The battlefield is shifting, and so is the advantage for Palantir Technologies (PLTR). As defense budgets swell and data-driven warfare becomes the norm, Palantir is securing a larger seat at the defense table, moving far beyond its roots as a federal-contract underdog and into the spotlight of the artificial intelligence (AI)-armed future of government tech. With fresh wins in military contracts and a rapidly expanding commercial business, Palantir finds itself riding two powerful currents simultaneously.

Adding fuel to the narrative, Wedbush Securities has turned decidedly bullish. Analyst Dan Ives recently raised the price target for PLTR while maintaining an “Outperform” rating, citing Palantir’s pivotal role in both national security and the AI revolution.

So, with a defense-tech tailwind, is Palantir stock a buy right now?

About Palantir Stock

Palantir Technologies is a software and data analytics company that develops platforms designed to integrate, manage, and secure complex datasets across government and commercial clients. Headquartered in Denver, Colorado, Palantir has grown from its roots in government intelligence into a broader enterprise-tech play. It specializes in big‑data analytics and AI platforms (including Gotham, Foundry, Apollo, and its newer Artificial Intelligence Platform or AIP) for both government and enterprise clients.

Its market cap is around $452.5 billion, placing it among the largest software and analytics companies globally.

Over the past 52 weeks, Palantir’s share price has delivered an extraordinary rally, climbing by around 215.9%, driven largely by investor enthusiasm around its expanding footprint in AI, defense contracts. and enterprise software. On a year-to-date (YTD) basis, the stock has surged 131.9%.

On Nov. 3, its shares surged to a fresh 52-week high of $207.52, before settling at $207.18 at close.

However, as concerns over its lofty valuation mount, the stock closed down 7.9% on Nov. 4 following its Q3 earnings release. Shares have fallen 9.8% in the past five trading sessions.

The stock is currently trading at a substantial premium over peers and its own historical average at 416.7 times forward earnings.

Steady Revenue Growth

Palantir Technologies released its third-quarter 2025 earnings on Nov. 3, revealing robust growth amid accelerating demand for its AI-driven software platforms. The company achieved revenue of $1.181 billion, representing a year-over-year (YOY) increase of 63%, substantially above expectations. Profitability also improved with adjusted earnings per share increasing significantly to $0.21, beating consensus estimates.

Driving much of the upswing was the U.S. commercial segment, which surged 121% YOY to about $397 million, while overall U.S. revenue rose 77% to roughly $883 million. The government business remained strong as well, with U.S. government revenue climbing 52% YOY to around $486 million.

These results were underpinned by record contract activity as the company closed 204 deals of at least $1 million, 91 deals of at least $5 million, and 53 deals of at least $10 million, with total contract value (TCV) reaching $2.76 billion, up 151% YOY.

Further, Palantir provided stable guidance for the remainder of the year. For Q4 2025, it projected revenue between $1.327 billion and $1.331 billion. For the full year 2025, the company raised its outlook to revenue between $4.396 billion and $4.400 billion, and expects adjusted income from operations in the $2.151 billion to $2.155 billion range.

Analysts expect the company’s EPS to climb 512.5% YOY to $0.49 in fiscal 2025 and rise another 32.7% to $0.65 in fiscal 2026.

What Do Analysts Expect for Palantir Stock?

Wedbush Securities raised its price target on Palantir Technologies to $230 from $200 ahead of the company’s Nov. 3 earnings release, while maintaining an “Outperform” rating. Lead analyst Dan Ives described Palantir as an emerging “AI juggernaut,” and cited robust demand for Palantir’s AIP, which continues to drive rapid customer adoption and contract growth.

The firm noted that Palantir’s AI bootcamps are accelerating sales cycles and delivering measurable enterprise value, positioning the company to capitalize on surging global AI investment, particularly under increased U.S. government spending and initiatives like Project Stargate. Ives reiterated his long-term bullish view, suggesting Palantir could evolve into a trillion-dollar company within two to three years as its commercial business scales into a multi-billion-dollar AI powerhouse.

However, many analysts are still favoring the sidelines.

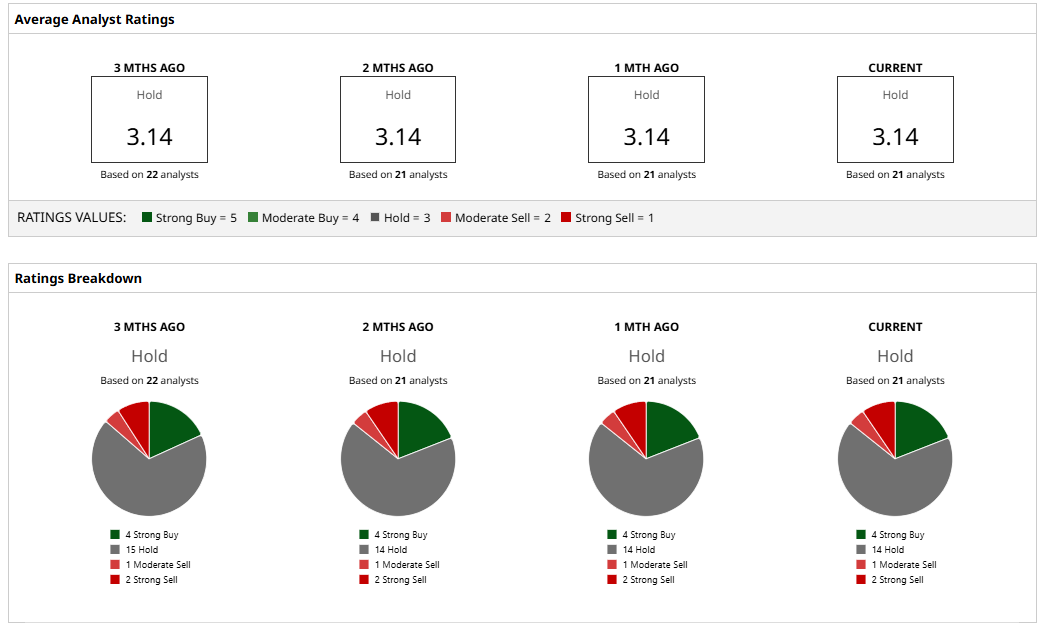

PLTR has a consensus rating of a “Hold” overall. Of the 21 analysts covering the stock, four advise a “Strong Buy,” 14 suggest a “Hold,” one analyst gives it a “Moderate Sell” rating, and two rate it as a “Strong Sell.”

PLTR is trading 5% below its average price target of $183.89, and the Street-high target of $255 signals that PLTR can still rise as much as 46% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.