The Campbell’s Company (CPB), headquartered in New Jersey, is a major food and beverage company with a legacy rooted in canned soups and has evolved into a broader meals & beverages and snacks provider. Today, Campbell’s operates through two main divisions: Meals & Beverages and Snacks and sells a portfolio of brands including Campbell’s, Pepperidge Farm, Goldfish, V8, Prego, and Snyder’s of Hanover. The company’s market cap is around $8.9 billion.

Shares of Campbell’s have significantly underperformed the broader market. CPB stock has plummeted 35% over the past 52 weeks and 28.2% on a year-to-date (YTD) basis, compared to the S&P 500 Index’s ($SPX) 13.4% surge over the past year and 14.3% gains in 2025.

Narrowing the focus, CPB has also lagged behind the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 15.3% decline over the past year and 10.8% dip on a YTD basis.

The stock price decline can be attributed to weak organic growth, particularly in its snacks division, where demand has softened. In addition, rising costs and tariff pressures are squeezing margins. Plus, its forward guidance is cautious as CPB now expects flat to declining sales and earnings for fiscal 2026, which has made investors wary.

For the current fiscal 2026, ending in July, analysts expect CPB’s EPS to decline 17.2% year-over-year to $2.46. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

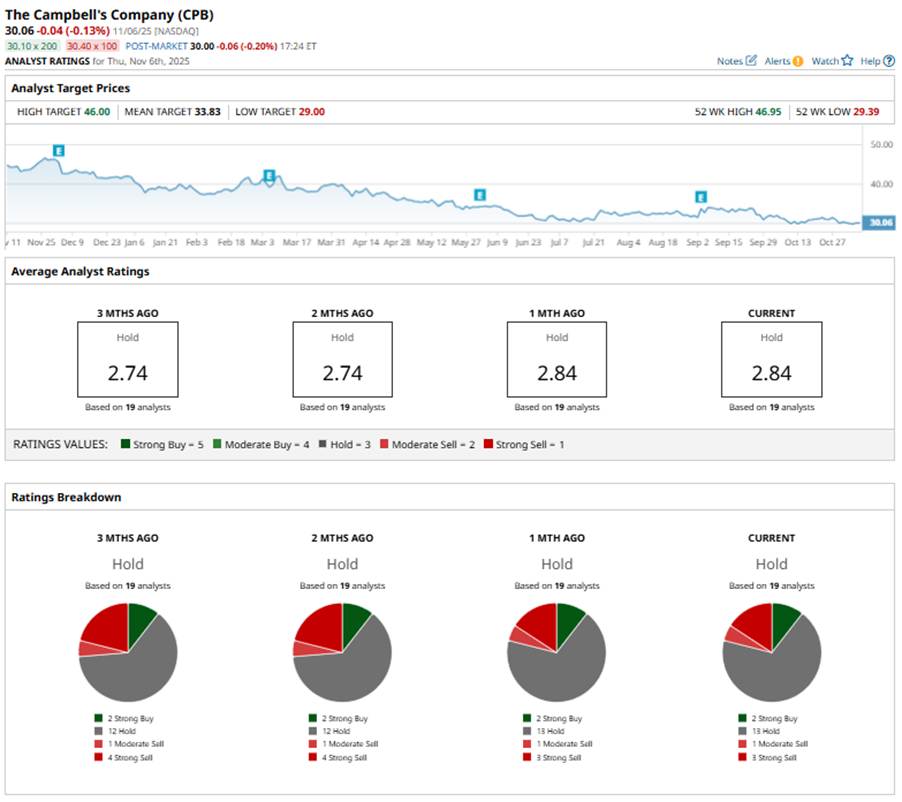

Wall Street analysts are cautious on the stock's prospects. Among the 19 analysts covering the CPB stock, the consensus rating is a “Hold.” That’s based on two “Strong Buys,” 13 “Holds,” one “Moderate Sell,” and three “Strong Sell” ratings.

This configuration is slightly less bearish than three months ago, when four analysts issued “Strong Sell” recommendations.

Last month, DA Davidson reiterated its “Neutral” rating on CPB after the company appointed Todd Cunfer, Freshpet’s CFO, as its new EVP and CFO.

CPB’s mean price target of $33.83 represents a 12.5% premium to current price levels, while its Street-high target of $46 suggests a 53% upside potential.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?