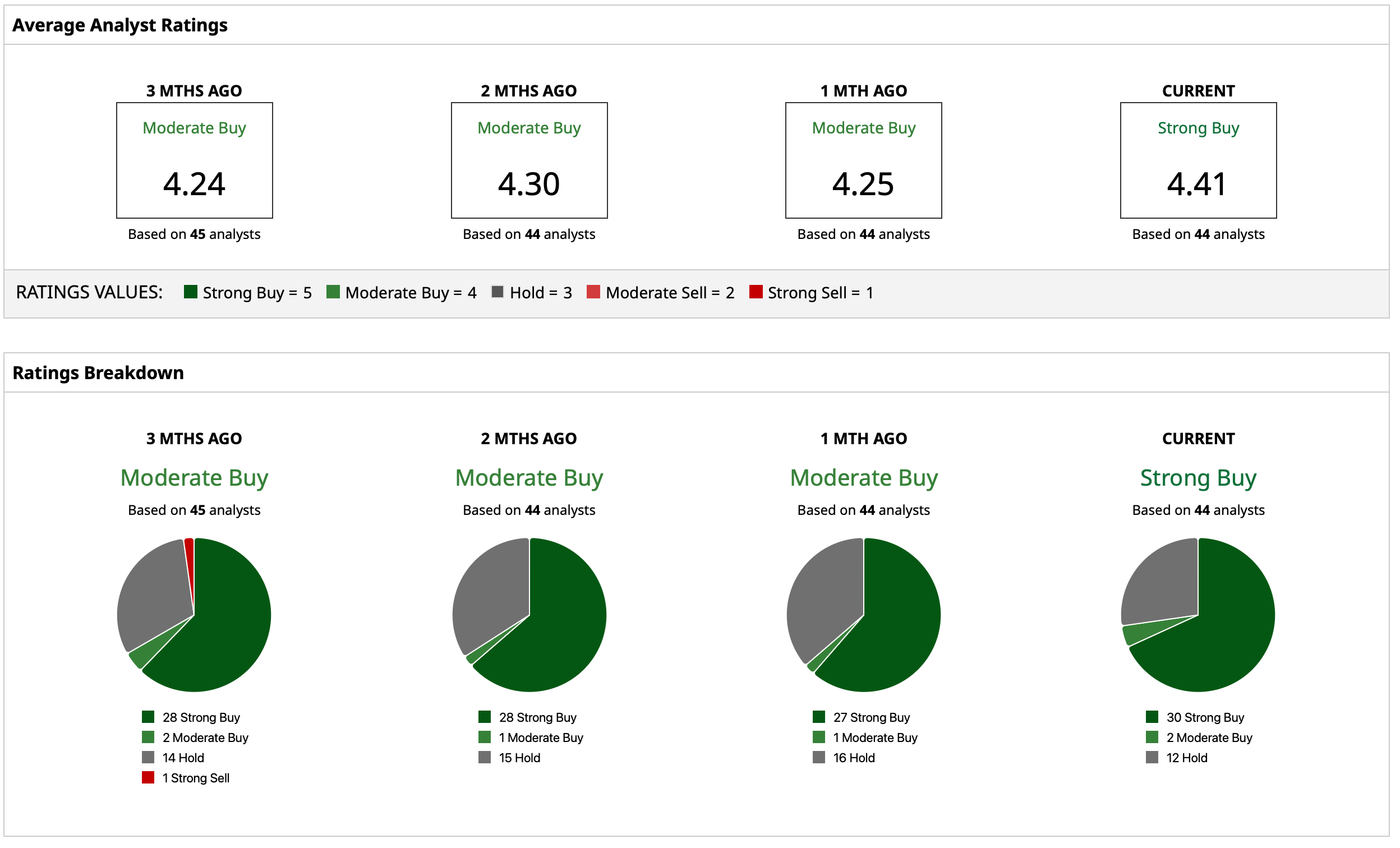

Overall, analysts have attributed a consensus rating of “Strong Buy” for AMD stock with a mean target price of $258.84, which implies limited upside potential from current levels. However, the high target price of $350 indicates an upside potential of 36.5% from current levels. Out of 44 analysts covering the stock, 30 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and 12 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?

- Should You Buy the Post-Earnings Dip in Axon Stock or Stay Far, Far Away?

- Michael Burry Abandons UnitedHealth Stock With Shares Down 35% YTD. Should You Sell UNH or Buy the Dip?

- Should You Buy the Post-Earnings Plunge in Celsius Stock?