With a market cap of $10.7 billion, Skyworks Solutions, Inc. (SWKS) is a global technology leader specializing in advanced semiconductor solutions that drive wireless connectivity. The company, headquartered in Irvine, California, designs and manufactures high-performance analog and mixed-signal semiconductors, enabling seamless communication across a broad range of applications, including mobile devices, automotive systems, the Internet of Things (IoT), and industrial technologies.

Skyworks shares have dipped 17.1% over the past year and 17.2% in 2025, trailing the S&P 500 Index’s ($SPX) returns of 7.8% over the past year and 15.6% in 2025.

Zooming in further, the SPDR Semiconductor ETF (XSD) has surged 43.1% over the past year and 36.5% on a YTD basis, outperforming the stock.

On Nov. 4, Skyworks Solutions posted a strong Q4 2025, and its shares dipped 5.9% but rebounded 2% in the next trading session. Its revenue stood at $1.10 billion, up 7% year-over-year and above expectations. Non-GAAP EPS came in at $1.76, beating estimates, and gross margin held steady near 46.5%. Despite the stellar performance, the company issued cautious guidance for Q1 2026, projecting a sequential decline in mobile revenue and only modest growth in Broad Markets, tempering the near-term outlook.

For the current fiscal year ending in September 2026, analysts predict its EPS to fall 36% year over year to $2.94. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters, while missing the forecast in the other two other quarters.

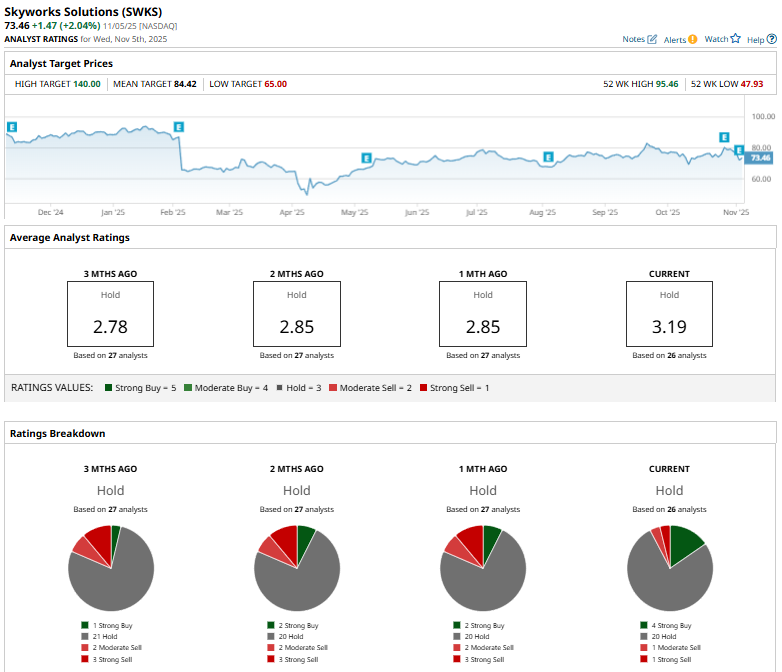

Among the 26 analysts covering SWKS stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy,” 20 “Hold rating,” one “Moderate Sell,” and one “Strong Sell” rating.

The current configuration is more bullish than it was a month ago, when it had two “Strong Buy” ratings.

On Nov. 5, UBS analyst Timothy Arcuri reiterated a “Neutral” rating on Skyworks Solutions and cut the price target from $85 to $80, reflecting a slightly more cautious outlook.

The mean price target of $84.42 is not quite as ambitious, representing potential upside of 14.9% to SWKS’ current price. The Street-high price target of $140 suggests an upside potential of 90.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart