Walmart (WMT) is a global retail giant that operates a vast network of discount department stores, supercenters, and e-commerce platforms.

Its core business revolves around offering a wide range of products, from groceries and apparel to electronics and household goods, at everyday low prices.

The company also runs Sam’s Club, a membership-based warehouse chain, and has expanded its digital footprint through online shopping and delivery services.

Walmart’s scale, supply chain efficiency, and aggressive pricing strategy make it a dominant force in both physical and digital retail.

Walmart has stayed above the expected range following all seven of the most recent earnings announcements.

WMT Earnings Bull Put Spread

With earnings set for November 20th before the opening bell, implied volatility on WMT stock is through the roof.

Implied volatility is sitting at 28.68% compared to a twelve-month low of 16.77%.

That means, it’s a great time to be an option seller.

If you have a bullish outlook for Walmart for their earnings announcement, then a bull put spread is a great strategy to employ.

To execute a bull put spread, an investor would sell a naked put and then buy a further out-of-the-money put to create a spread.

A bull put spread is considered less risky than a naked put, because the losses are capped thanks to the bought put.

Potential Benefits

Bull put spreads offer several advantages for options traders seeking to generate income while managing risk.

They provide a defined-risk strategy, allowing traders to know their maximum potential loss upfront.

Additionally, bull put spreads benefit from time decay, as they profit from the erosion of extrinsic value over time.

This time decay accelerates as the expiration date approaches.

Bull put spreads will benefit from the drop in implied volatility that always occurs after an earnings announcement.

Potential Risks

While bull put spreads offer enticing benefits, they also come with inherent risks.

One significant risk is the potential for substantial losses if the underlying stock's price declines sharply.

Traders must also consider the possibility of early assignment, which can occur if the stock price moves below the short put option's strike price before expiration.

It's essential for traders to thoroughly understand and manage these risks when implementing this options strategy.

Selling a WMT Bull Put Spread

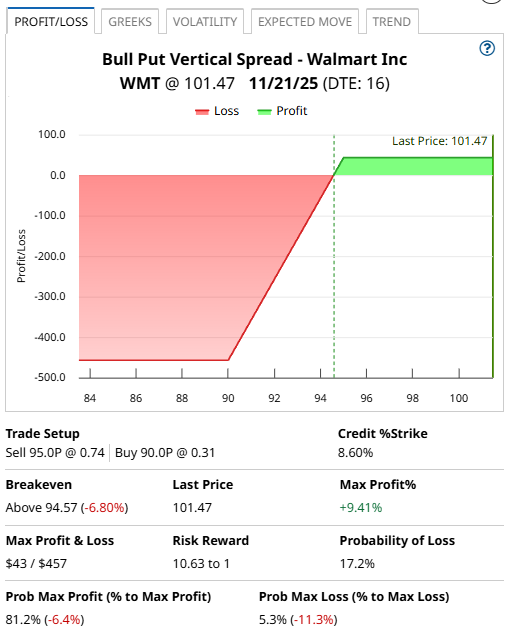

A trader selling the November 21st, $95-strike put and buying the $90-strike put on WMT would receive around $43 into their account, and would have a maximum risk of $457.

That represents a 9.41% return on risk between now and the November 21 if WMT stock remains above $95.

If WMT stock closes below $90 on Friday the 21st, the trade loses the full $457.

The breakeven point for the bull put spread is $94.57 which is calculated as $95 less the $0.43 option premium per contract.

Company Details

The Barchart Technical Opinion rating is a 56% Buy with a Weakening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Of the 38 analysts covering WMT, 31 have a Strong Buy rating, 6 have a Moderate Buy rating and 1 has a Hold rating.

Conclusion

Selling a bull put spread on WMT ahead of earnings can offer traders an opportunity to capitalize on anticipated bullish sentiment while managing downside risk.

By carefully selecting strike prices and expiration dates, traders can position themselves to potentially profit from a favorable earnings outcome while limiting potential losses.

However, it's crucial for traders to conduct thorough analysis and adhere to risk management principles to navigate the inherent uncertainties associated with earnings events.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart