San Francisco, California-based Prologis, Inc. (PLD) is the world’s largest industrial real estate company, specializing in logistics and distribution properties. With a market cap of $97.2 billion, it owns, operates, and develops warehouses and fulfillment centers that support e-commerce, retail, manufacturing, and supply-chain operations for major global companies.

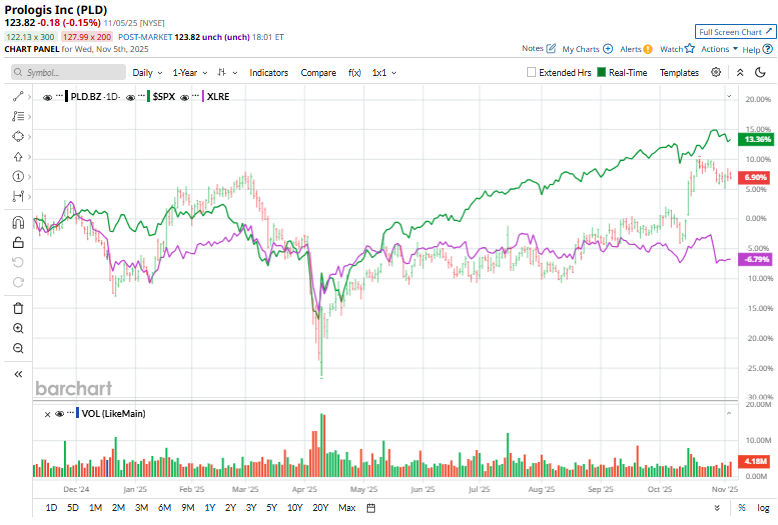

Shares of Prologis have been quietly powering higher, surging 8.2% over the past year and increasing 14.1% in 2025. However, it has lagged behind the broader S&P 500 Index ($SPX), which has gained 17.5% over the past year and 15.6% this year.

On the positive side, the sector-specific Real Estate Select Sector SPDR ETF (XLRE) has declined 6.6% over the past year and is up marginally on a YTD basis, making Prologis a clear outperformer in an otherwise sluggish real estate landscape.

On Oct. 15, Prologis reported its third-quarter earnings, and its shares popped 7.3%. It posted an EPS of $0.82 and its core FFO stood at $1.49, up 4.2% year over year. Its total revenue surged 8.7% year over year to $2.2 billion. Driven by healthy industrial real estate demand and strong leasing activity, occupancy rose to 95.3%, while same-store net operating income increased 3.9% on a net effective basis and 5.2% on a cash basis. Leasing momentum remained robust, with record signings totaling 62 million square feet, and rental growth stayed strong with net effective rent change near 49% and cash rent change around 29%.

For the current fiscal year, ending in December 2025, analysts expect Prologis to report an FFO of $5.80, representing a growth of 4.3% YoY. The company has consistently outperformed expectations, beating consensus EPS estimates in each of the past four quarters.

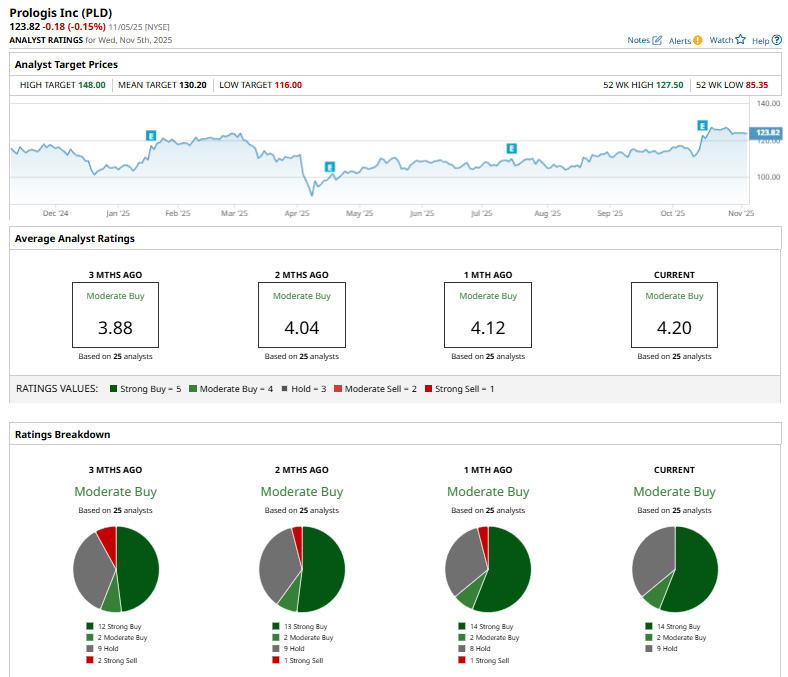

Out of the 25 analysts covering PLD stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buys,” two “Moderate Buys,” and nine “Hold” ratings.

The current configuration is more bullish than two months ago when 13 analysts had recommended a “Strong Buy” rating for the stock.

On Oct. 17, Evercore ISI analyst Steve Sakwa reiterated a “Hold” rating on Prologis and set a $116 price target.

The mean price target of $130.20 represents a premium of 5.2% to PLD’s current price, while the Street-high price target of $148 suggests an upside potential of 19.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart