Social media company Snap (SNAP), the owner of Snapchat, has seen better days. SNAP stock is down a whopping 90% from all-time highs set back in 2021, as it has lost ground to TikTok and to Meta Platforms’ (META) Facebook, Instagram, and Threads.

However, the company has now announced a $400 million deal with Perplexity AI while simultaneously reporting third-quarter results that were better than expected. SNAP stock jumped 15% on the news, although it’s still badly dragging the market so far this year.

Is SNAP stock a buy now? Or is this just a flash in the pan?

About SNAP Stock

Based in Santa Monica, California, Snap owns the Snapchat social media platform, known for its short videos and images called Snaps. Users can create a collection of Snaps that are visible to followers for 24 hours, or they can look through curated videos from the Snapchat community. Snapchat also offers a chat function for one-on-one or group messaging.

The company claims 477 million daily active users, trending toward a younger demographic—Snap says that more than 75% of people ages 13 to 34 in over 25 countries are Snapchat users. It has a market capitalization of $13.5 billion.

Shares are down 24% so far this year, even after the company’s post-earnings pop. Its performance is far below the S&P 500 ($SPX), which is up 13% this year.

Snap is not profitable, so the best way to measure its valuation is to look at the forward price-to-sales ratio, which measures the company’s stock price to estimated future sales per share. Snap’s forward P/S ratio is a reasonable 2.3 when compared to competitor Meta Platform’s 7.8 forward P/S. Of course, Meta is worth that premium, as the company has a much larger audience and brings in billions of dollars a year in profits.

Snap Beats on Earnings

Snap’s third-quarter earnings report was a pleasant surprise—the company reported revenue of $1.5 billion, up 10% from a year ago, and narrowed its losses from $153 million in Q3 2024 to $104 million in the current quarter. Earnings per share were a loss of $0.06, while analysts had been expecting a loss of $0.11 per share.

Snap also announced a $500 million share repurchasing plan over the next 12 months to offset the dilution of shares related to restricted stock issued to employees.

Snapchat also showed strong growth in users—the number of daily average users rose 8% from a year ago, and the company announced that users created more than 1 trillion Snaps in all of 2024. In addition, Snap said that views in the Spotlight feature, in which Snap shows users’ popular content from the Snapchat community, increased by more than 300%.

However, the most interesting thing in the stock earnings report was Snap’s announcement of its partnership with Perplexity AI, which is an AI-powered search engine that uses conversational search. Management says that the Perplexity interface will be incorporated into Snapchat in the first quarter of 2026.

“This collaboration makes AI-powered discovery native to Snapchat, enhances personalization, and positions Snap as a leading distribution channel for intelligent agents, laying the groundwork for a broader ecosystem of AI partners to reach our global community,” management said in a letter to investors.

What Do Analysts Expect for SNAP Stock?

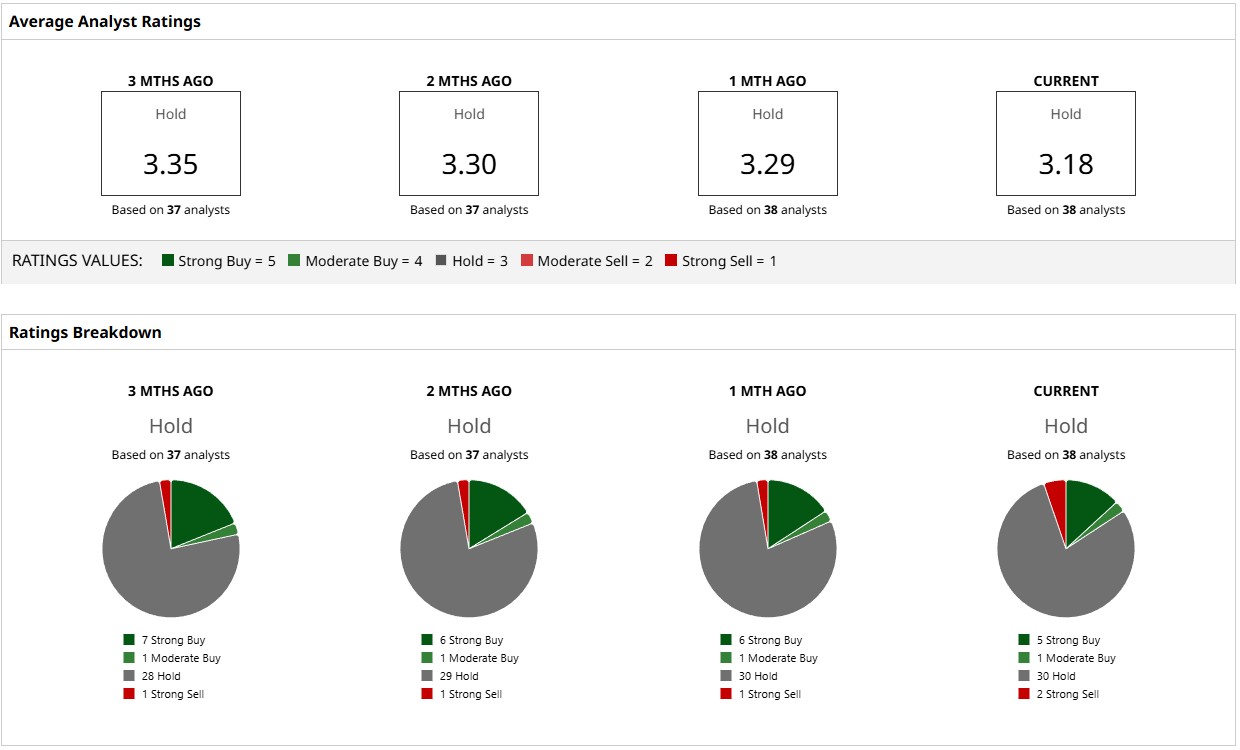

Analysts aren’t enamored with SNAP stock, but they aren’t pushing it off the table as well. Of the 38 analysts currently covering the stock, 30 of them suggest holding. Six say the stock is either a “Strong Buy” or "Moderate Buy" and two of them have “Strong Sell” ratings.

Snap’s stock price of $8.08 at market open puts it very close to analysts’ mean price target of $9.49, meaning that there’s not a lot of room to run right now. Targets at the high and low end suggest the stock could go up as much as 98% or fall by as much as 20%.

Snap’s partnership with Perplexity AI is long overdue and perhaps will give Snap momentum to start breaking even. But I don’t see it as a compelling investment opportunity right now.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual QQQ Options Activity Prompts Covered Strangle Thought Experiment

- Amid SoftBank Takeover Rumors, Should You Buy, Sell, or Hold Marvell Stock?

- This Robotaxi Stock Just Plunged. Should You Buy the Dip or Stay Far, Far Away?

- Snap Has a $400 Million Catalyst Right Now. Does It Make SNAP Stock a Buy?