Valued at a market cap of $57.2 billion, Digital Realty Trust, Inc. (DLR) is a leading real estate investment trust (REIT) that owns, acquires, develops, and operates data centers. The Austin, Texas-based company provides secure, scalable, and interconnected environments for the storage and exchange of digital information and supports cloud computing, artificial intelligence, and enterprise IT infrastructure.

This specialty REIT has underperformed the broader market over the past 52 weeks. Shares of DLR have declined 3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.4%. Moreover, on a YTD basis, the stock is down 5.1%, compared to SPX’s 14.3% return.

Narrowing the focus, DLR has also lagged behind the Pacer Benchmark Data & Infrastructure Real Estate ETF’s (SRVR) marginal downtick over the past 52 weeks and 1.6% YTD rise.

On Oct. 23, DLR posted stronger-than-expected Q3 results, sending its shares up 2.2% in the following trading session. Primarily due to higher rental revenues, the company’s total operating revenue increased 10.2% year-over-year to $1.6 billion, surpassing consensus estimates by 3.9%. Moreover, its core FFO of $1.89 improved 13.2% from the same period last year, topping analyst expectations of $1.78. Additionally, noting this strong momentum, DLR raised its fiscal 2025 core FFO per share outlook, and now expects it to be between $7.32 and $7.38.

For the current fiscal year, ending in December, analysts expect DLR’s FFO to grow 9.5% year over year to $7.35. The company’s FFO surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

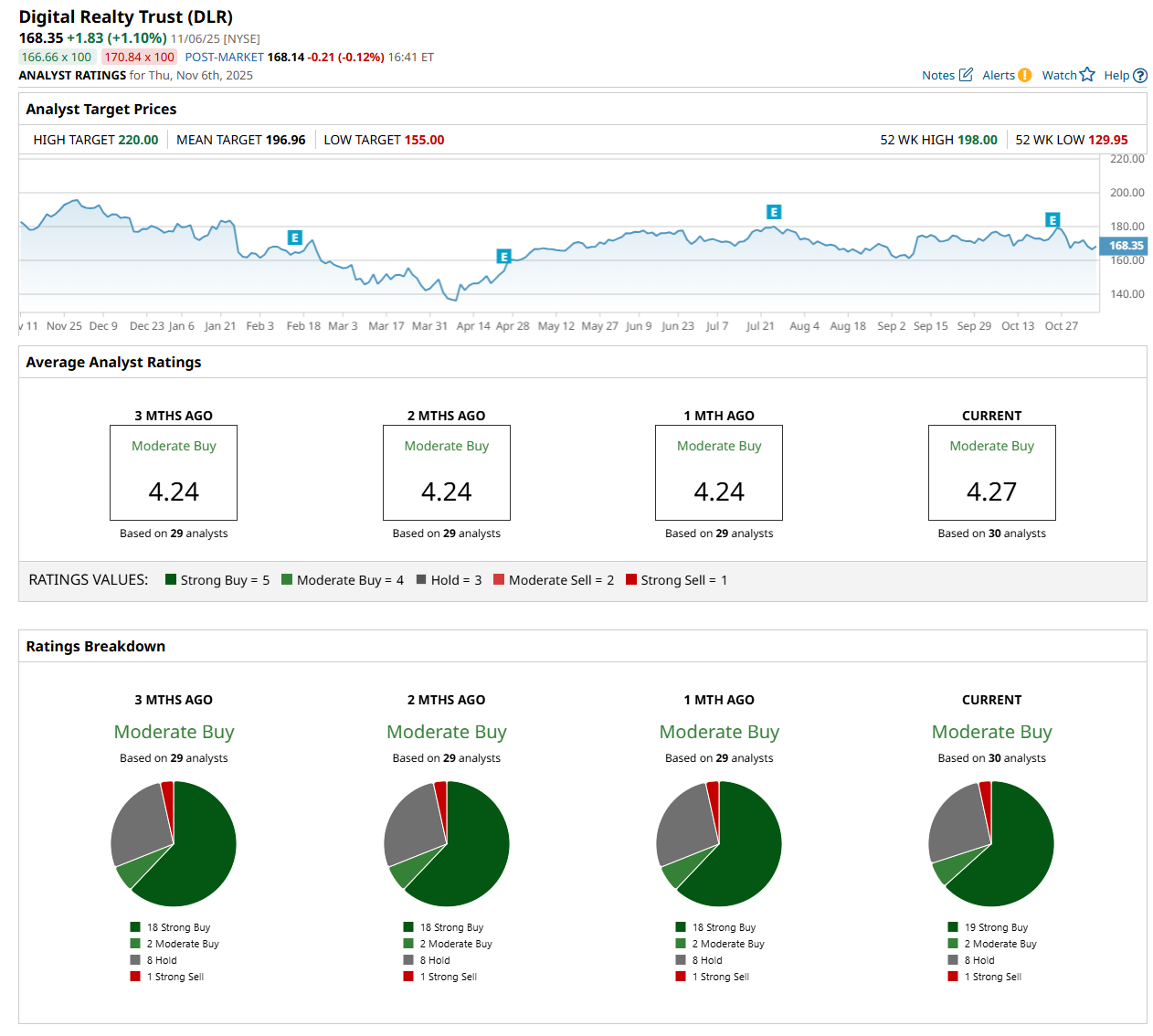

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on 19 “Strong Buy,” two “Moderate Buy,” eight "Hold,” and one “Strong Sell” rating.

This configuration is slightly more bullish than a month ago, with 18 analysts suggesting a “Strong Buy” rating.

On Nov. 5, Anthony Hau from Truist Financial Corporation (TFC) maintained a “Buy" rating on DLR, with a price target of $200, indicating an 18.8% potential upside from the current levels.

The mean price target of $196.96 represents a 17% premium from DLR’s current price levels, while the Street-high price target of $220 suggests an ambitious upside potential of 30.7%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?