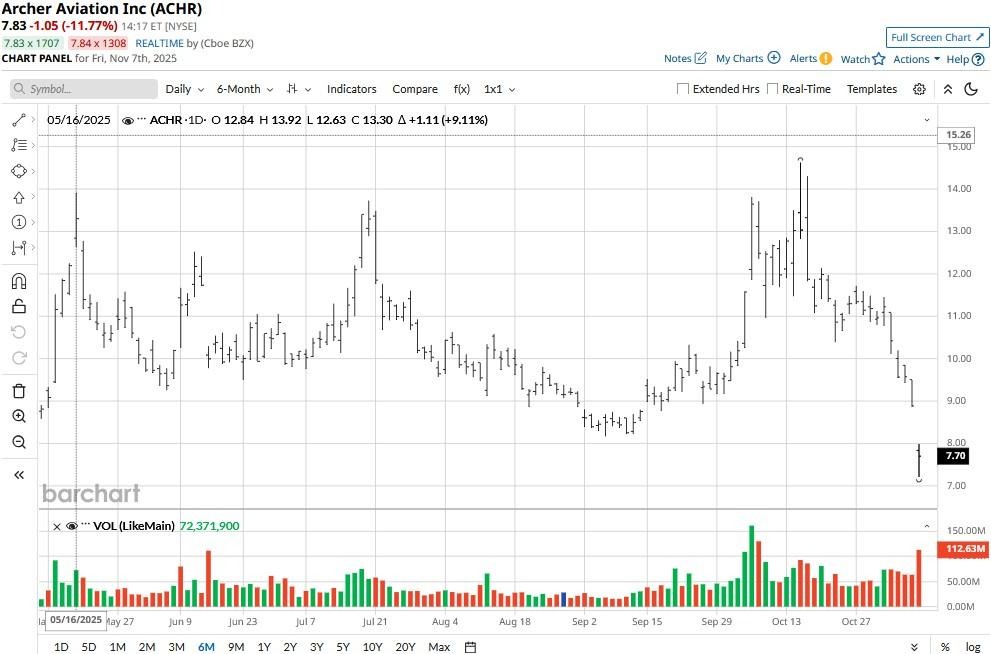

Archer Aviation (ACHR) fell as much as 20% on Nov. 7 after the eVTOL company reported a strong enough Q3 but announced a $126 million acquisition of Hawthorne Airport.

ACHR plans on using the Los Angeles-area airport as a strategic hub for its air taxi operations and artificial intelligence (AI) testing.

At its intraday low, Archer Aviation stock was seen trading nearly 50% below its year-to-date high.

Why Did Archer Aviation Stock Crash on Hawthorne News?

ACHR shares crashed this morning primarily because the company plans on funding its Hawthorne deal with a $650 million equity offering.

On Friday, the air taxi firm issued 81.25 million new shares, eroding its earnings per share (EPS) and raising dilution concerns.

Investors fear that future profits will be spread thinner, weakening upside potential, and pressuring valuation multiples. Plus, there’s notable execution risk tied to the Hawthorne acquisition as well.

Still, famed investor Cathie Wood remains bullish on Archer Aviation stock and sees the pullback this morning as an opportunity to load up on a quality name at a deep discount.

How Many ACHR Shares Did Cathie Wood Buy?

Cathie Wood – founder and chief executive of Ark Invest – capitalized on the ACHR selloff to increase her exposure to the NYSE-listed urban air mobility specialist.

On Thursday, Wood spent another $26 million to buy over 3 million shares of the Archer Aviation for three of her flagship exchange-traded funds (ETFs).

Her allocation signals unwavering confidence in the company’s long-term potential despite near-term volatility and dilution risk.

Note that ACHR stock has historically (over the past four years) returned nearly 39% on average in November, which also makes a strong case for buying it on the dip on Nov. 7.

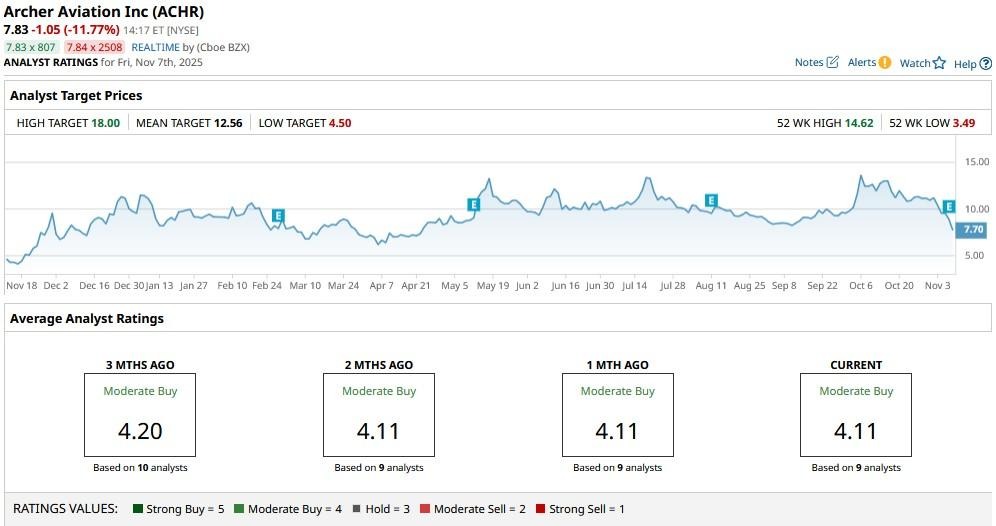

Wall Street Remains Bullish on Archer Aviation

Wall Street analysts remain bullish on Archer Aviation shares especially since the eVTOL firm is fast improving its fundamentals as evidenced in the earnings release posted today.

According to Barchart, the consensus rating on ACHR stock remains at “Moderate Buy” with the mean target of about $12.50 indicating potential upside of some 70% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart