Major fast-food restaurant operator Yum! Brands (YUM) is considering selling its Pizza Hut chain. The company stated that it was conducting a formal strategic review of options regarding the brand’s future. While the brand’s global footprint has been strong, its U.S. division has been hit by outdated dine-in spots in a backdrop where quick pickup and delivery have become important. Pizza Hut is also facing some pressure from its arch-rival, Domino’s, with its expansive delivery focus.

The strategic review might result in a complete divestiture of the business, which could lead to Yum! Brands becoming a lighter and more capital-efficient firm. So, do you think you should consider investing in its restaurant chain operator now?

About Yum! Brands Stock

Yum! Brands stands as a leading force in the global quick-service restaurant industry, overseeing well-known chains such as KFC, Pizza Hut, Taco Bell, and the Habit Burger Grill. Its expansive operations rely primarily on franchising, with tens of thousands of outlets located in over 155 countries and territories. Renowned for its aggressive growth strategy, YUM opens new restaurants frequently, adding more than 4,500 units worldwide in 2024 alone.

The company’s corporate headquarters are in Louisville, Kentucky. By leveraging its massive scale and local adaptation, YUM continuously innovates in the fast-food market, delivering popular menu items across its diverse systems. The company has a market capitalization of $41.46 billion.

The stock has remained relatively stable over the past year, gaining 9.71% over the past 52 weeks, and has increased marginally over the past six months. It had reached a 52-week high of $163.30 back in March, but is down 8.8% from that level. Based on its solid Q3 results, the company’s stock is up 7.7% over the past five days.

YUM’s stock is trading at a premium valuation compared to its peers. The stock price is currently trading at 28.8 times earnings, which is higher than the industry average of 18.86 times.

Yum! Brands’ Third-Quarter Bottom Line Topped Estimates

On Nov. 4, YUM reported its third-quarter results, which showed that the company was firing on all cylinders, except for the weakness recorded in the Pizza Hut division. YUM’s total revenues increased 8.4% year-over-year (YOY) to $1.98 billion, which was slightly lower than the $2 billion that Wall Street analysts had expected.

YUM’s company sales increased by 12.2% annually to $697 million, while its franchise and property revenues climbed 6.6% to $857 million. The company’s global system sales rose by 5%, while same-store sales increased by 3%.

YUM’s core operating profit grew by 7.5% YOY to $677 million. Except for the Pizza Hut division, the company’s other major divisions, KFC and Taco Bell, reported growth in their core operating profits. YUM’s adjusted net income grew 13% YOY to $442 million. The company’s adjusted EPS was $1.58, up 15.3% annually and higher than the $1.48 figure expected by Wall Street analysts.

Aside from the company’s plans for the Pizza Hut brand, YUM expects to acquire 128 Taco Bell restaurants across the Southeast U.S. in the fourth quarter, which is projected to bolster its equity-owned restaurant base.

Wall Street analysts are considerably optimistic about YUM’s future earnings. They expect the company’s EPS to increase by 10.6% YOY to $1.78 for the fourth quarter. For the current fiscal year, EPS is projected to surge 10.8% annually to $6.07, followed by 8.7% growth to $6.60 in the next fiscal year.

What Do Analysts Think About Yum! Brands Stock?

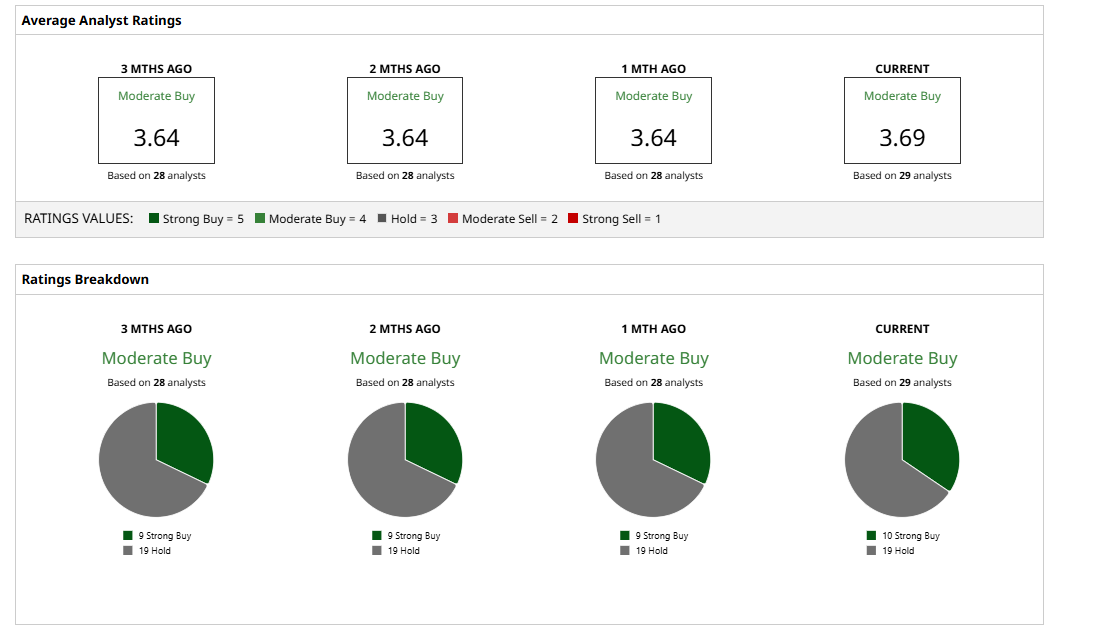

Wall Street analysts, although exhibiting a speck of cautiousness, have been more or less bullish on YUM’s stock.

Wall Street analysts have a favorable view of YUM’s stock, awarding it with a “Moderate Buy” rating overall. Of the 29 analysts rating the stock, 10 analysts have rated it a “Strong Buy,” while 19 analysts are playing it safe with a “Hold” rating. The consensus price target of $163.25 represents 10% upside from current levels, while the Street-high price target of $185 indicates 25% upside.

Key Takeaways

As the Pizza Hut review continues, YUM’s other divisions keep its top and bottom line buoyant. Moreover, as Wall Street analysts see potential upsides in the stock, it may be a good time to consider buying now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart