SoftBank Group (SFTBY) explored a potential takeover of Marvell Technology (MRVL) earlier this year in what would have been the semiconductor industry's largest-ever acquisition, according to a Bloomberg report.

Billionaire founder Masayoshi Son has studied Marvell as a possible target on and off for years as part of his ambitious strategy to capture hardware opportunities fueled by the artificial intelligence boom.

SoftBank made overtures several months ago with plans to combine Marvell with Arm Holdings (ARM), the UK chip designer it controls; however, the parties were unable to agree on terms, and negotiations are currently inactive.

Under the leadership of CEO Matthew Murphy, Marvell designs chips and technologies for data centers that power cloud computing and artificial intelligence, having recently reported record quarterly revenue of $2 billion.

A deal faces substantial obstacles beyond a potential $100 billion price tag. The U.S. government's push to develop domestic semiconductor capabilities raises questions about approval for selling a key chipmaker to a Japanese conglomerate despite Son's close relationship with President Trump.

Antitrust concerns loom large, given that regulators previously forced Nvidia (NVDA) to abandon its 2020 acquisition of Arm.

Is Marvell Technology Stock a Good Buy Right Now?

In fiscal Q2 of 2026 (ended in July), Marvell Technology reported record sales of $2 billion, an increase of 58% year-over-year (YoY). The data center segment led the performance with $1.49 billion in revenue, representing a 69% YoY growth, as AI and cloud infrastructure accounted for over 90% of data center sales. The company reported non-GAAP earnings per share of $0.67, representing a 123% YoY increase, demonstrating significant operating leverage.

CEO Matt Murphy addressed mounting speculation about the company's participation in follow-on design programs with its lead customer. The chipmaker also emphasized that it maintains strong partnerships across all major hyperscalers and expects custom revenue to grow in the second half compared to the first half.

Management guided third-quarter data center revenue to be flat sequentially, as double-digit percentage growth in electro-optics would be offset by lower custom revenue in the period. However, the fourth quarter is expected to see substantially stronger custom business performance, driven by the typical lumpiness in large hyperscale builds.

Marvell showcased expanding design win momentum with its pipeline growing beyond the 18 multigenerational XPU and XPU attach sockets announced at the June investor day. Management revealed additional wins, representing multibillion-dollar lifetime revenue potential, with some individual XPU attach programs now approaching $1 billion in lifetime value, versus the initial several hundred million-dollar estimates.

The $75 billion pipeline of over 50 tracked opportunities continues to expand as next-generation AI data centers increase complexity and customization requirements. Marvell's electro-optics business remains on fire, with management expecting double-digit sequential percentage growth in the third quarter.

The PAM DSP franchise, which generated $600 million in annual sales when Marvell acquired Inphi in 2021, has now scaled to approximately $3 billion, representing a five-fold increase in just four years.

The enterprise networking and carrier infrastructure businesses recovered sharply, with combined revenue reaching an annualized $1.7 billion run rate in the third-quarter guidance, compared to a $900 million trough in early fiscal 2025.

Marvell completed its automotive Ethernet divestiture for $2.5 billion in cash, providing flexibility for continued share repurchases and potential tuck-in acquisitions to accelerate AI capabilities.

Management will consolidate non-data center end markets into a single “Communications and Other” segment starting next quarter, given that the data center now represents 74% of total revenue.

Is MRVL Stock Undervalued Right Now?

Analysts tracking Marvell forecast revenue to grow from $5.76 billion in fiscal 2025 to $16 billion in fiscal 2030. During this period, adjusted earnings per share are expected to increase from $1.57 to $6.94.

Today, MRVL stock trades at 30.5x forward earnings, which is higher than its 10-year average multiple of 27x. If it continues to trade at a similar multiple, MRVL stock should be priced at $211, indicating an upside potential of 127%.

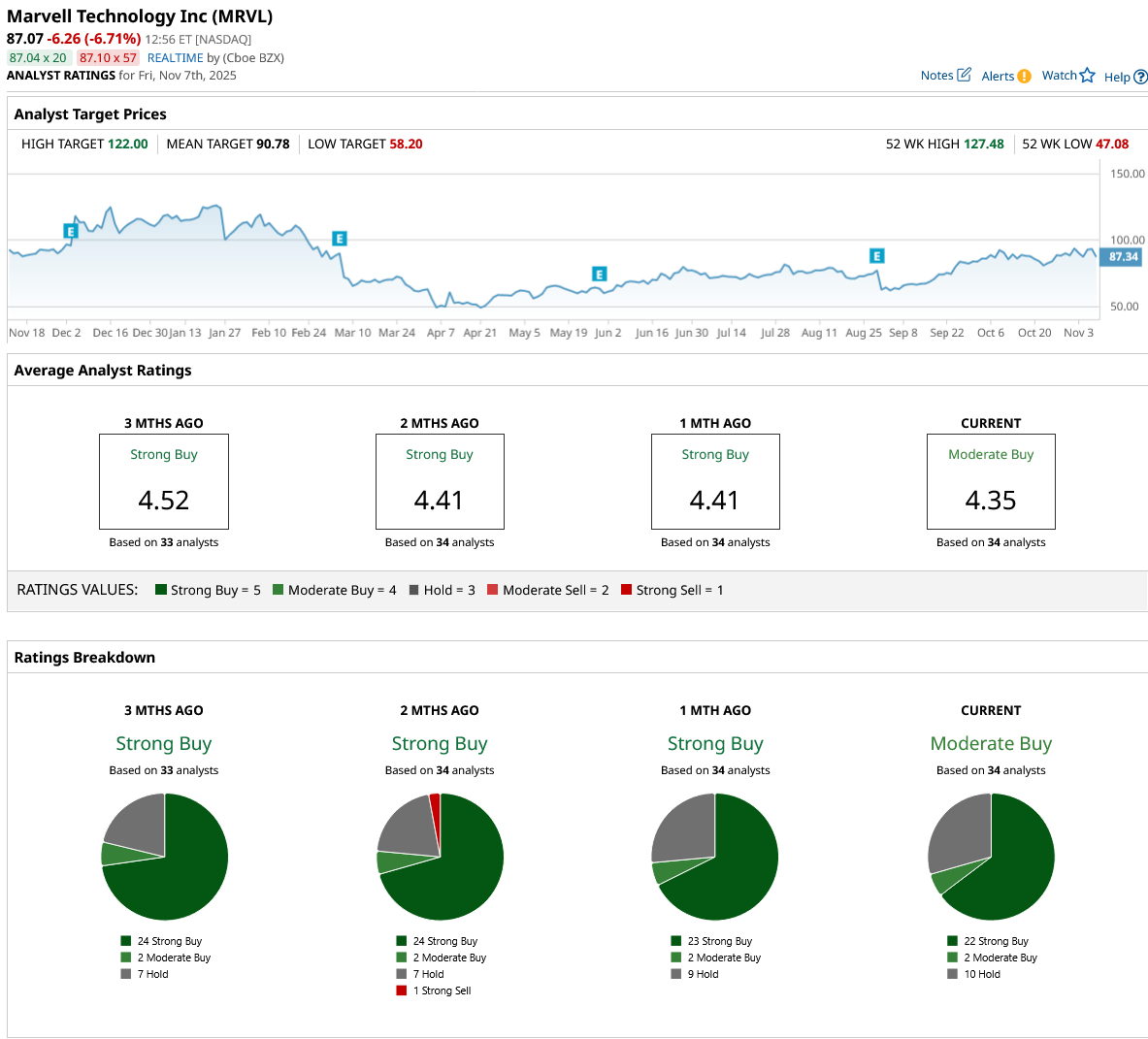

Out of the 34 analysts covering MRVL stock, 22 recommend “Strong Buy,” two recommend “Moderate Buy,” and 10 recommend “Hold.” The average MRVL stock price target is $90.78, below the current price of $87.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Is Falling Behind in the European EV Race. Should You Buy, Sell, or Hold TSLA Stock Before It Accelerates Again?

- Unusual QQQ Options Activity Prompts Covered Strangle Thought Experiment

- Amid SoftBank Takeover Rumors, Should You Buy, Sell, or Hold Marvell Stock?

- This Robotaxi Stock Just Plunged. Should You Buy the Dip or Stay Far, Far Away?