In the age of generative AI, data is the new electricity, and the power lines running it are high-capacity fiber routes. These fiber networks form the backbone of modern computing, enabling lightning-fast data transfers between sprawling data centers that fuel everything from real-time analytics to massive artificial intelligence (AI) model training. Without them, the AI revolution simply cannot run.

That’s where Verizon Communications (VZ) has stepped in. Recently, the telecom company announced a new partnership with Amazon Web Services to build high-capacity fiber routes linking AWS data centers across key regions. Under the “Verizon AI Connect” initiative, the company will lay down long-haul, low-latency pathways designed to handle the heavy traffic of next-gen AI workloads. It’s a timely move that strengthens Verizon’s deep relationship with AWS, and underscores how telcos are quietly becoming the muscle behind the AI boom.

But with VZ stock still treading cautiously, should investors plug in now while it’s trading at an attractive valuation?

About Verizon Stock

New York-based Verizon Communications is one of the world’s leading names in connectivity – powering how people, businesses, and governments communicate. With a market capitalization of about $166.4 billion, Verizon is best known for its rock-solid network, dependable coverage, and lightning-fast data speeds. The company’s backbone lies in its wireless business, which drives roughly 75% of its service revenue, serving millions of postpaid and prepaid phone users across the U.S.

Beyond mobile, Verizon extends its reach through fixed-line telecom services, connecting millions of homes and businesses, many powered by its ultra-fast Fios fiber technology. Constantly evolving, the company continues to invest heavily in 5G and fiber technologies – cementing its role as among the nation's leaders in performance and quality in an increasingly connected world.

Yet, shares of the wireless carrier have been treading a choppy path – down about 3.81% over the past 52 weeks and off 9.06% just this past month. But after a mixed Q3 and some upbeat analyst chatter, VZ is showing flickers of life. Trading volume has been ticking higher, hinting at renewed investor interest as the company’s new CEO, Daniel Schulman, in the Q3 earnings call last week, signals a major strategic reset.

Technically, the setup looks mildly encouraging. The 14-day RSI is hovering near neutral around 43.87, suggesting the stock is not overbought or oversold. More notably, the MACD line (orange) has just crossed above the blue signal line – a bullish sign that momentum may be shifting upward. The histogram turning positive reinforces that sentiment, showing buying strength building beneath the surface.

With Schulman steering a turnaround and Verizon teaming up with tech giants like Amazon (AMZN) to bolster its data and fiber backbone, the stock could be setting up for a more connected and confident rebound.

VZ stock looks like a bargain. Trading at just 8.4 times forward earnings and 1.2 times forward sales, it is priced below both its sector peers and its own history, making it a quietly compelling pick for value hunters in telecom.

Meanwhile, for income investors, Verizon has long been the quiet heavyweight that consistently pays out dividends. The company has raised its dividend for two decades, a streak built on discipline and shareholder loyalty. On Nov. 3, it handed out its latest quarterly dividend of $0.69 per share, translating to an annualized dividend of $2.76.

That gives Verizon a handsome 6.95% yield, one of the richest in the telecom space. With a forward payout ratio hovering around 57.3%, the company strikes a smart balance between rewarding investors and keeping enough cash to reinvest in its network and manage debt. In a volatile market, Verizon remains the steady income engine investors can count on, quarter after quarter.

Verizon’s Shares Surge After Its Q3 Results

On Oct. 29, Verizon released its earnings report for the third quarter of 2025, and the stock rose 2.3%. Revenue came in at $33.8 billion, up 1.5% year-over-year (YOY), with adjusted EPS climbing 1.7% annually to $1.21. While earnings beat expectations, revenue fell just shy of estimates – a minor miss in an otherwise solid showing. Driving top-line growth was a 2.1% rise in wireless service revenue to $21 billion, alongside a 5.2% jump in wireless equipment sales to $5.6 billion.

Verizon’s broadband engine continued to hum, adding 261,000 fixed wireless access customers, lifting its base to nearly 5.4 million – well on track toward its 8 million to 9 million goal by 2028. The company also saw 61,000 new Fios Internet customers, pushing total broadband additions to 306,000, though traditional Fios Video subscriptions slipped by 70,000 as streaming alternatives gain traction.

Meanwhile, free cash flow – the lifeblood of Verizon’s rich dividend – hit $15.8 billion for the first nine months of 2025, up from $14.5 billion a year ago.

Management reaffirmed full-year guidance, projecting wireless service revenue growth between 2% and 2.8%, EBITDA gains of 2.5% to 3.5%, and FCF between $19.5 and $20.5 billion.

Meanwhile, analysts tracking the stock anticipate the company’s Q4 EPS of $1.08, down 1.8% YOY, on revenue of roughly $36.1 billion. But for fiscal 2025, EPS is anticipated to rise by 2.2% YOY to $4.69, and then rise by another 4.3% annually to $4.89 in fiscal 2026.

What Do Analysts Expect for Verizon Stock?

Verizon’s shares have been on a slow climb out of the red, trying to win back Wall Street’s full confidence – and analysts have plenty to say about its next move.

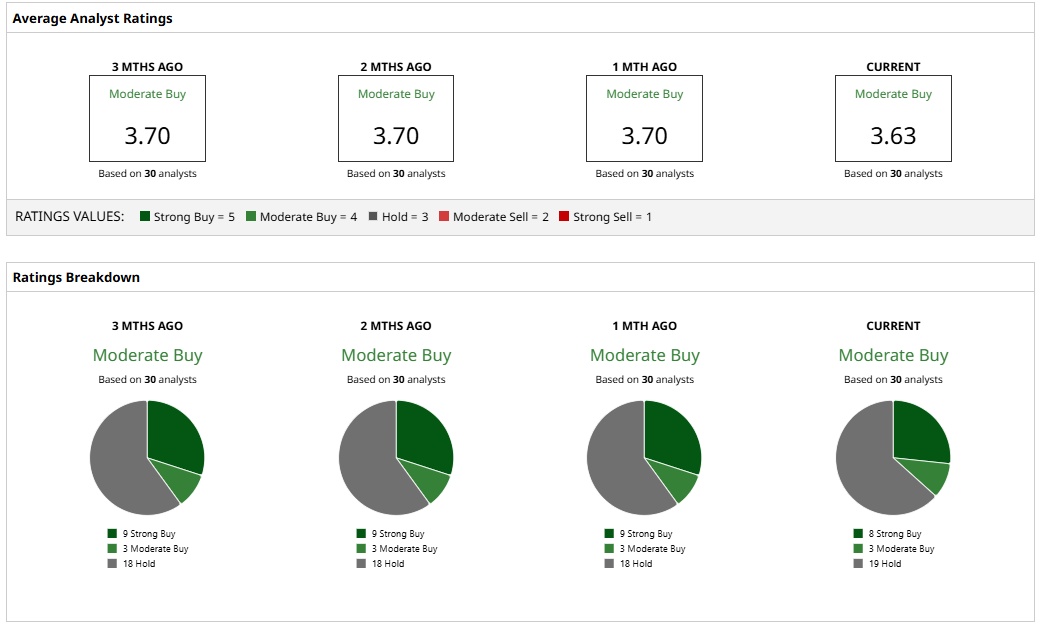

With a “Moderate Buy” consensus, Verizon may just be gearing up for a steadier signal ahead. Of the 30 analysts monitoring the telecom stock, eight suggest a “Strong Buy,” three recommend a “Moderate Buy,” and a majority of 19 analysts are playing it safe, advising a “Hold.”

The average analyst price target for VZ is $47.15, indicating potential upside of 20.5%. The Street-high target price of $58 suggests that the stock could rally as much as 49% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?