Tesla (TSLA) is once again losing ground in Europe, and it’s not hard to see why. Even as the region’s appetite for electric vehicles (EVs) continues to surge, Tesla’s sales in Europe have faltered throughout most of 2025, mainly due to its aging lineup, which is struggling to stand out amid a flood of new models from legacy automakers and ambitious Chinese upstarts. Once the undisputed leader of the EV revolution, Tesla now finds itself fighting to stay relevant in a market that’s moving faster than ever.

The brand’s image has also taken a hit, with some European consumers turning away following CEO Elon Musk’s support for Donald Trump’s U.S. presidential campaign last year. That sentiment is certainly showing up in the numbers. In Sweden, Tesla registered just 133 new vehicles in October, marking a staggering 89% year-over-year (YOY) decline, according to the nation’s auto manufacturers’ association. Sales also tumbled 50.2% in Norway, 47.8% in the Netherlands, and 30.6% in Spain.

France was the lone bright spot, posting a modest 2.4% rise after a steep 47% drop a year earlier. Overall, Tesla’s European registrations are down 30% year-to-date (YTD), a clear sign that the automaker is struggling to recapture the hearts of European consumers. So, with rivals gaining traction and sentiment cooling, is it time to pull the plug on Tesla’s stock?

About Tesla Stock

Founded in 2003 by a team of engineers determined to prove that EVs could outperform traditional cars, Tesla has grown from a Silicon Valley startup into one of the world’s most influential companies. Under the leadership of CEO Elon Musk, the automaker has revolutionized the industry with its high-performance EVs. Today, Tesla’s ambitions stretch even further, from autonomous driving and artificial intelligence (AI)-powered robotics to the development of energy-efficient infrastructure and grid-scale battery technology.

Currently valued at a market capitalization of roughly $1.5 trillion, the company ranks among the elite “Magnificent Seven” group. While the company is obviously best known for electric cars, much of Tesla’s 2025 momentum comes from growing excitement around its AI and robotics projects. With advances in self-driving technology and the ambitious Optimus humanoid robot, Tesla is proving it’s more than just an automaker.

Despite hitting a few bumps this year, Tesla’s stock has performed quite well. It’s up about 11.2% so far in 2025. But the real story is its recent surge, jumping 63% over the past six months and 40.4% in just the last three months. That easily beats the broader S&P 500 Index’s ($SPX) gains of 20% and 6% over the same periods, respectively. In fact, the rally has pushed Tesla’s stock to within just 9% below its all-time high of $488.54, set back in December 2024, signaling renewed confidence in the EV giant’s long-term story.

Tesla’s valuation is sky-high, and that’s putting it mildly. The stock is currently trading at a jaw-dropping 388 times forward earnings and 15 times sales, far above the industry averages of 16.8x and 0.91x, respectively. Such a massive gap shows just how much future growth investors have already priced in, leaving little room for error as expectations soar.

Tesla’s Mixed Q3 Earnings Report

The EV giant dropped its fiscal 2025 third-quarter earnings report last month, which painted a somewhat mixed picture. The big headline was revenue, which came in at $28.1 billion, up 12% YOY and comfortably above Wall Street’s forecast figure of $26.6 billion. More importantly, it also marked the first quarter this year where Tesla’s sales grew compared to 2024. One key driver behind the stronger sales came from U.S. buyers rushing to take advantage of the $7,500 federal EV tax credit before it expired.

This surge in demand helped lift Tesla’s automotive segment, pushing revenue up 6% from the year-ago quarter to $21.2 billion. Meanwhile, Tesla’s energy-storage business also continued to shine, with revenue soaring 44% annually to $3.4 billion. The segment has consistently posted double-digit growth for several quarters, fueled by surging demand for Tesla’s cutting-edge battery technology.

But not everything was smooth sailing. Fierce competition and aggressive price cuts took a toll on profitability, forcing Tesla to sacrifice margins to maintain volume. Gross margin dropped sharply to 18%, compared to 19.8% a year ago, while operating margin slipped 501 basis points to 5.8%. On an adjusted basis, earnings per share (EPS) fell 31% YOY to $0.50, missing analyst expectations by roughly 10.5%.

Still, the company had something to celebrate. In early October, Tesla reported record deliveries of 497,099 vehicles in the third quarter on total production of 447,450 vehicles. Looking ahead, Tesla didn’t provide specific volume guidance but reiterated its ambitious plans for the future.

The company remains focused on beginning “volume production” of the long-awaited Cyberbercab, heavy-duty electric Semi trucks, and its next-generation Megapack 3 energy storage system in 2026. At the same time, it’s gearing up the first production lines for its humanoid robot, Optimus, signaling that mass production isn’t far off.

What Do Analysts Expect for Tesla Stock?

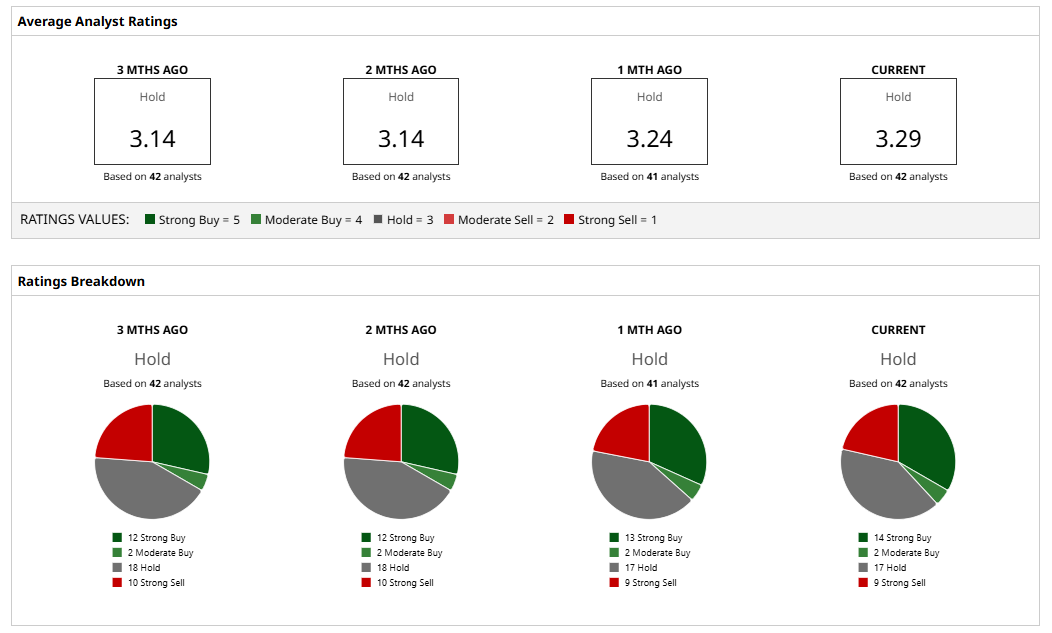

Overall, Wall Street sentiment remains divided on TSLA, with the stock carrying a consensus “Hold” rating. Among the 42 analysts covering the company, 14 have tagged it a “Strong Buy,” two issued a “Moderate Buy,” 17 believe it’s a “Hold,” and the remaining nine suggest a “Strong Sell.”

Currently, Tesla’s stock is trading above its average price target of $385.26. Still, the most bullish analysts see further room to run, with a Street-high target of $600, suggesting a potential upside of roughly 35% from here.

Key Takeaways

While Tesla may be facing setbacks in Europe, that alone isn’t enough reason to turn completely bearish on the company. The company is making rapid strides in AI, robotics, and autonomous driving, fields that could define its next era of growth. Thus, keeping this in mind, it might be premature to write off the stock just yet. Instead, investors may want to keep a close eye on Tesla's execution of its ambitious plans in the coming quarters.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here