Nvidia (NVDA) is poised for yet another stellar year, with year-to-date (YTD) gains of around 40%, ranking it among the top 50 gainers of the S&P 500 Index ($SPX). It was preceded by gains of 171% in 2024 and 239% in 2023. The gravity-defying rally recently catapulted Nvidia’s market cap to $5 trillion as it became the first-ever company to hit that milestone. Milestones, incidentally, have been a recurring event for Nvidia, as earlier this year, it became the first company to command a market cap of $4 trillion.

Nvidia Stock 2026 Forecast: Can NVDA Rise to $350?

If Loop Capital analyst Ananda Baruah is correct, Nvidia could become an $8.5 trillion company over the next year. His $350 target price is the new Street high on NVDA stock and well ahead of the $234.51 that the average sell-side analyst thinks the stock is worth. That said, Nvidia should soon see target price hikes in the coming days, as it typically has ahead of (and after) its earnings reports.

AI Boom Is Far from Over

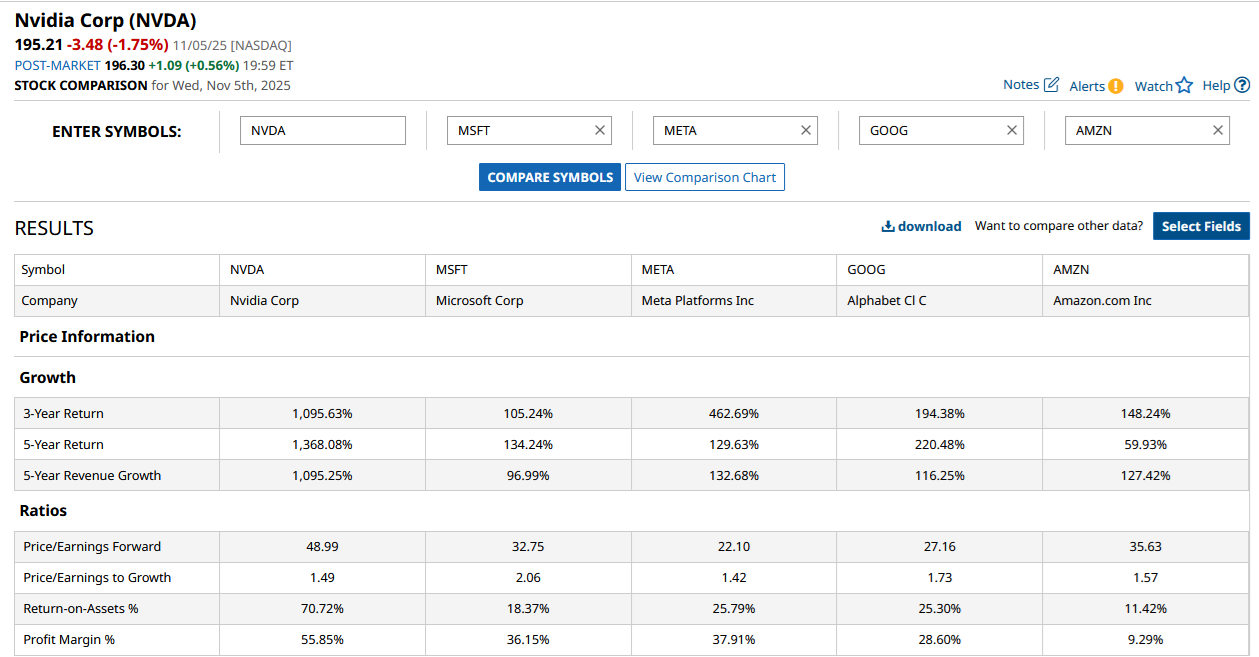

As things stand today, I believe Nvidia’s rally might continue in 2026. To begin with, the artificial intelligence (AI) boom, which has fueled Nvidia’s earnings and, by extension, its share price, looks far from over. The recently concluded September quarter earnings show that tech companies, especially the so-called hyperscalers, are only doubling down on AI capex. AI spending was a central theme this earnings season, and Big Tech companies like Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), and Amazon (AMZN) have raised their capex guidance and see it rising even further.

Notably, while Microsoft had previously indicated that its capex growth in fiscal year 2026 (ending June 30, 2026) would be lower than the previous year, it now sees it going higher. Meta has also been on a spending spree, having raised its 2025 capex guidance several times and expecting it to rise “notably” next year. Much of these dollars will land in Nvidia’s coffers even as there are signs of tech companies looking at alternatives, including their own chips.

Shifting to other chips is easier said than done, though, given Nvidia’s Compute Unified Device Architecture (CUDA) computing platform, which has become the de facto standard for AI developers and researchers, creating a lock-in of sorts.

Nvidia Continues to Maintain Its Lead

Nvidia has managed to maintain its lead in AI chips and is a generation ahead of competitors who have been trying to play catch-up. In September, Nvidia unveiled its Vera Rubin NVL144 CPX platform, which will be a successor to the current Blackwell GPU. Nvidia has also signed a flurry of deals, including the $100 billion partnership with OpenAI. While these investments have raised concerns over Nvidia basically buying revenue by investing in AI companies, since much of this money will flow back into its coffers as these companies buy Nvidia chips, it is a clever way of ensuring a continued revenue stream and gaining from the rising valuations of AI companies.

Sovereign AI is another growth driver for Nvidia as major countries globally are pouring billions into the initiative amid what’s a literal AI arms race.

Valuation Concerns Over NVDA Stock

While Nvidia’s rally has been backed by a surge in its earnings, there have been intermittent concerns over AI being a bubble and NVDA’s soaring valuations. There are obvious comparisons with the dot-com bubble, which I find somewhat preposterous, as the tech companies today are quite profitable with rock-solid balance sheets. Barring some sections in the unlisted space, AI plays are not valued on flimsy metrics, and their valuations are driven by hard earnings and cash flows.

Talking specifically of Nvidia, the stock trades at a forward price-to-earnings (P/E) of nearly 50x, which would appear lofty on the face of it. However, Nvidia’s profits are expected to grow at a faster pace than most other tech companies, and the stock looks reasonably valued at a P/E-to-growth (PEG) multiple of 1.49x, which is not much different from Magnificent Seven peers, barring Tesla (TSLA).

The multiples might start to look even more tempting if Nvidia's China business gets back on track. While the U.S. government has allowed Nvidia to resume some exports, pending a revenue-share deal, there is still a lot of uncertainty over the company’s China business as the world's two biggest economies work towards a trade deal.

Overall, I believe 2026 could be yet another good year for Nvidia, even as the rally that we have seen since 2023 might not continue with the same fervor. China, meanwhile, remains a wild card for Nvidia, and if it gets reasonable leeway to participate in what CEO Jensen Huang believes is a $50 billion opportunity for the company this year, we could see the stock rising even higher from these levels.

On the date of publication, Mohit Oberoi had a position in: NVDA , MSFT , AMZN , META , GOOG , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart