Duolingo (DUOL) came in handily above Street estimates for its fiscal third quarter on Thursday.

In its earnings release, the online language learning platform revealed plans of shifting focus from near-term monetization to user experience and long-term growth.

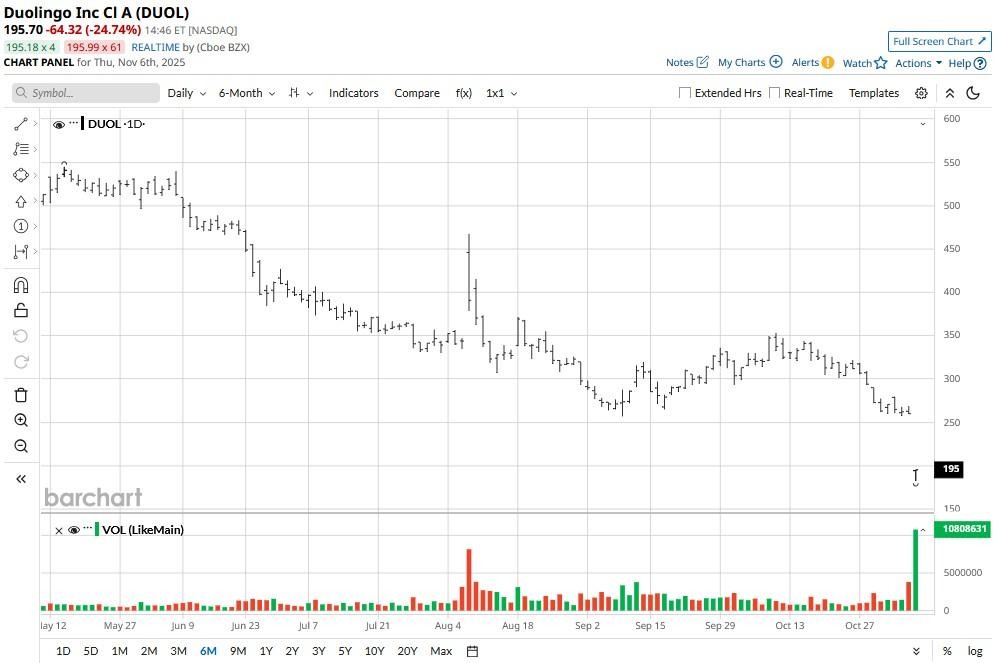

Its management, therefore, offered muted guidance for the current quarter, which is why DUOL shares were punished on Nov. 6. Versus their May high, they’re now down an alarming 65%.

The Strategic Shift Isn’t Negative for Duolingo Stock

Despite soft guidance, Raymond James senior analyst Alexander Sklar sees the strategic update as largely positive for long-term investors.

According to him, the announcement simply confirms Duolingo has growth ambitions that are “far grander” than previously thought.

Shifting focus to boosting user engagement, especially in nascent markets like Asia, suggests the company is really playing the long game here.

Prioritizing durable growth over quick wins, he’s convinced, could help DUOL retain its edge over Google Translate, potentially driving the Duolingo stock price higher over time.

DUOL Shares Stand to Benefit From AI Tailwinds

DUOL stock is worth owning heading into 2026 also because the company is tapping on artificial intelligence (AI) to unlock its next leg of rapid growth.

By enhancing the user experience through AI-driven features (e.g., guided video calls, math/music modules, gamified chess), Duolingo is increasing platform stickiness.

This could result in higher lifetime value per user, even if immediate bookings soften.

Duolingo ended its third quarter with a record 50.5 million daily active users (DAUs), which makes up for another great reason to buy its stock on the post-earnings plunge.

According to Barchart, on the positive side, options traders currently expect Duolingo shares to recover to about $230 by Jan. 16.

Wall Street Sees Massive Upside in Duolingo

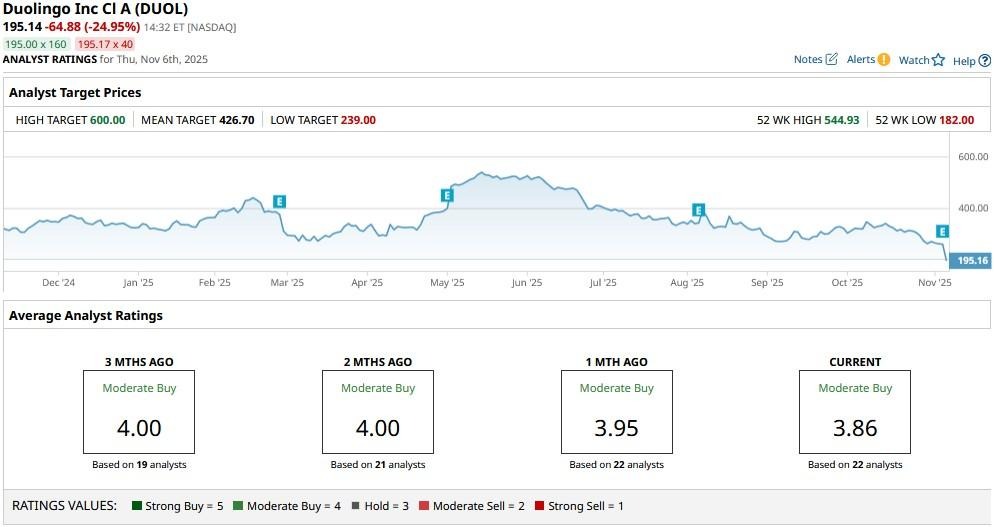

Despite a disappointing Q4 outlook, Wall Street analysts recommend sticking with DUOL shares for the long term.

The consensus rating on Duolingo stock remains at “Moderate Buy” with the mean target of about $427 indicating potential upside of a remarkable 120% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?

- Should You Buy the Post-Earnings Dip in Axon Stock or Stay Far, Far Away?