With a market cap of $83.4 billion, American Tower Corporation (AMT) is one of the world’s largest global REITs, specializing in owning, operating, and developing multitenant communications real estate. With a portfolio of over 149,000 communications sites and a growing network of U.S. data center facilities, it provides infrastructure solutions that support wireless connectivity worldwide.

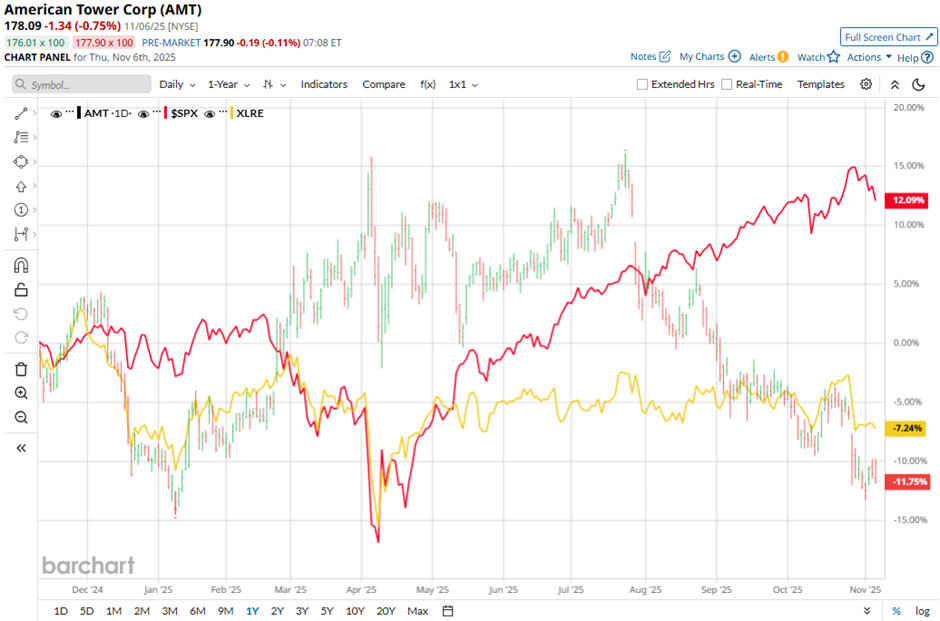

Shares of the Boston, Massachusetts-based company have lagged behind the broader market over the past 52 weeks. AMT stock has dropped 9.8% over this time frame, while the broader S&P 500 Index ($SPX) has risen 13.4%. Moreover, shares of the company are down 2.9% on a YTD basis, compared to SPX’s 14.3% return.

Zooming in further, the stock’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) 4.5% decline over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 AFFO of $2.78 per share and revenues of $2.72 billion, American Tower’s shares fell 3.7% on Oct. 28 as investors focused on flat U.S. and Canada property revenue and only a 6% overall property segment increase. While the company raised 2025 property revenue guidance to $10.21 billion - $10.29 billion, management disclosed $30 million in revenue reserves related to ongoing legal disputes in Latin America and with DISH.

For the fiscal year ending in December 2025, analysts expect American Tower’s AFFO per share to dip 2.3% year-over-year to $10.30. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

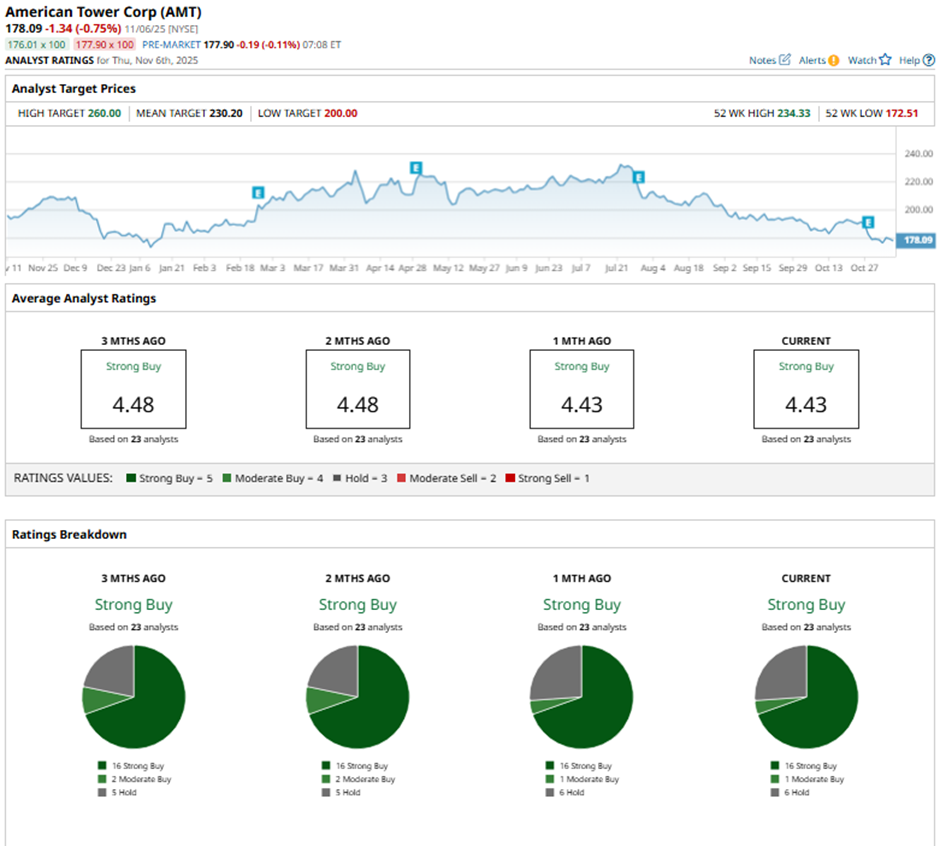

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Oct. 30, Argus analyst Marie Ferguson lowered the price target on American Tower to $210 but maintained a “Buy” rating.

The mean price target of $230.20 represents a premium of 29.3% to AMT's current price. The Street-high price target of $260 suggests a nearly 46% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?