GE HealthCare Technologies Inc. (GEHC) is a medical-technology company headquartered in Chicago, Illinois, currently valued at a market cap of around $33.8 billion. The company designs, manufactures and markets a wide array of healthcare equipment and digital solutions: its major segments include Imaging, Ultrasound, Patient Care Solutions and Pharmaceutical Diagnostics.

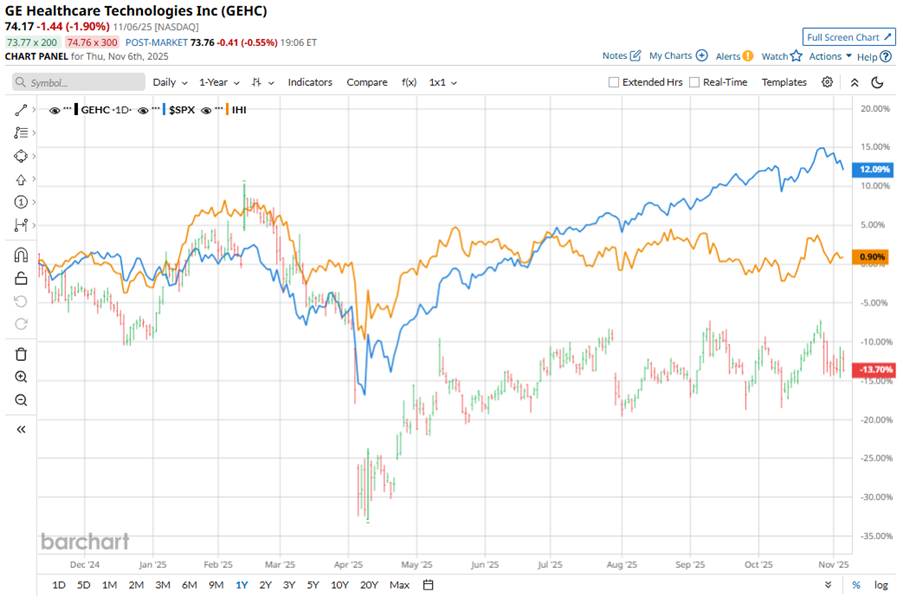

This healthcare company’s shares have underperformed the broader market. GEHC stock has declined 14.5% over the past 52 weeks, while the broader S&P 500 Index ($SPX) has surged 13.4%. Moreover, on a year-to-date (YTD) basis, the stock is down 5.1%, compared to SPX’s 14.3% return.

Narrowing the focus, GEHC has also lagged behind the iShares U.S. Medical Devices ETF’s (IHI) 1.5% rise over the past 52 weeks and 4% uptick on a YTD basis.

The decline in GEHC stock in 2025 is largely driven by mounting concerns over trade and margin pressures rather than outright poor business performance. Its significant exposure to China left it vulnerable to escalating U.S.–China tariff tensions and anti-dumping investigations, which spurred investor unease.

For the current fiscal year, ending in December, analysts monitoring GE HealthCare expect its EPS to grow 1.6% year-over-year to $4.56. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

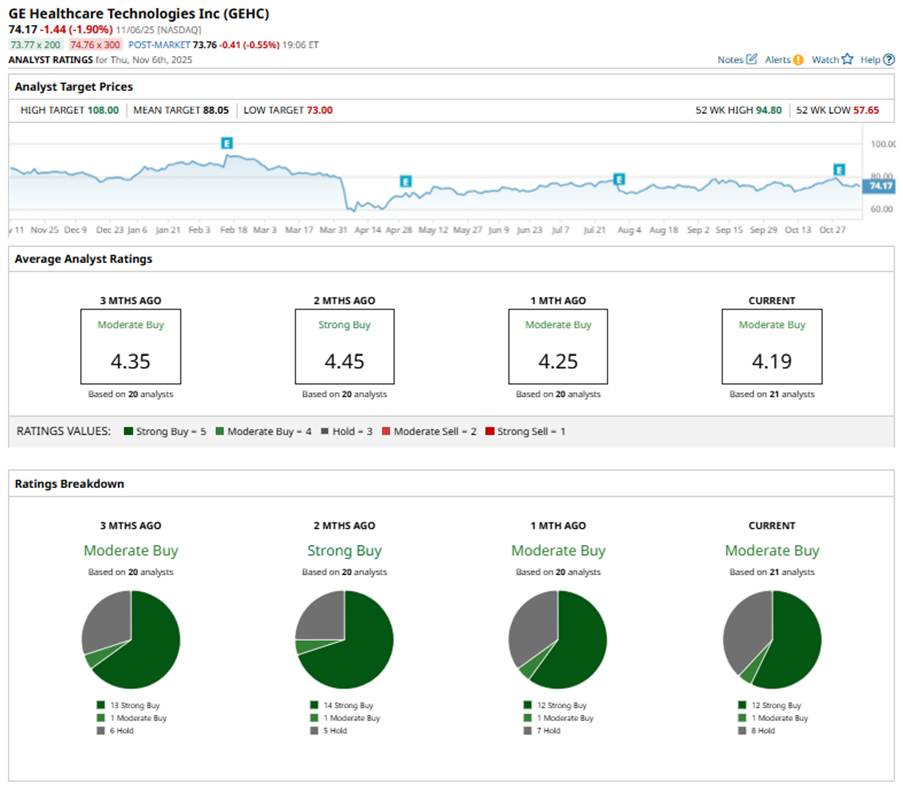

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on 12 “Strong Buys,” one “Moderate Buy,” and eight “Hold” ratings.

This configuration is less bullish than two months ago, when the overall rating for the stock was a “Strong Buy.”

Last month, Morgan Stanley raised its price target for GE HealthCare to $80 from $74, while maintaining an “Equal-Weight” rating.

The mean price target of $88.05 represents 18.7% premium to GEHC’s current price levels, while the Street-high price target of $108 suggests an ambitious upside potential of 45.6%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?