Broadcom (AVGO) is a global technology giant specializing in designing, developing, and supplying a wide range of semiconductor and infrastructure software solutions. Broadcom serves industries including data centers, networking, broadband, wireless communications, and enterprise software. The company’s products underpin internet connectivity, cloud computing, and digital infrastructure worldwide. Broadcom has grown through strategic acquisitions, most notably integrating CA Technologies, Symantec’s enterprise business, and VMware to expand into software and security.

Founded in 1991, the company is headquartered in Palo Alto, California.

Broadcom Stock Boom

AVGO stock has demonstrated strong performance in 2025, trading near its 52-week high with notable momentum. Over the past five days, the stock has dipped 5%, while its one-month return stands at approximately 7%, and the six-month gain is near 80%, reflecting robust growth fueled by demand in semiconductors and infrastructure software.

Broadcom has significantly outperformed the S&P 500 ($SPX), which gained about 14% in the last 52 weeks, underscoring the company’s leadership in specialized chips for AI and data centers. Year-to-date (YTD), AVGO stock surged roughly 55%, and over the past 12 months, it nearly doubled, highlighting continued investor confidence and strong earnings.

Broadcom Posts Strong Results

Broadcom announced strong Q3 fiscal 2025 results with revenue of $15.95 billion, up 22% year-over-year (YoY), just slightly below analyst estimates of $16.14 billion. GAAP net income totaled $4.14 billion, with non-GAAP diluted EPS at $1.69, marginally beating the $1.66 consensus. The company’s adjusted EBITDA reached a record $10.7 billion, reflecting a strong 67% margin through robust demand in custom AI accelerators, networking, and infrastructure software.

Broadcom’s semiconductor segment grew 26% to $9.17 billion, while infrastructure software revenue rose 17% to $6.79 billion, supported by VMware integration. Free cash flow hit a record $7.02 billion, with $2.79 billion returned to shareholders via dividends, sustaining strong shareholder returns. Cash from operations was $7.17 billion, with capital expenditures of just $142 million, fueling a strong balance sheet and operating leverage.

Looking ahead, management guided for Q4 2025 revenue of $17.4 billion, a 24% YoY increase, with AI semiconductor revenue expected to grow another 66% to $6.2 billion. Adjusted EBITDA margin is projected at 67%, supported by continued operating leverage despite higher XPUs and wireless mix. Broadcom remains well-positioned for AI-driven growth and sustained profitability.

Broadcom Named as a “Top Pick”

Jefferies has named Broadcom its new Top Pick, citing a major inflection point driven by surging demand for custom AI chips among hyperscalers. The firm raised its price target from $415 to $480, reflecting an upside of 33% from the market rate, and designated Broadcom as a Franchise Pick, highlighting “outsized upside relative to estimates.” Analysts led by Blayne Curtis emphasized the rapid growth of Broadcom’s ASIC (Application-Specific Integrated Circuit) business, fueled by Google (GOOG) (GOOGL), Meta (META), and OpenAI’s expansion of AI accelerators.

Google’s TPU shipments are projected to reach nearly 3 million units by 2026, bolstered by Anthropic’s $10 billion order for 250,000 units. Jefferies forecasts Broadcom’s AI-related revenue to hit $10 billion in 2027, with the potential to scale to $40–50 billion annually by 2028 and beyond. Meta is expected to launch its first AI chip with high-bandwidth memory in Q3 2026 and follow with an OpenAI ASIC later that year.

Revenue estimates for Broadcom were raised to $100 billion in 2026 and $130 billion in 2027, with EPS targets lifted to $10.31 and $13.88. In a bullish scenario, EPS could reach $20 in 2027 and $30 in 2028 if OpenAI’s capacity scales by 2–3 gigawatts annually.

Should You Pick AVGO?

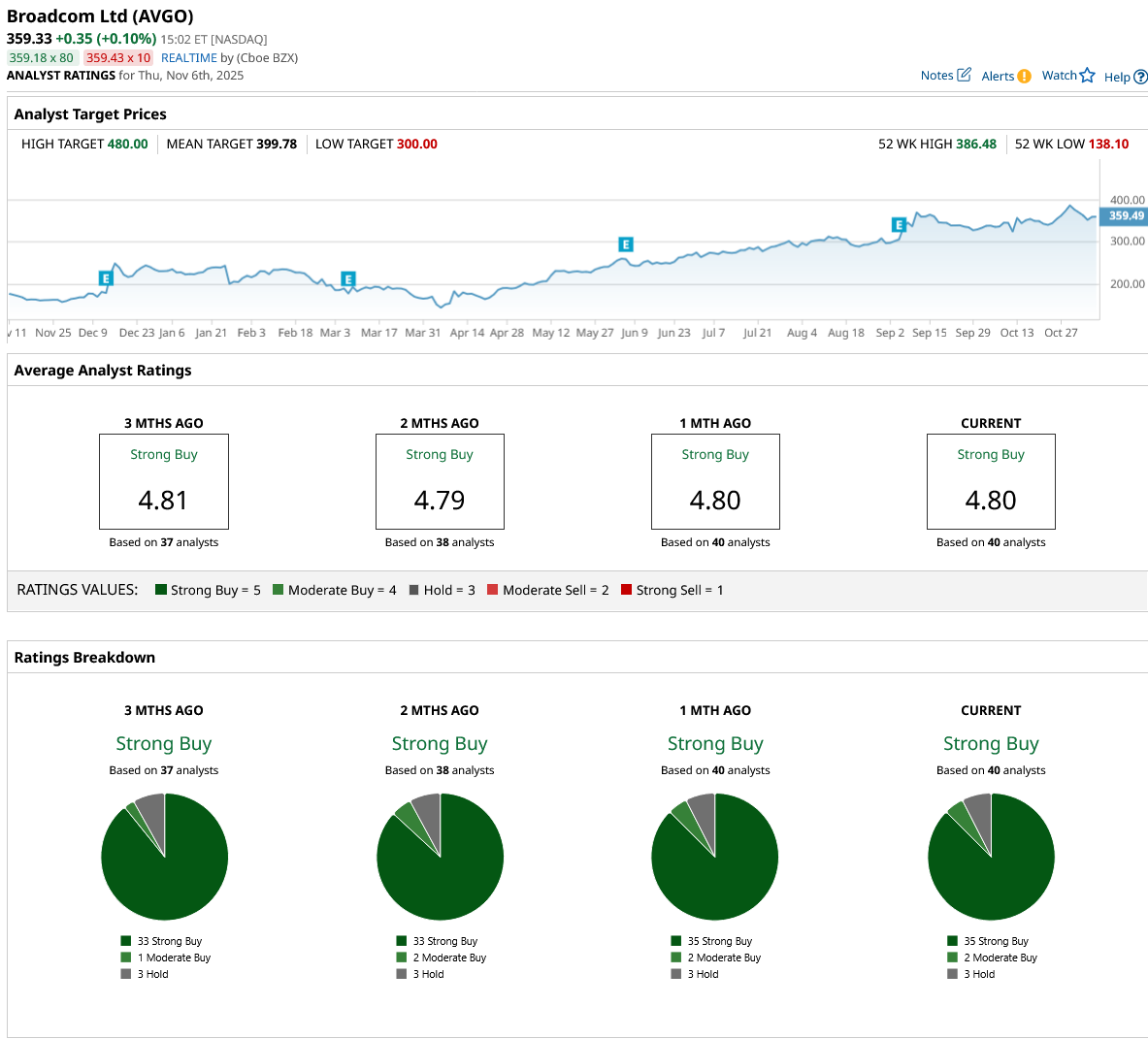

Analysts have the stock rated a consensus “Strong Buy” with a mean price target of $399.78, implying an upside of 11% from the current price. Broadcom has been reviewed by 40 analysts, who have assigned 35 “Strong Buy,” two “Moderate Buy,” and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?