New York-based Tapestry, Inc. (TPR) is a luxury fashion and lifestyle company that designs and markets modern accessories and apparel. Valued at a market cap of $22.6 billion, the company owns a portfolio of iconic brands, including Coach, Kate Spade, and Stuart Weitzman, known for their craftsmanship, innovation, and distinctive style.

Shares of this luxury goods company have significantly outpaced the broader market over the past 52 weeks. TPR has rallied 98.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.4%. Moreover, on a YTD basis, the stock is up 51.3%, compared to SPX’s 14.3% uptick.

Zooming in further, TPR’s outperformance looks even more pronounced when compared to the Kraneshares Global Luxury Index ETF’s (KLXY) 11.4% return over the past 52 weeks and 7.2% rise on a YTD basis.

On Nov. 6, TPR's shares plunged 9.6% after its Q1 earnings release, despite delivering a solid performance. The company’s net sales grew 13.1% year-over-year to $1.7 billion, while its adjusted EPS of $1.38 climbed 35.3% from the prior-year quarter, both surpassing consensus estimates. Moreover, TPR raised its fiscal 2026 outlook, reflecting strength in its momentum. However, the sharp stock decline suggests that investors remained cautious about the sustainability of this growth, particularly amid ongoing challenges at Kate Spade and broader macroeconomic uncertainties.

For the current fiscal year, ending in June 2026, analysts expect TPR’s EPS to grow 7.5% year over year to $5.48. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

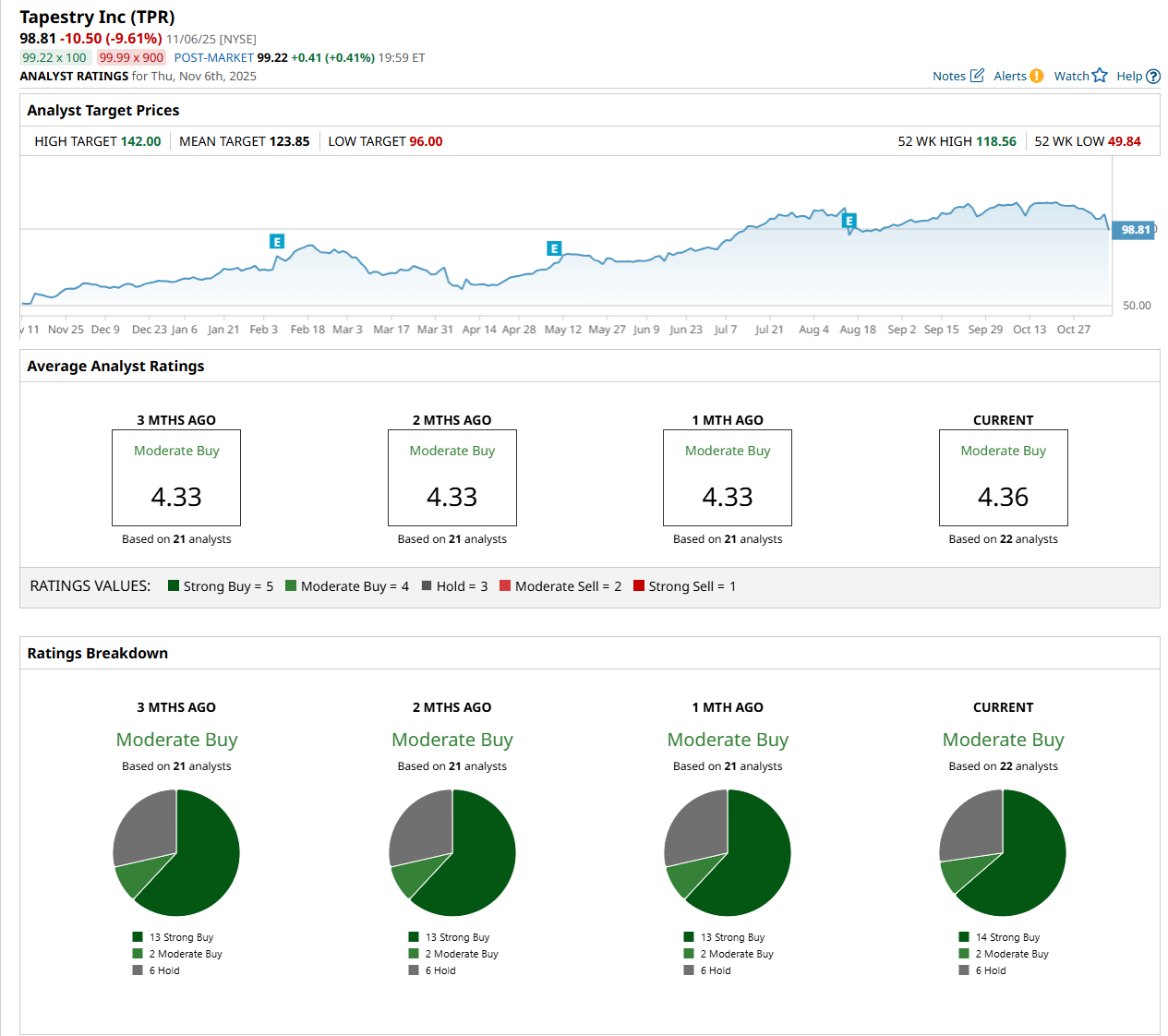

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 14 “Strong Buy,” two “Moderate Buy,” and six "Hold” ratings.

This configuration is slightly more bullish than a month ago, with 13 analysts suggesting a “Strong Buy” rating.

On Nov. 6, Jason Strominger from Telsey Advisory maintained a "Buy" rating on TPR, with a price target of $125, indicating a 26.5% potential upside from the current levels.

The mean price target of $123.85 represents a 25.3% premium from TPR’s current price levels, while the Street-high price target of $142 suggests an ambitious upside potential of 43.7%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart